Dollar Fails And Transports Keep Lagging

Dollar failure

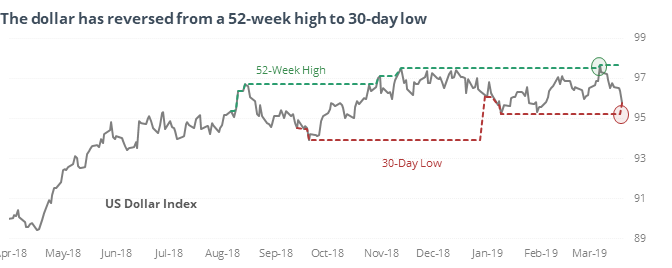

The U.S. dollar hit a new high in early March, and optimism was high. That proved to be a headwind again, and the buck has since reversed to close at a 30-day low.

This is an unusually quick reversal and quick reversals in the dollar like this have been a negative sign. During the next week, the dollar managed to reverse its decline only 19% of the time. A few of those reversed in the weeks and months ahead, but for the most part, the weakness stuck around.

Fed-Exed

Thanks in part to a sluggish Fed-Ex, the Dow Transports have sunk to a multi-year low relative to the S&P 500, even while the S&P itself was recently trading at a 100-day high. When Transports have lagged this badly on a relative basis, it has been a negative sign for the broader market.

New low

The post-FOMC reaction drove the yield on 10-year Treasuries to the lowest level in over a year, the first 52-week low in a couple of years. Since 1962, when the yield sunk to its first 52-week low in over a year, it managed to rise over the next two months only 33% of the time and over the next six months only 20% of the time.

Dovish

Both TLT and GLD rallied more than 0.5% on a day the FOMC announced a rate decision. Of the 16 other times they’ve reacted this way, over the next three weeks, TLT added to its gains only 31% of the time. GLD rallied 69% of the time.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.