Financial conditions are recovering from epic plunge

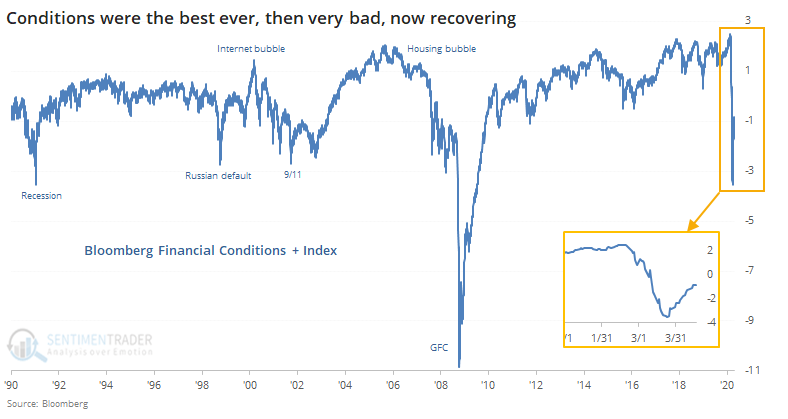

In a mid-February report, we showed that financial conditions were as good as it gets. The best in 30 years, at least.

March changed that in a hurry. Conditions when from the best-ever to one of the worst-ever in a matter of weeks. The Bloomberg Financial Conditions + index (BFC+) went from +2 to -2 in only three weeks, a record drop.

Per Bloomberg:

The Bloomberg Financial Conditions index tracks the overall level of financial stress in the U.S. money, bond, and equity markets to help assess the availability and cost of credit. A positive value indicates accommodative financial conditions, while a negative value indicates tighter financial conditions relative to pre-crisis norms. Bloomberg also calculates a Financial Conditions + index which includes all the elements of the BFCI index as well as indicators of asset-price bubbles, which also have an effect on financial conditions. These include tech-share prices, the housing market, and deviations from equilibrium yield levels.”

The rally off the March low has eased those conditions, however, and the index has reversed much of the decline.

The first two were excellent signals that the recovery was in force and sustainable, with excellent gains and very little risk in the months ahead. Like so many other indicators have shown, the first post-panic moves in October-November 2008 were a head-fake and it preceded some painful months for those who bought into the initial recovery.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A closer look at price performance following financial condition recoveries

- Curiously high volume has been flowing into declining stocks

- What happens to energy stocks after big drops in crude oil rig counts

- Earnings expectations are plunging

- The S&P 500's weekly RSI is recovering from a deeply oversold condition

- The S&P is above its 50-day average, but few of its members are

- The VIX has dropped for 4 consecutive weeks

- More sectors are showing extreme optimism

- Commodities have been crunched relative to stocks