Did the utility sector just signal higher inflation for longer?

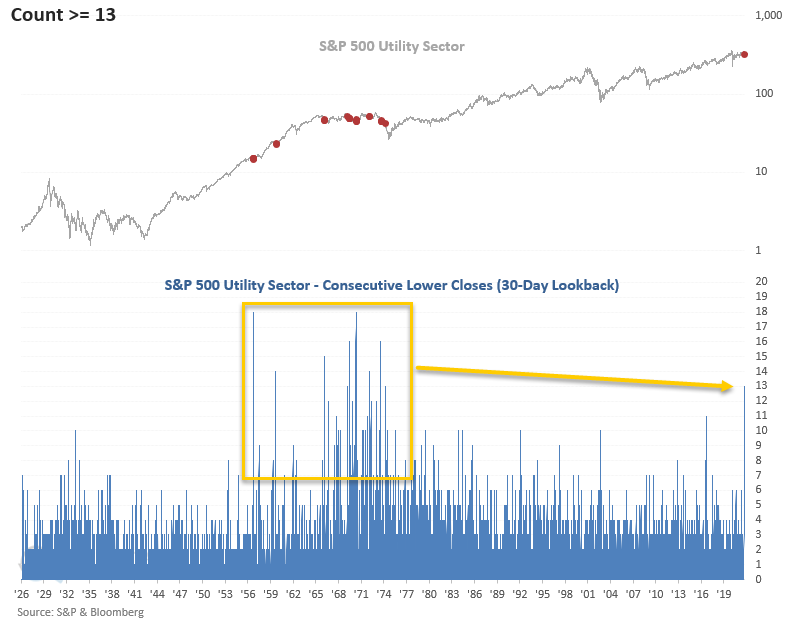

The S&P 500 Utility sector has now closed lower for 13 consecutive days in a 30-day lookback period. The last instance of the magnitude occurred over 48 years ago, in April 1974. We wonder if the interest-rate-sensitive utility sector is signaling that inflation will persist at a higher level for a much more extended period than most think. The surge in energy prices of late certainly helps the case.

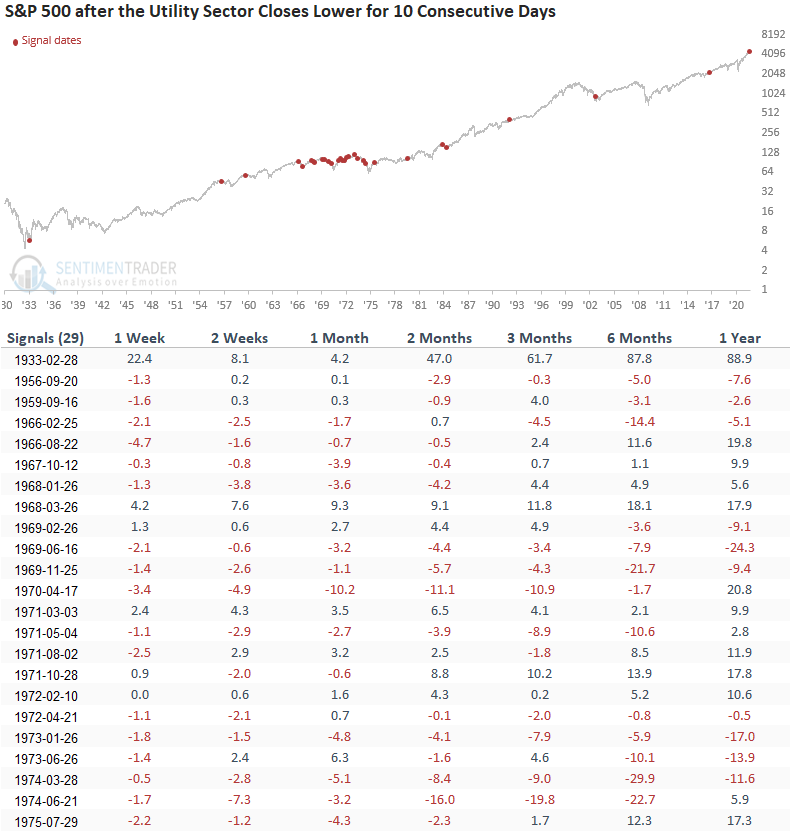

Let's conduct a study to assess the outlook for stocks and bonds when utilities close lower for ten consecutive days in a 30-day lookback period. I lowered the threshold level to ten, so we could assess more historical instances.

HISTORICAL CHART

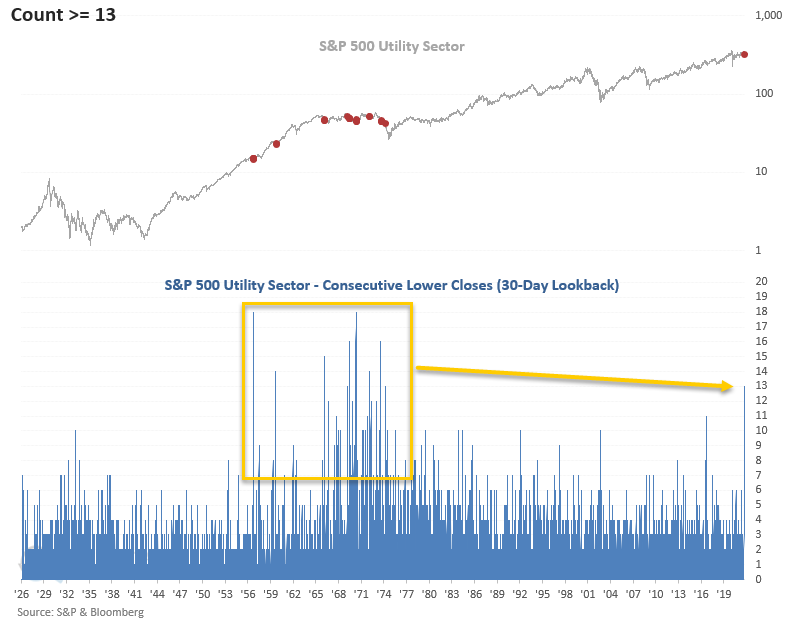

HOW THE SIGNALS PERFORMED - UTILITY SECTOR

The results for utilities look poor on almost all time frames. Interestingly, the 1-year time frame looks okay from a consistency point of view.

I would note that the study is heavily influenced by the 1966-1982 secular bear period when inflation impacted equities.

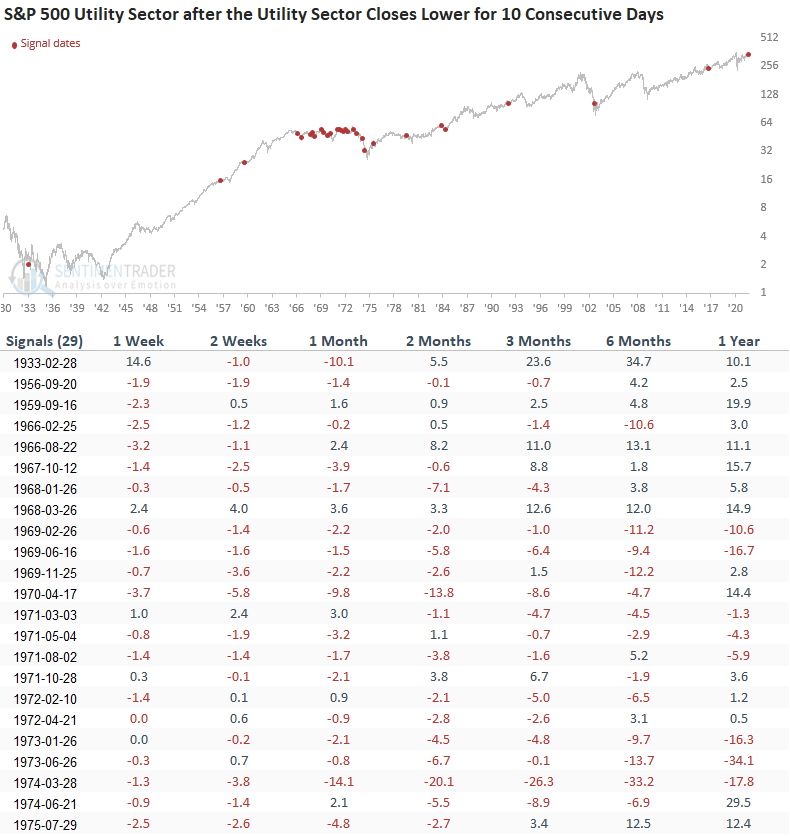

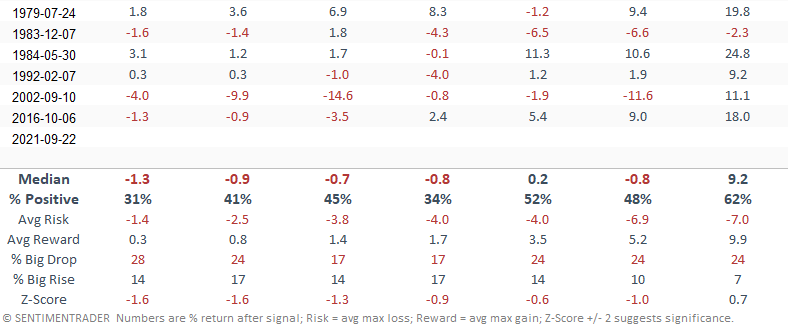

HOW THE SIGNALS PERFORMED - S&P 500

Results for the S&P 500 look weak across most time frames. If we look at the 2-month window, we see negative returns in 4/5 of the most recent instances.

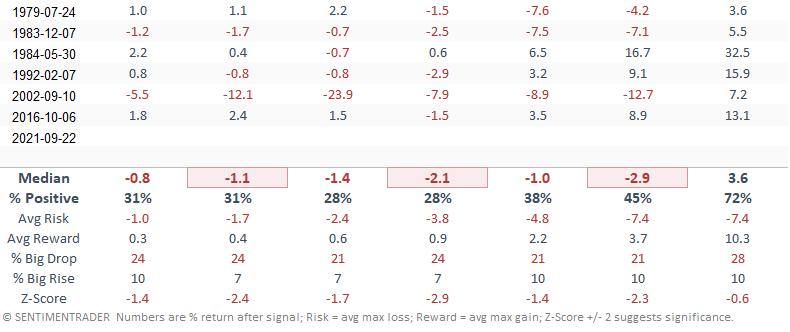

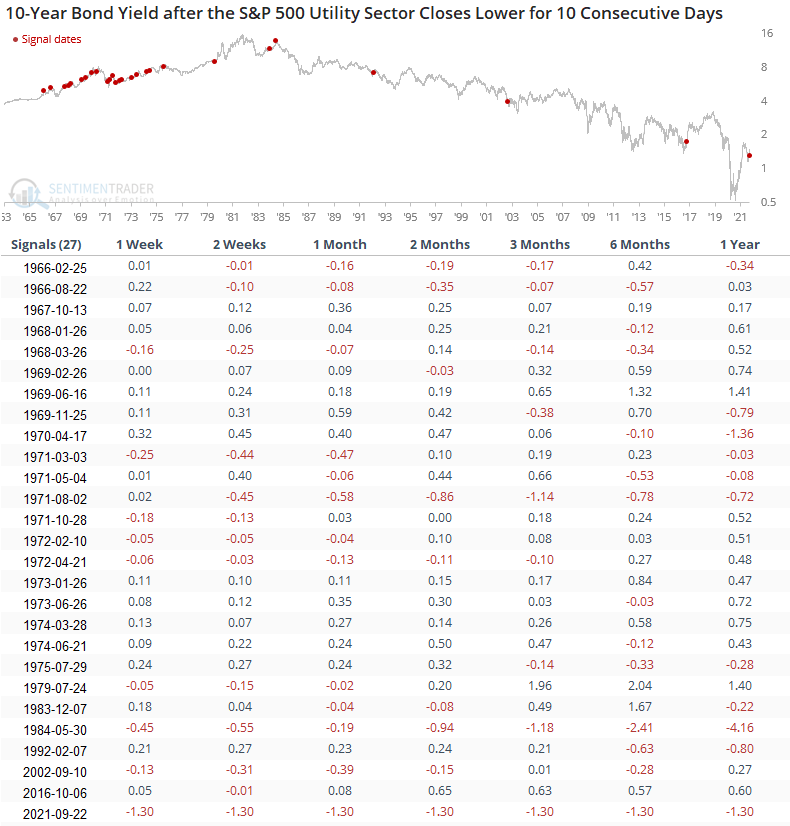

HOW THE SIGNALS PERFORMED - BOND YIELDS

Bonds yields clearly show an upward bias, especially in the 2-3 month time frame.

Please note the bond table reflects the net change in yields and contains fewer signals due to data limitations.

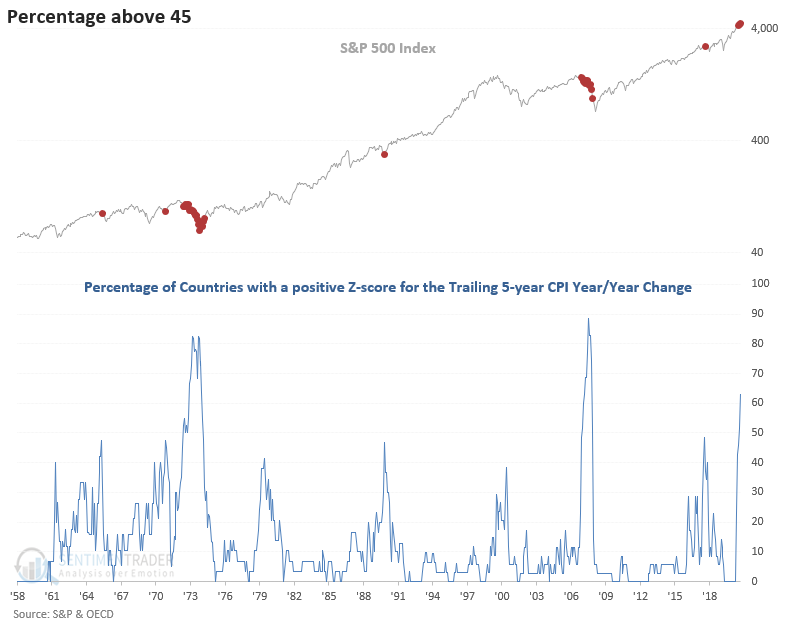

Inflation is a global phenomenon. The last significant spike in the following inflation indicator occurred in the summer of 2018. The market drifted higher for three more months before succumbing to an almost 20% decline in the fourth quarter.

I've read many reports over the last 25 years suggesting a coming inflation tsunami from all the central bank easy money. So far, technology and demographics have won, and inflation has been benign except for an occasional and short-lived spike. Did the covid pandemic ignite the spark that changed the course of history? Stay tuned.