Energy's recovery attempt

We saw yesterday that sentiment toward oil is horrendous, among the worst ever.

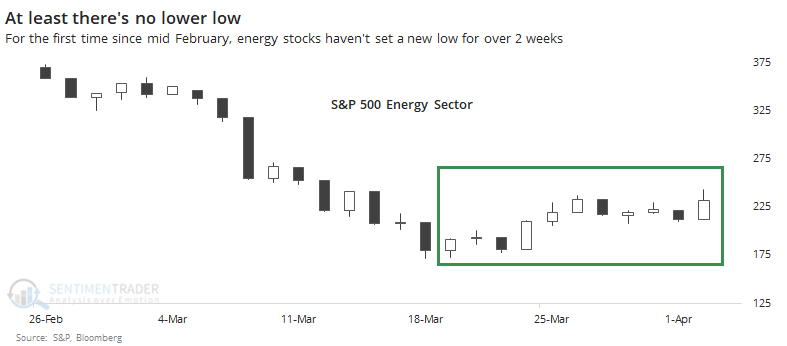

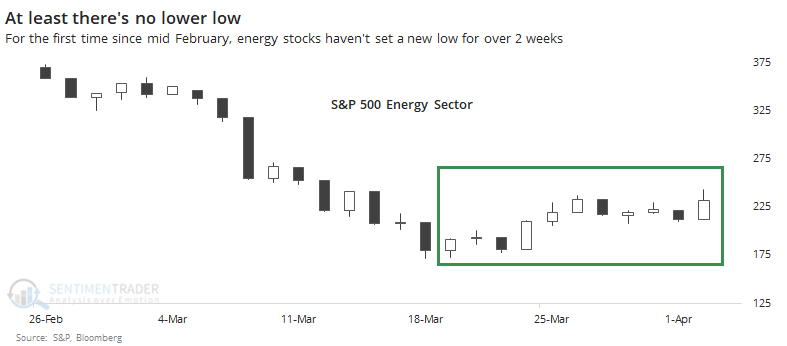

Now that there seems to be some geopolitical cooperation when it comes to the price of the commodity (depending on who's being asked), energy stocks have seen more committed buying interest. Perhaps it's at least a good sign that they have made a lower lower for two weeks.

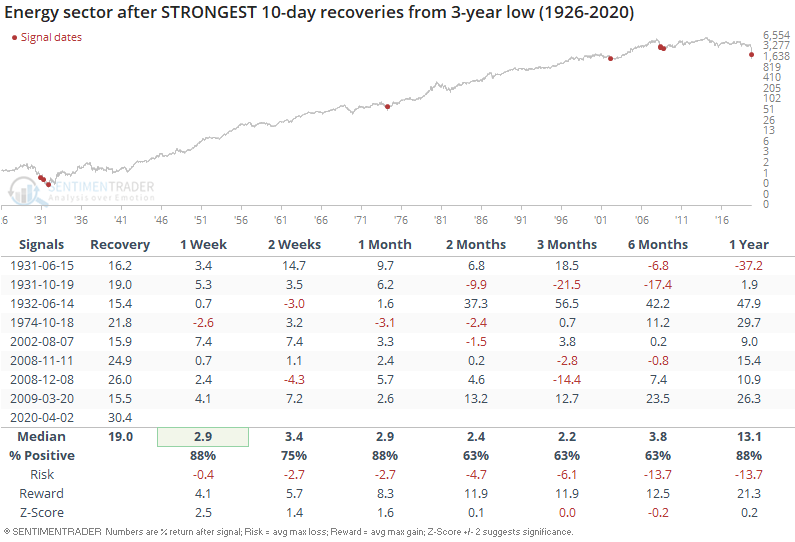

From today's highest price to the low a little over two weeks ago, energy stocks have rebounded more than 30%, qualifying for the strongest push off a low since 1926.

It was not a foolproof sign that a prolonged low was in, with a couple of head-fakes in the 1930s and again in 2008. The others were mostly a sign that sellers were exhausted.

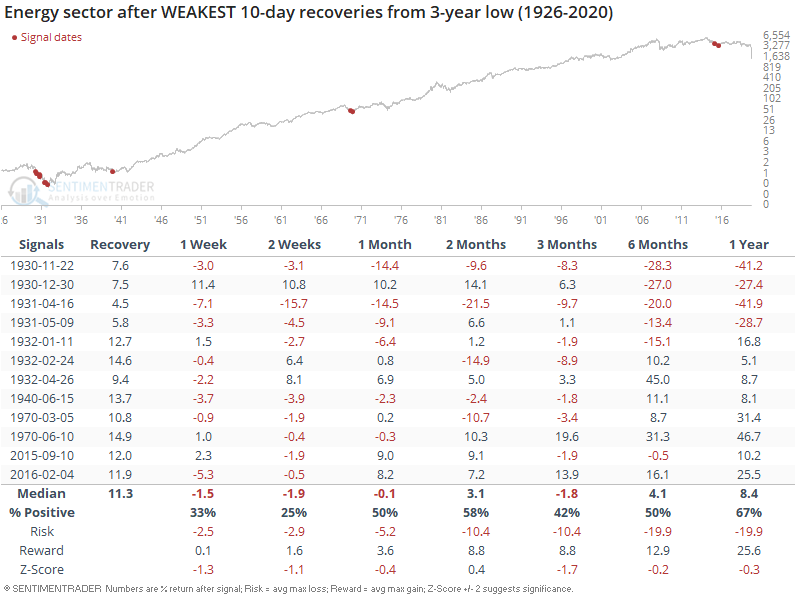

The size of the bounce seemed to make a difference. After the stocks had sunk to a 3-year low then recovered for 10 days but with a weak bounce, there was more of a tendency to see additional losses going forward.

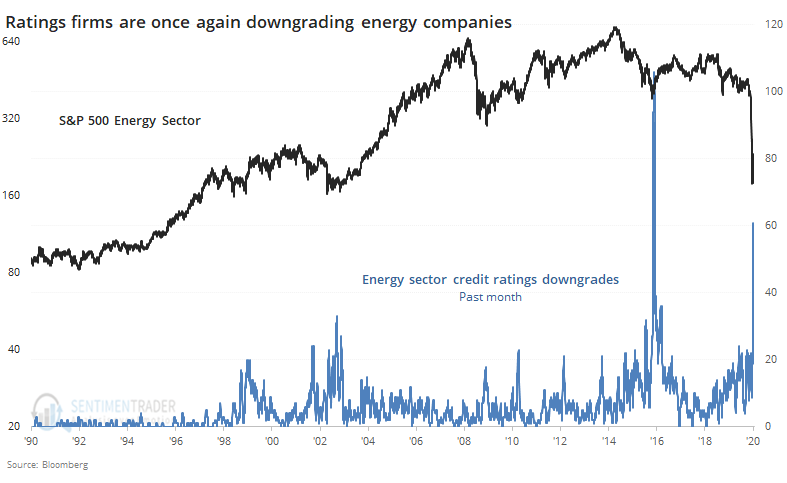

Back in February 2016, we looked at the surge in rating downgrades on Wall Street for stocks in the energy sector. Ratings firms are not exactly known as being forward thinkers when it comes to their public pronouncements, and once again they proved to be woefully behind the curve as the companies surged that year.

They're back at it.

Downgrades haven't yet matched the pace from 2016, but it's changing quickly.

With such negative sentiment and at least the inklings of a sustained recovery, the sector is looking better than it has in months. The plunge in March violated all kinds of historical precedent, which is a worry. As long as it holds above the low of the past week, though, it looks constructive.