Did the utility sector signal too much pessimism

Key points:

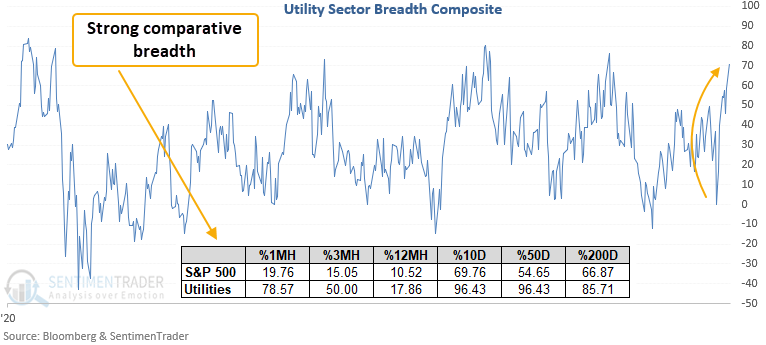

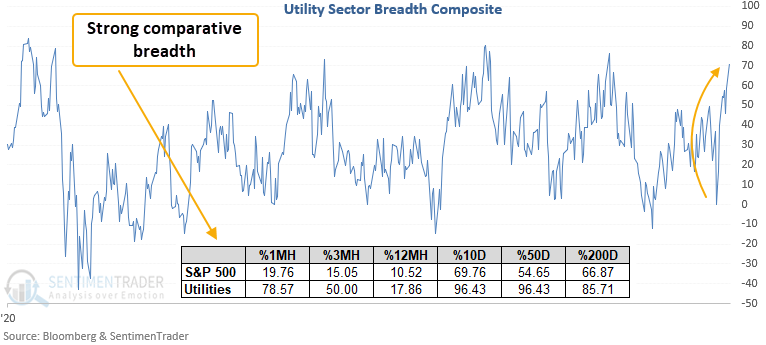

- A breadth composite shows utility stocks are surging

- The composite crossed above 71% on Monday

- The S&P 500 rallied 91% of the time over the next 12 months after other signals

Utility stocks as a contrary sentiment indicator

Does a surge in utility stocks, a traditionally defensive sector, signal too much pessimism and therefore provide a bullish market message for the S&P 500?

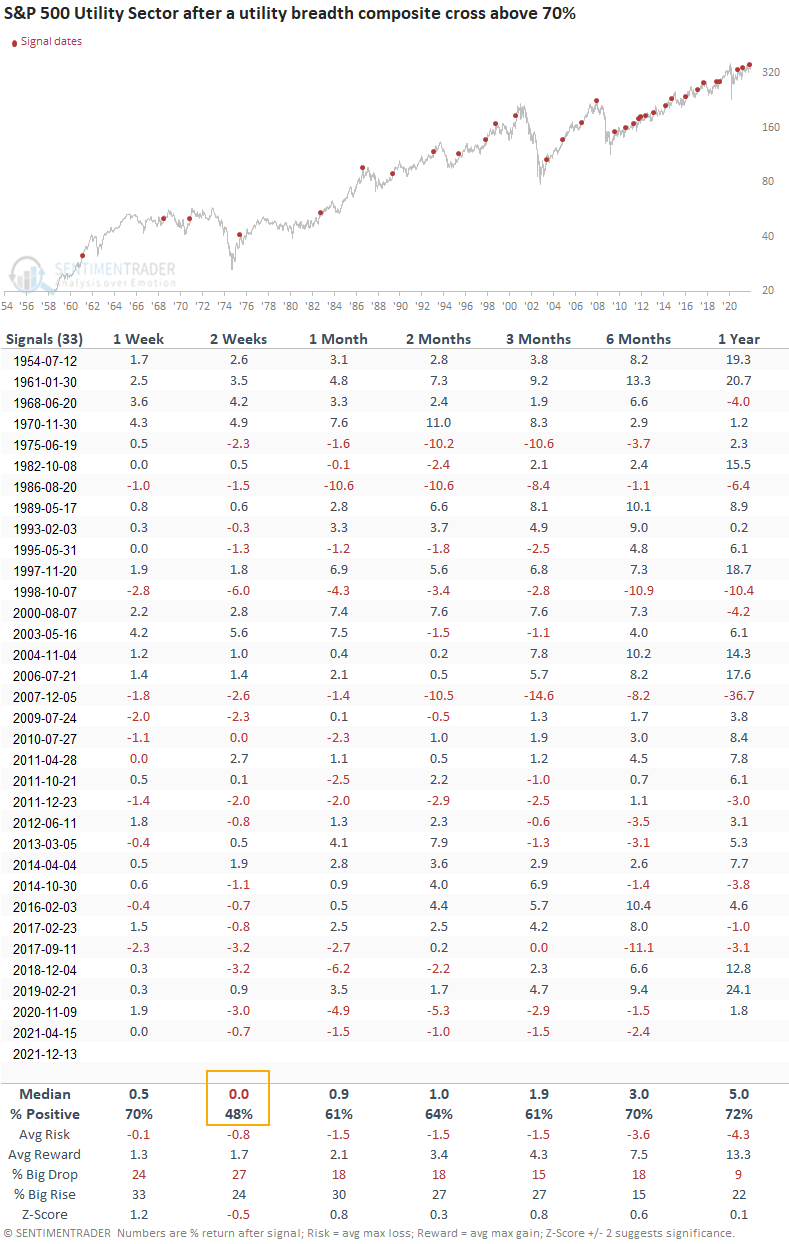

Let's conduct a study to assess the outlook for the S&P 500 after a composite breadth indicator for the utility sector surges above 70%. I used a reset condition of 0% for the signal generation to screen out repeats and identify the first instance.

Utility breadth is surging and looks strong on a comparative basis

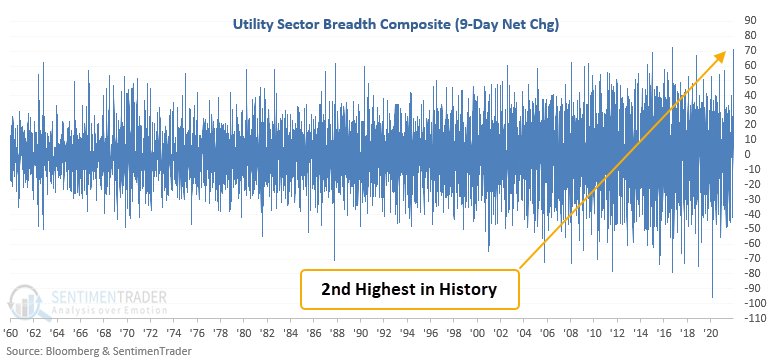

Suppose I apply a 9-day net change to the utility sector composite. In that case, we see that participation over the trailing 9 sessions has surged to the second-highest level in history.

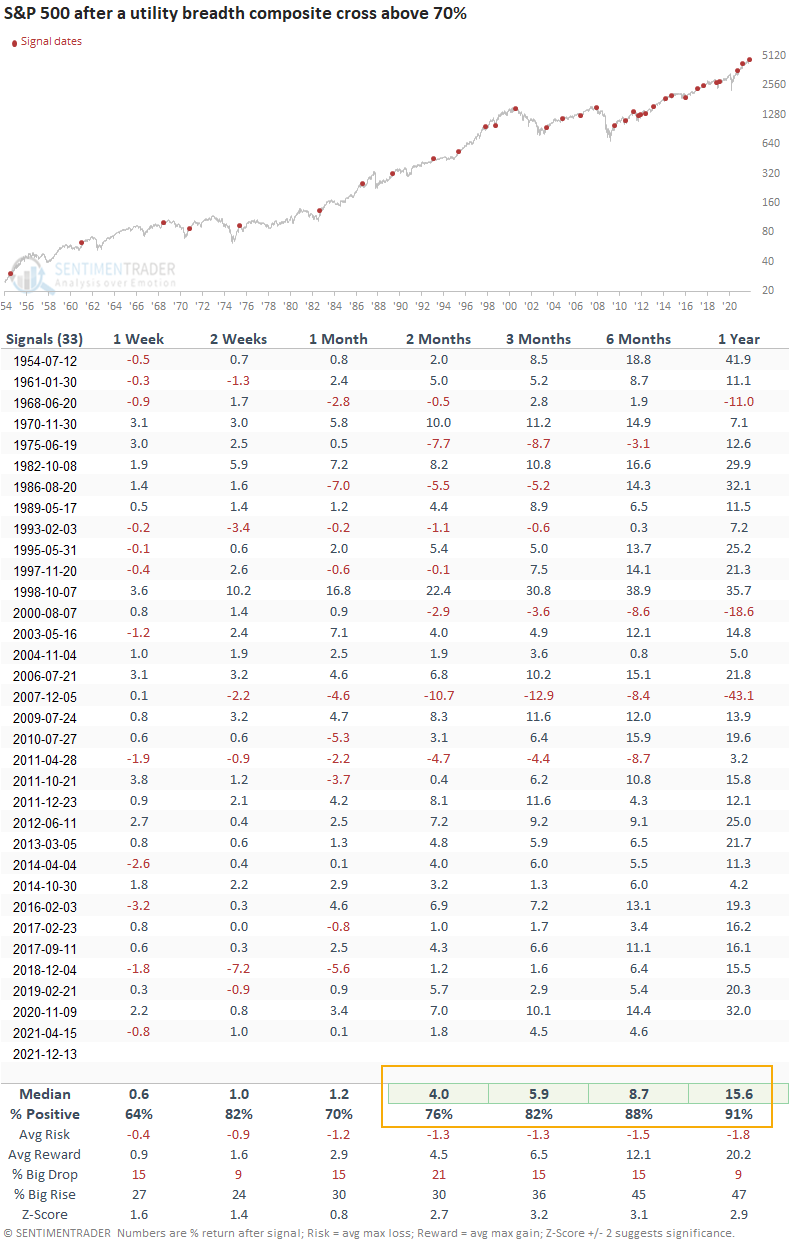

Similar signals preceded strong gains across all time frames

This signal has triggered 33 other times over the past 68 years. After the others, future returns were strong, with several significant risk/reward profiles. A year later, the S&P 500 was higher 91% of the time, with 2 out of 3 untimely signals occurring during bear markets.

The utility sector shows above-average gains, but significantly underperforms the S&P 500

While win rates and gains are favorable across almost all time frames, the surge in utility participation suggests one would be better off with an allocation to the S&P 500. The 2-week window suggests that utilities pause after the initial strength.

Bond yields showed a tendency to decline

The surge in utility participation suggests bond yields will move lower. However, most signals occurred during a structural bull market for bond prices. i.e., a falling yield environment.

What the research tells us...

When the traditionally defensive utility sector sees a surge in participation, market participants may have become too pessimistic on the outlook for the stock market. Similar setups to what we're seeing now have preceded solid returns and win rates for the S&P 500, especially on a medium and long-term basis.

The surge in participation also suggests that the 10-year bond yield could move lower.