Energy Company Default Risk Is Soaring

The Wall Street Journal published an article today about the free-falling price of bonds for many energy-related companies. Stock and bond prices have been falling by 5%-15% a day in some of these issues.

As a result, the probability of default is rising.

But the thing about that is that it is backward-looking. The probability of default doesn't rise until a company is in trouble, and it soars when panic is in the air. Sometimes that's right, but most often it is not.

There is a sense that "everyone" is trying to bet on a bottom in oil. That is demonstrably false by almost any measure that looks at actual money flows. There have been more puts traded versus calls on USO over the past two weeks than almost any time in that fund's history. Money managers are holding the fewest number of contracts in crude in more than five years.

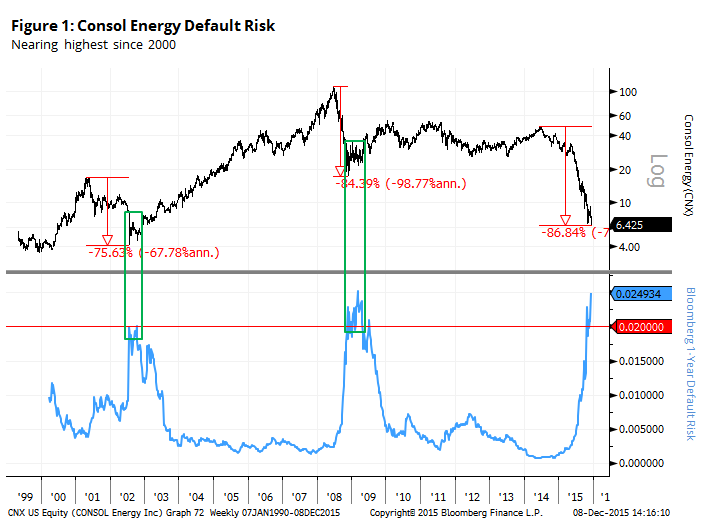

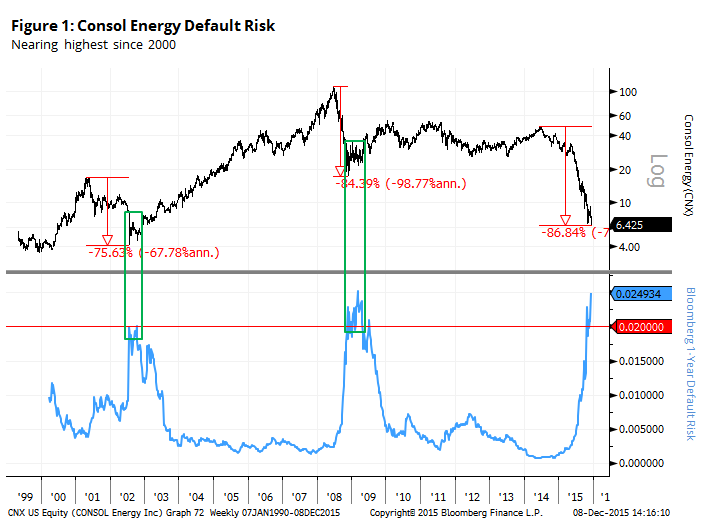

Regardless, one of the companies mentioned in the Journal piece is Consol Energy (CNX). It has the double-whammy negative of being involved in energy and mining.

The stock is more than 85% off its recent high and the probability that it's going to default is nearing its highest level since 2000.

That's the interesting thing. Look at the other two times it fell 75% or more from a high, and the default probability rose to 2% or higher. Both marked a general bottoming area for the stock.

We know nothing about the fundamental properties of this stock or industry. It's just at a notable juncture sentiment-wise on a long-term time frame that is being echoed by a number of different stocks in this sector.