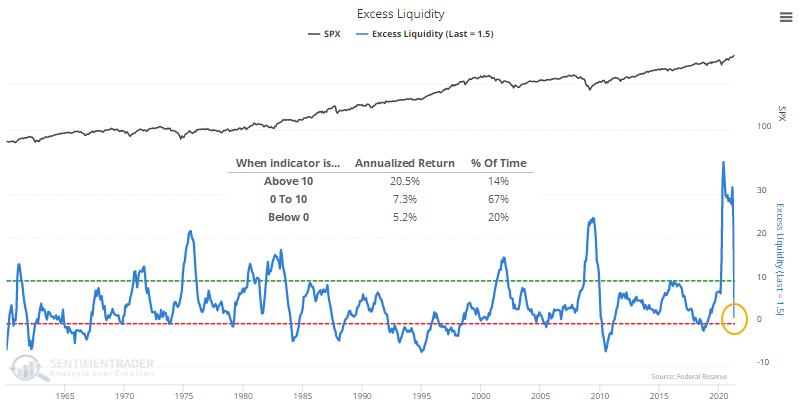

Excess Liquidity Is Draining From the Market

The flood of money that found its way into financial markets is leaving and pooling into economic production. This behavior suggests that Excess Liquidity is plunging.

On our site, we define Excess Liquidity as:

This shows the growth in growth in M2, a broad measure of the money supply that includes deposits and money market funds, and the growth in the economy. In the long term, they tend to grow together. However, when the supply of money grows faster than the economy (represented by the growth in Industrial Production), the excess money is not invested in "things" but rather tends to find its way into financial assets. Therefore, high levels of excess liquidity tend to be positive for stock prices. Low levels of excess liquidity are negative for stocks but are not as strong as the opposite condition.

We can see just how much this figure spiked and then plunged with the latest economic releases.

The S&P 500 has returned an annualized +20.5% when Excess Liquidity is above 10%, where it had been since last March. Its returns are more in line with random as that figure drops below 10% and heads toward zero.

The overall takeaway from the plunge in Excess Liquidity shouldn't be that it's necessary bearish. More than anything, for the broader market, it's simply "not bullish." Stocks tend to perform better when the figure is high. When it drains out, the S&P has mostly held up okay, but two sectors, in particular, showed vastly different returns.

| Stat Box More than $1 billion flowed out of the Nasdaq 100 trust, QQQ, on Thursday. According to our Backtest Engine, over the past 3 years, buying QQQ and holding for 1 month following a $1 billion outflow would have returned 188% versus 98% for buy-and-hold. |

What else we're looking at

- Full returns in the S&P 500 after a plunge in Excess Liquidity

- How sectors and factors performed after Liquidity declined

- A look at momentum stocks, and whether they suffered from draining Liquidity

- Brazilian stocks are showing an internal thrust

- An update on the gold / S&P 500 ratio and where it stands today