ETF Investors Stay Home As Mom & Pop Go Back To Stocks

This is an abridged version of our Daily Report.

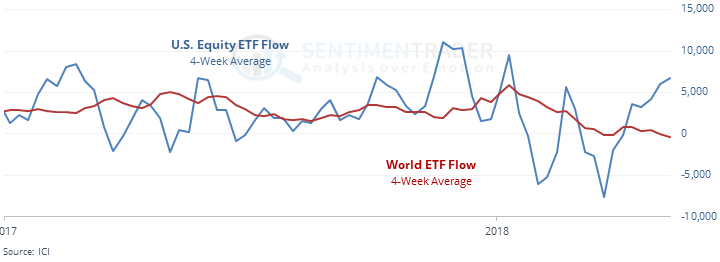

ETF investors stay home

Flows into domestic ETFs have swamped that of overseas funds over the past 4 weeks.

The other times it happened to this degree, world stocks started to outperform the S&P.

Mom & pop ignore safety

Individual investors are showing one of the widest differences in allocations to stocks vs safe investments. The spread between the two has been seen twice before. Both times, there was a long-term rotation out of stocks and into bond.

Cubes got engulfed

The Nasdaq 100 fund, QQQ, hit a high then put in a bearish engulfing pattern. That has led to some very short-term weakness, not so much after that.

Exposed

According to the NAAIM organization, the average active investment manager is now 90% net long stocks, and even the most bearish manager is long (usually there’s at least one short seller). Since the 2006 inception of the survey, there have been 22 other weeks when this was the case.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |