Equity Risk Premium back to extreme under-valuation

The concept of valuation is up in the air for now, since nobody knows how earnings are going to be impacted by the economic shutdowns. That's always the case in times of tumult, though the uncertainty now seems far beyond the typical.

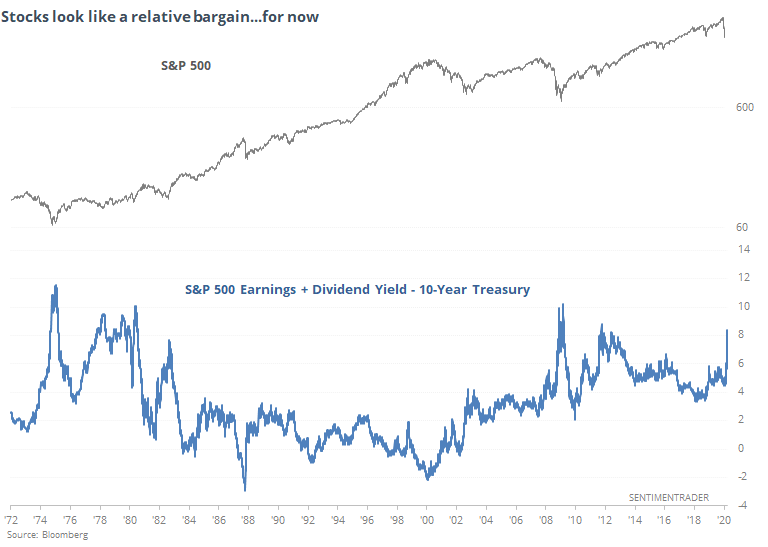

Even though we know earnings will be dramatically lower, and dividends will also be cut, for now they're commanding a big premium over Treasuries.

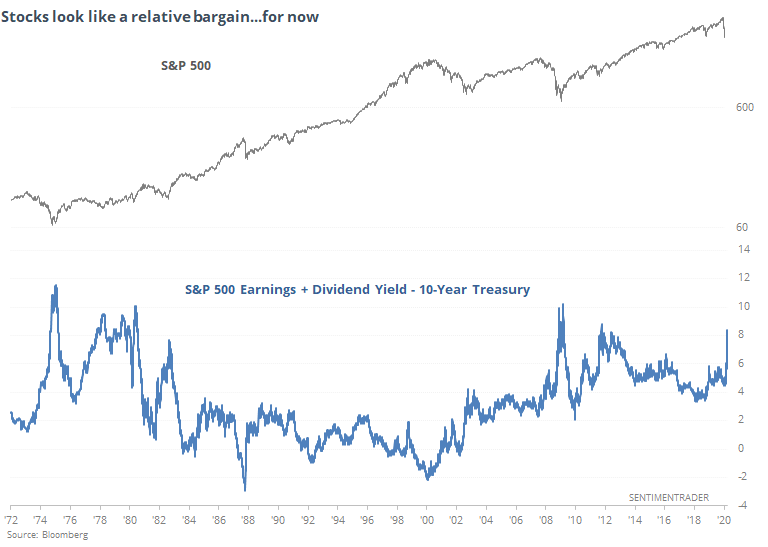

When we looked at this in December 2018, we viewed it as a z-score. At the time, the Equity Risk Premium had eclipsed 4 standard deviations. Recently, it moved beyond 6 and at a record extreme. The scale is inverted to better line up with periods of over- and under-valuation.

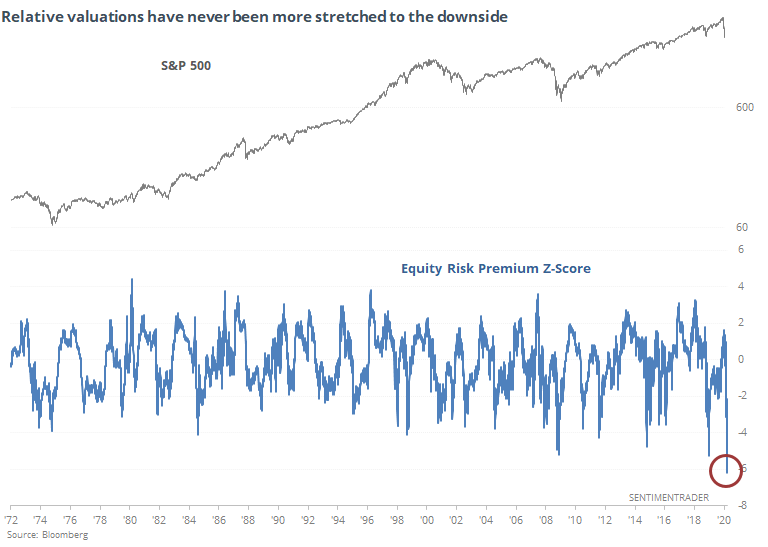

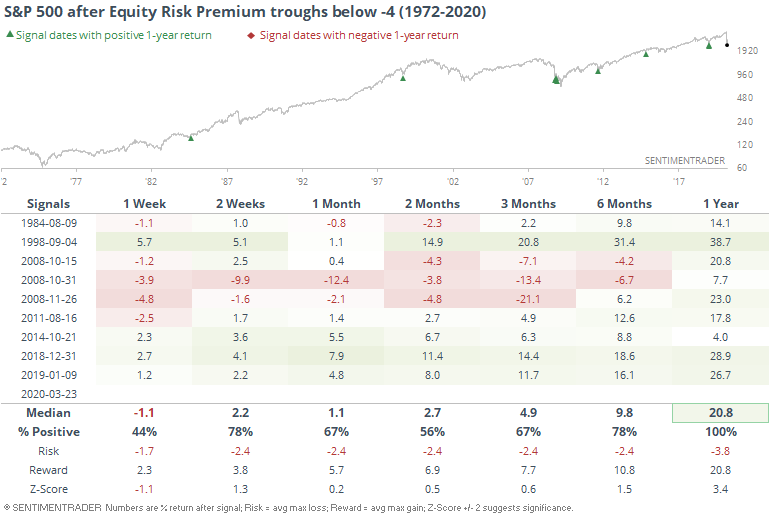

This indicator troughed a week ago. if we look at other times it exceeded -4 then didn't set a new low for a week, we get the following.

This proved to be a false bottom a couple of times in 2008 as the extreme volatility caused it to swing back and forth, and shorter-term risk was still high. But over the next year, all the signals showed a positive return, and well above average. Even with the 2008 gyrations, the overall risk/reward was still skewed heavily to the upside over the longer-term.

Clearly, earnings and dividends will drop, and probably significantly. Using the trailing 12 months, which is what we use here, it's possible that yields won't dip too much if we get a quick recovery in Q3 and Q4. Even so, we've likely seen the trough for this Equity Risk Premium, and it's been a good long-term sign when hitting such an extreme.