Flows to bonds versus stocks reaches another record

Investors still aren't showing much love for stocks, at least according to flows in mutual funds and ETFs. They still favor bonds, despite a recent blip.

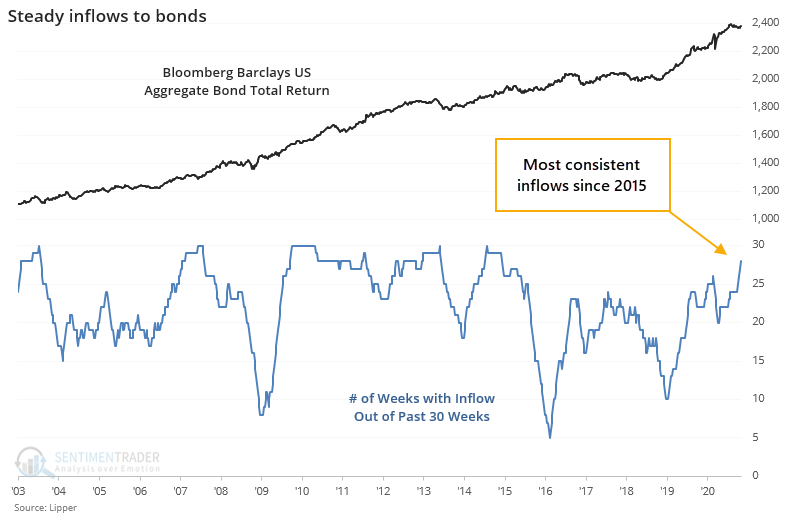

The latest data from Lipper shows that investors finally pulled some money out of bond funds over the past week. That's only the 2nd outflow in the past 30 weeks.

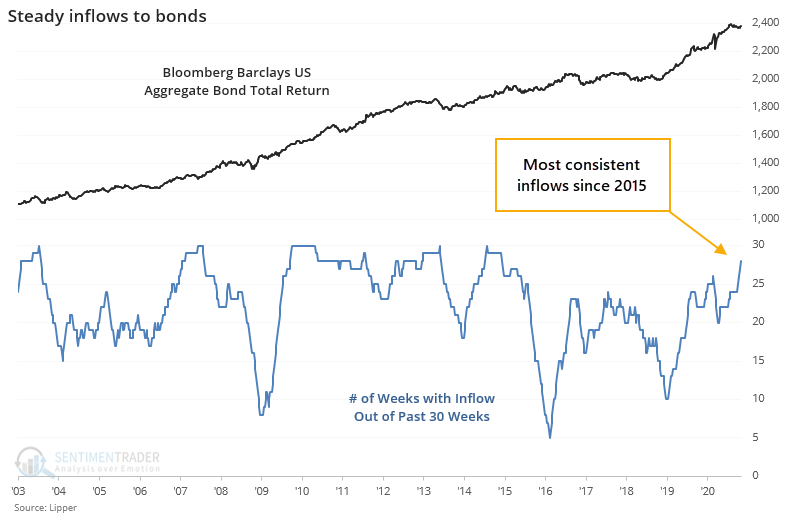

Stocks, on the other hand, have seen almost nothing but outflows over that time span.

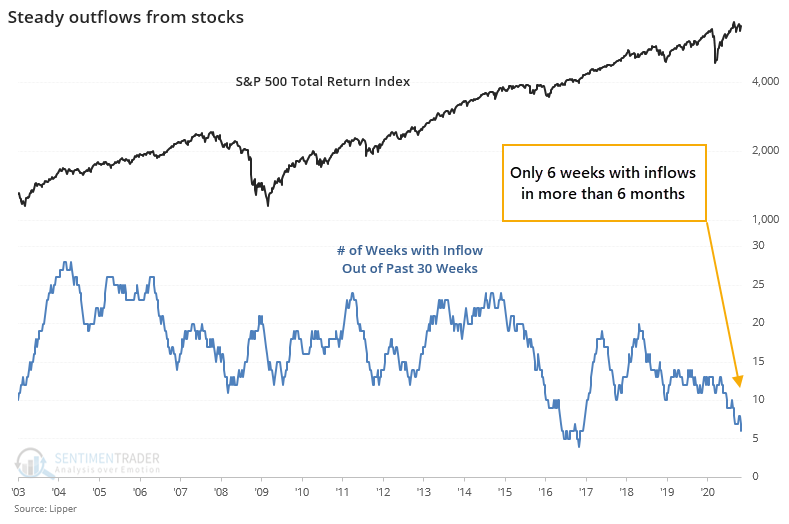

The consistency of flows between the two asset classes has never been more stark. The chart below shows the difference in the number of weeks with inflows between bonds and stocks, along with a ratio of the Bloomberg Barclays U.S. Aggregate Bond Total Return index versus the S&P 500 Total Return index.

The difference in flows moved to a record several weeks ago and continues to reach new highs. The handful of other times there were around 15 more weeks of inflows to bonds versus stocks, the bond/stock ratio tended to decline. Clearly, the overall trend has been down anyway, so it wasn't a high hurdle to cross. It's simply a suggestion that it would be odd to see bonds turn meaningfully higher versus stocks given the way investors have been shifting their assets.