Failed vs successful bear market rallies

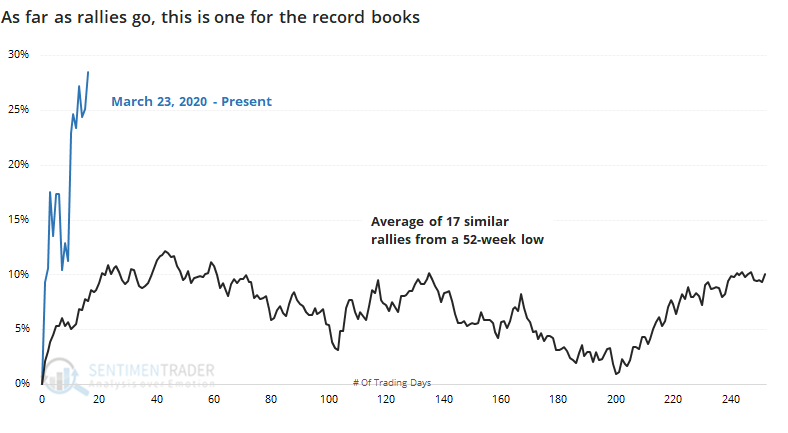

As far as rallies from a low, the past few weeks have been epic. It's been well-documented that stocks have enjoyed one of the best-ever stretches over the past couple of weeks, pushing the S&P 500 nearly 30% off its 52-week low.

If we go back to 1928 and look at every time the S&P managed to rally for this long off of a low, we can get a sense for how it performed afterward, depending on whether the rally ended up being a success or failure.

The chart below shows every time it rallied for 18 sessions off a 52-week low, gaining at least 5%.

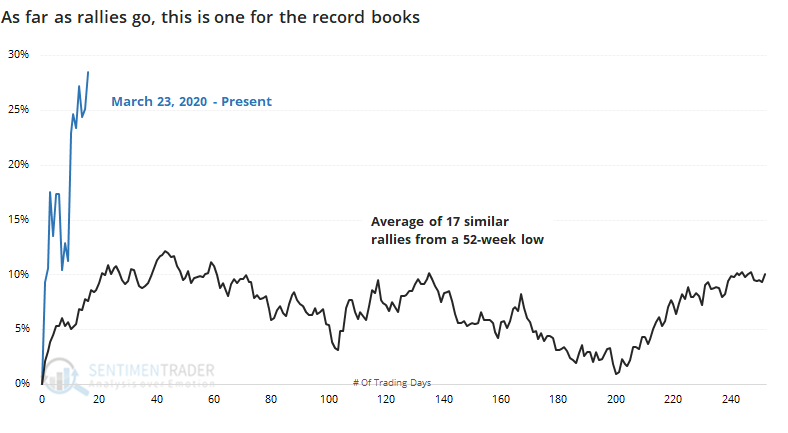

When the rebounds ultimately succeeded, these initial kick-off rallies tended to hit the pause button right about now. Once we got about 20 days into the recovery, the S&P often plateaued, chopping around for weeks at least.

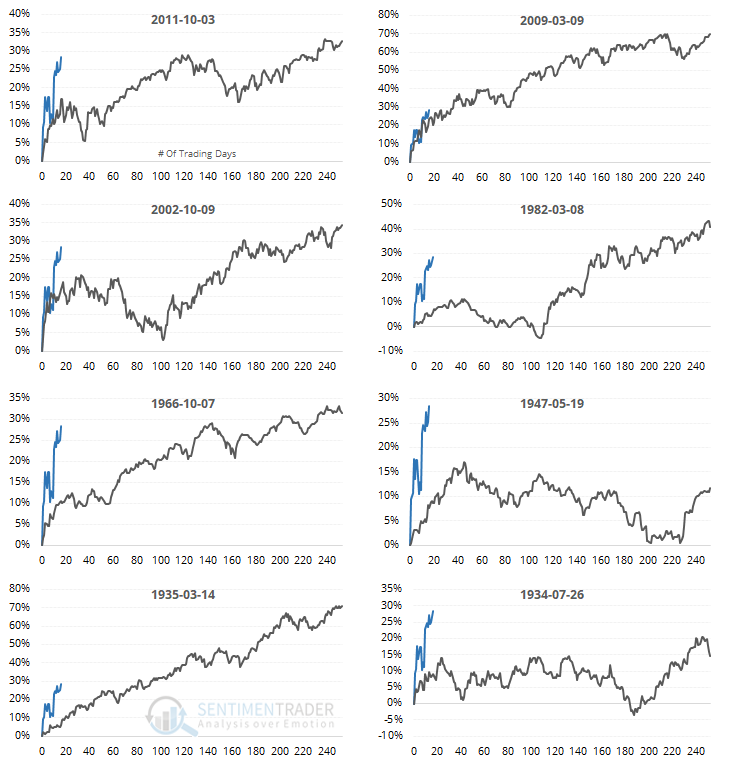

There was wide variability among the samples, but there were only two bottoms that took off like a rocket and just kept going, in 2009 and 1935. Otherwise, buyers paused for a while and digested those initial gains.

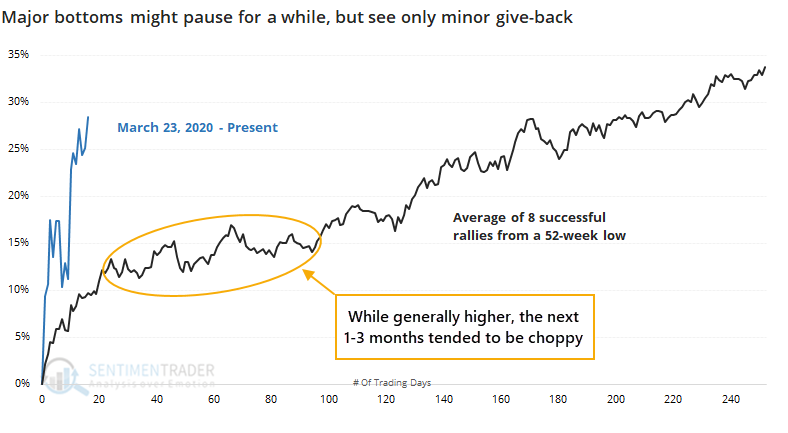

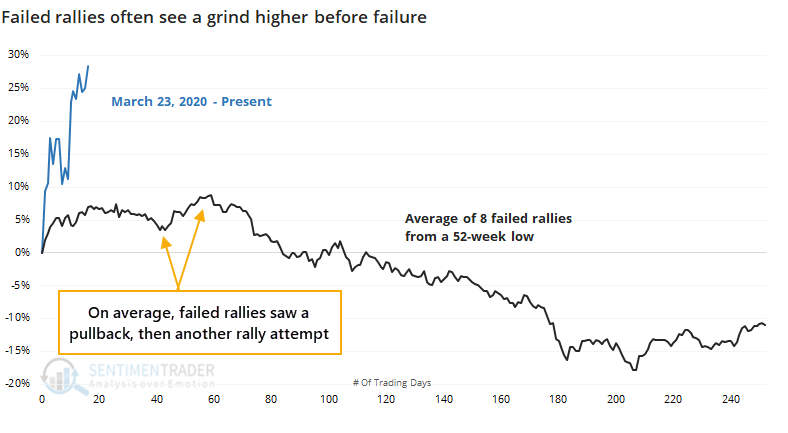

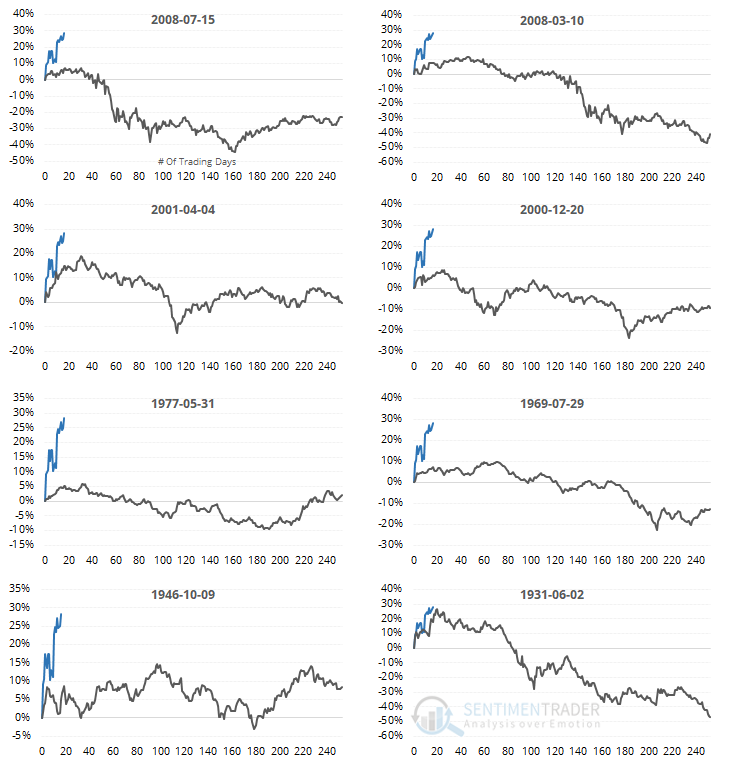

Now, let's look at the failures. These are times when the S&P also made a major push off a 52-week low but ended up seeing either a negative or only slightly positive return over the next year.

Even though these rallies ended up failing, it usually didn't happen right away. While the initial kick-off rally often paused right around now, there was another round of buying interest following the dip. This was the first real opportunity for buyers who didn't catch the falling knife, and missed out on the initial rebound.

It's interesting how rare it was to see the S&P roll over and head to new lows immediately, even during what ultimately proved to be failures.

Nothing is guaranteed, and we're in one of the most unique market environments in recorded history. If we can count on investor behavior repeating in a very general sense, then we should see buyers try to make another attempt following the first real pullback, even if we're due for a long-term slog and more protracted bear market.