Energy Stocks Hit New Highs As Volatility Traders Pile In

This is an abridged version of our Daily Report.

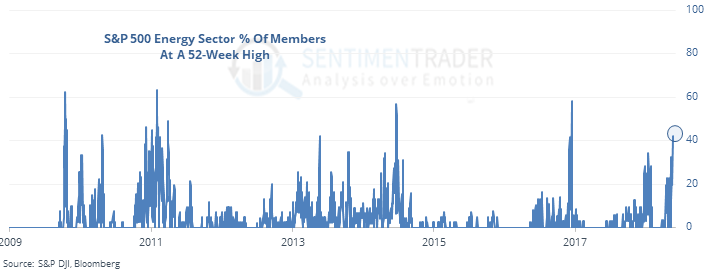

Energy stocks enjoying new highs

More than 40% of stocks in the S&P 500 Energy sector have reached a 52-week high.

That’s the most in more than a year and has preceded declines in the sector in recent years.

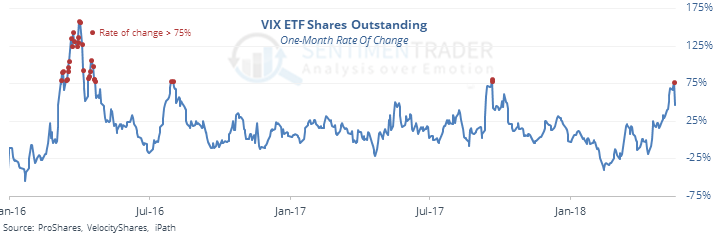

ETF traders bet on a spike in volatility

Shares outstanding in ETFs that bet on a rise in volatility have soared in recent weeks, doubling since April.

These tend to be “smart money” traders, anticipating big moves in the VIX with uncanny accuracy.

The latest Commitments of Traders report was released, covering positions through Tuesday

According to the 3-Year Min/Max Screen, “smart money” hedgers are holding the most net long contracts in hogs in several years, since 2012, actually.

No Utilities in short-term uptrends

All 28 members of the S&P 500 Utilities sector are trading below their 10-day moving averages.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |