First Large Down Open

The prolonged period of low volatility ended last week, which we took a look at a couple of times last week. Now we're looking at a large gap down in the S&P 500 futures, which hasn't happened since November 9 (and June 24 prior to that).

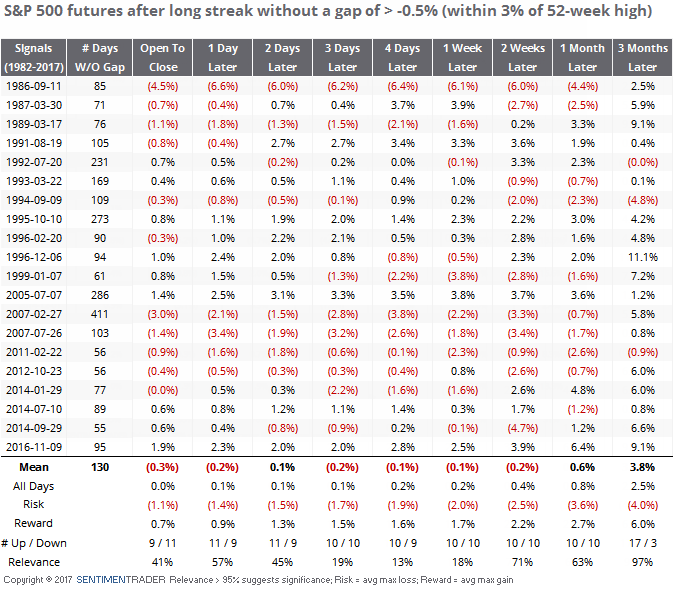

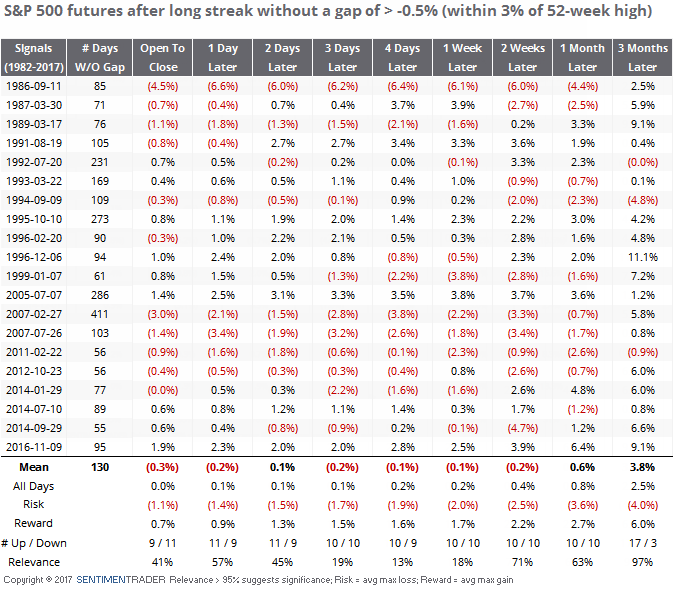

Let's take a look at other times the futures finally had a large gap down open of at least -0.5% after having gone at least 50 days without one, including instances where the futures were within 3% of a 52-week high. Our current streak is past 90 days.

We would expect generally positive results, but that wasn't really the case. The futures lost ground more often than not from open to close, and even looking out over the next several days, both the average return and risk/reward ratio were skewed to the downside. It wasn't until the medium-term of 3 months later that there was a clear positive drift. This would caution against being too eager to buy into early weakness.