Dollar Doldrums Leads To Commodity Streak

This is an abridged version of our Daily Report.

Dollar doldrums

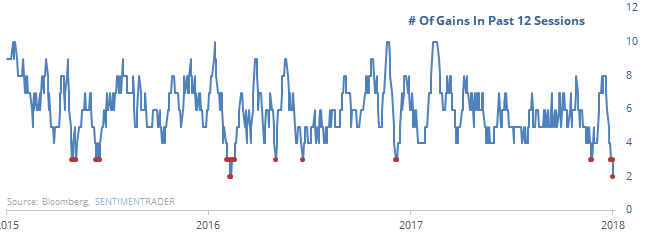

The dollar has only been able to rise twice in nearly three weeks, tied for its worst streak since it entered its trading range in 2015.

Similar selloffs since then have led to quick rebounds, but longer-term history is mixed and not suggestive of a lasting mean-reversion rally.

One man’s trash…

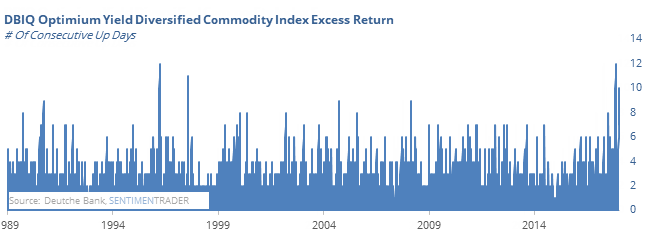

The broader commodity market has a strong inverse correlation to the dollar, so its slump has coincided with big positive streaks in some contracts. The index underlying a popular commodity ETF has rallied for 10 straight days, its 3rd-longest in 30 years.

Jumping into tech

The Nasdaq Composite rose more than 1% to a 52-week high on the first day of a new year 3 other times (2000, 2010, and 2011).

NEW FEATURE

Over the weekend, Eric released a site update that allows you to save tests from the Backtest Engine. Simply run any test, then click the Add To Favorites button and give it a name. It’s a nifty addition that will save a lot of time and scrambling to remember just what parameters you used before. You can always check the What’s New page to see what has been updated.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.