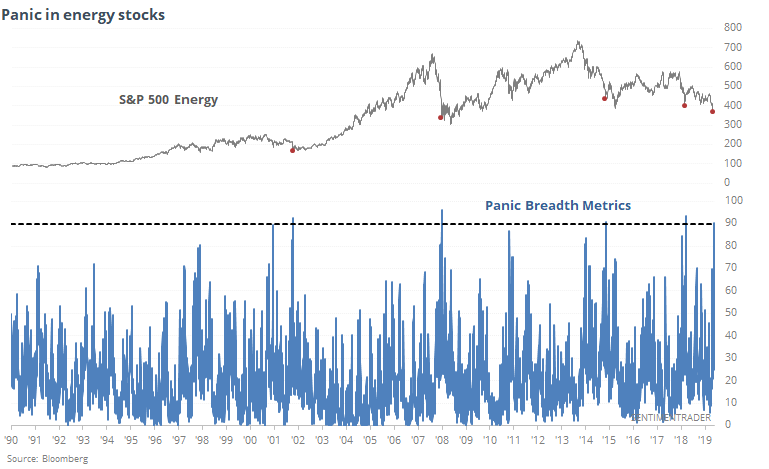

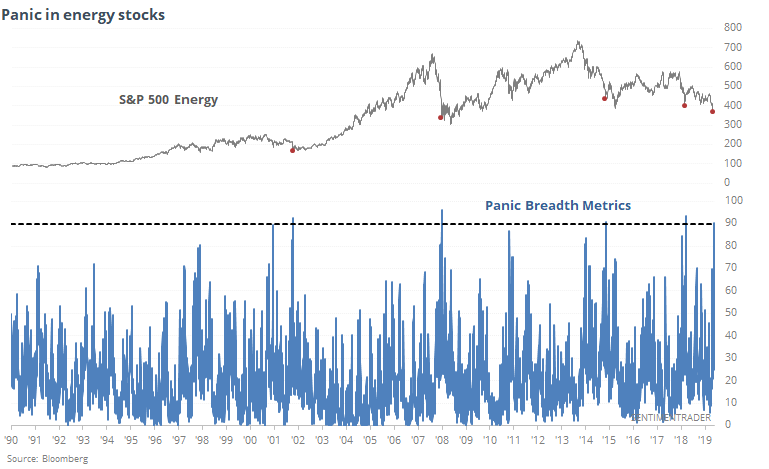

Energy washout

In recent days, we've looked at the washout in energy stocks. Looking at a variety of breadth metrics, the only real holdout was the percentage of them plunging to 52-week lows.

Past "pukes" were near the end of their runs when more than half of the stocks fell to a 52-week low at the same time. Until today, that hadn't been reached. With the selling today, that figure is at 64% of the sector and climbing.

Based on all the various breadth metrics we watch, if the figures hold into the close, this would be the worst-breadth combination in energy stocks in 30 years.

On average, the "panic breadth" readings are at 90%, a level that has been matched only a few times.

The sector has tended to do extremely well in the months following wholesale selling pressure like this.

The next day or two might see a crescendo of selling that washes out the final clingers among buyers (especially since we're seeing this late in the week and buyers may be hesitant ahead of the weekend), but it would be historically rare - unprecedented, really - if we don't see the sector work higher in the months ahead.