Dip-Buyers Are Determined As Volatility Subsides

Dip-buyers are determined

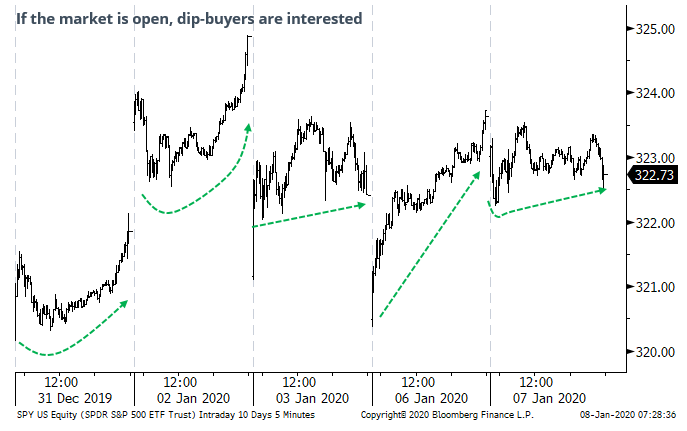

Several times over the past week, stock futures saw weakness in the overnight session. But as soon as regular trading hours opened, dip-buyers did their thing. It became even more egregious if we include Wednesday's session following the Iran conflict and subsequent intraday recovery.

The return on S&P 500 futures during regular trading hours exceeded the return overnight by an average of 0.74% over the past week, the largest spread in months. This 5-day difference between the S&P’s return during the day vs overnight is unusually large for a time when stocks are tickling all-time highs.

Such confidence among buyers was not typically rewarded, but there were certainly some exceptions.

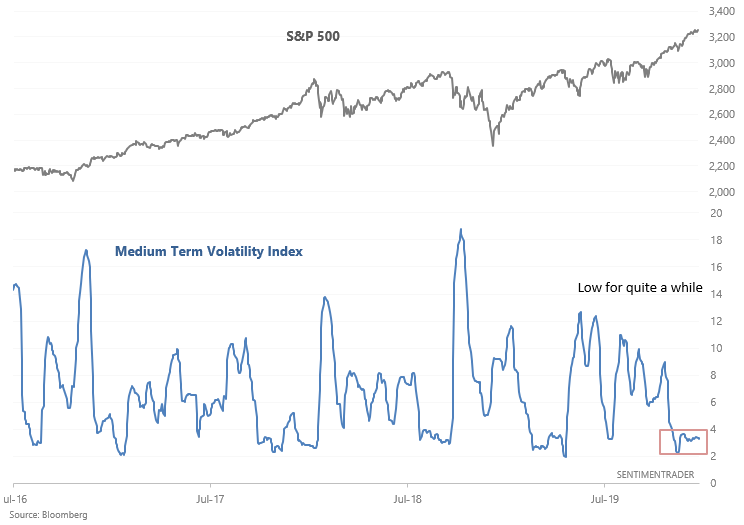

Lack of volatility

With the stock market refusing to break down, volatility has been low. I created a volatility index called the Medium Term Volatility Index which looks at the volatility of the stock market's volatility. Right now, the Medium-Term Volatility Index has been low for quite a while:

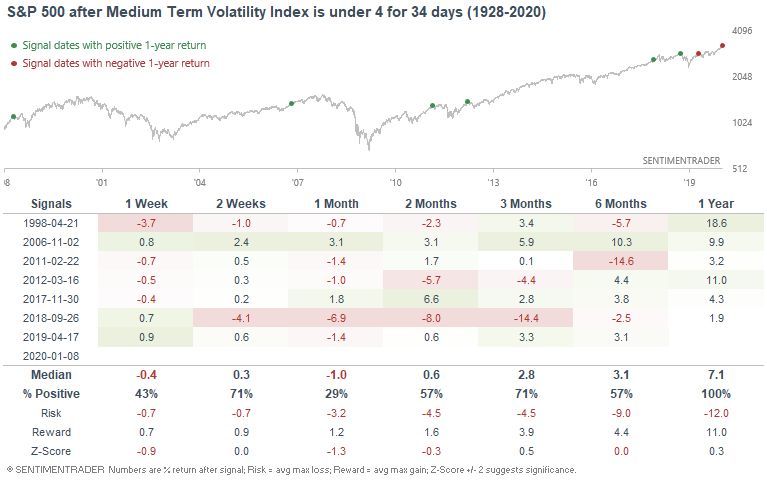

When the Medium Term Volatility Index was under 4 for 34 consecutive days, the S&P's returns over the next month were slightly worse than random, particularly from 1998-present:

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A longer history of low volatility

- Wall Street analysts are piling in with a record number of upgraded price targets on S&P 500 stocks

- What happens after markets rally after a sentiment extreme

- The VIX "fear gauge" is jumpy, but still under 15

- Nasdaq new high / new low breadth continues to shine

- Palladium is veeeeeeery stretched