Following the Smart Money

Previously, I looked at using the Smart Money / Dumb Money Spread as a signal for trading both long and short. Annual returns on that trading signal were 2.24% using no leverage.

We had a request come in to take a look at using the Smart Money model as a trading signal. The request was much bigger than the simple strategy below, but I wanted to use the request as a way to work through a couple blog posts on Smart Money and building signals / strategies from the model.

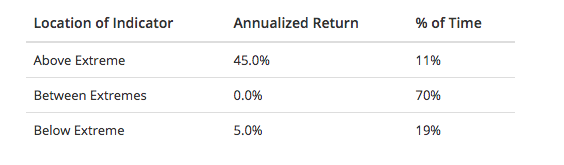

First off, as always, I like to take a look at the annualized threshold returns for the signal before building any strategies. The threshold returns for the Smart Money model shows a very positive skew when readings are above 0.70.

[caption id="attachment_911" align="aligncenter" width="564"] Figure 1: Threshold returns for the Smart Money Model[/caption]

Figure 1: Threshold returns for the Smart Money Model[/caption]

For this strategy, I'm going to use the same approach I've taken previously. This will be a long-only strategy. Trading rules are defined below.

Trading Rules

- Trading dates are Sept 16 1996 to Oct 21 2016 (entire history of the model)

- Long only

- No Margin. Account size is $250K.

- 1,000 shares of SPY ETF

- Commission of $10 per trade

- $0.01 per share slippage

- Go long when:

- Smart Money closes above 0.70 (Excessive Optimism)

- Close when:

- Smart Money closes below 0.30 (Excessive Pessimism)

- All orders are entered at the open of the next day’s trading session after a signal is given.

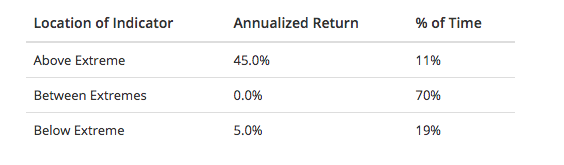

This strategy doesn't provide a large number of trades, but it does provide some very good returns. Some basic trade statistics are provided below.

[caption id="attachment_913" align="aligncenter" width="392"] Figure 2: Trade statistics for the Smart Money Model[/caption]

Figure 2: Trade statistics for the Smart Money Model[/caption]

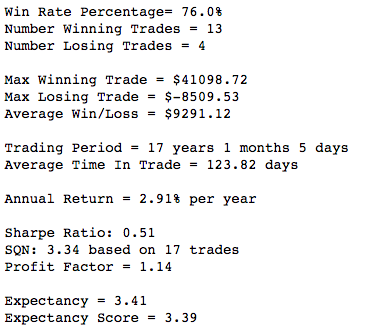

[caption id="attachment_915" align="aligncenter" width="281"] Figure 3: Win/Loss statistics for the Smart Money Model[/caption]

Figure 3: Win/Loss statistics for the Smart Money Model[/caption]

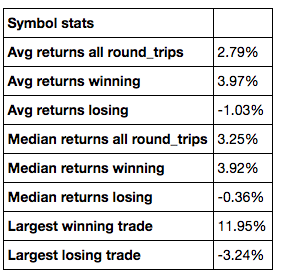

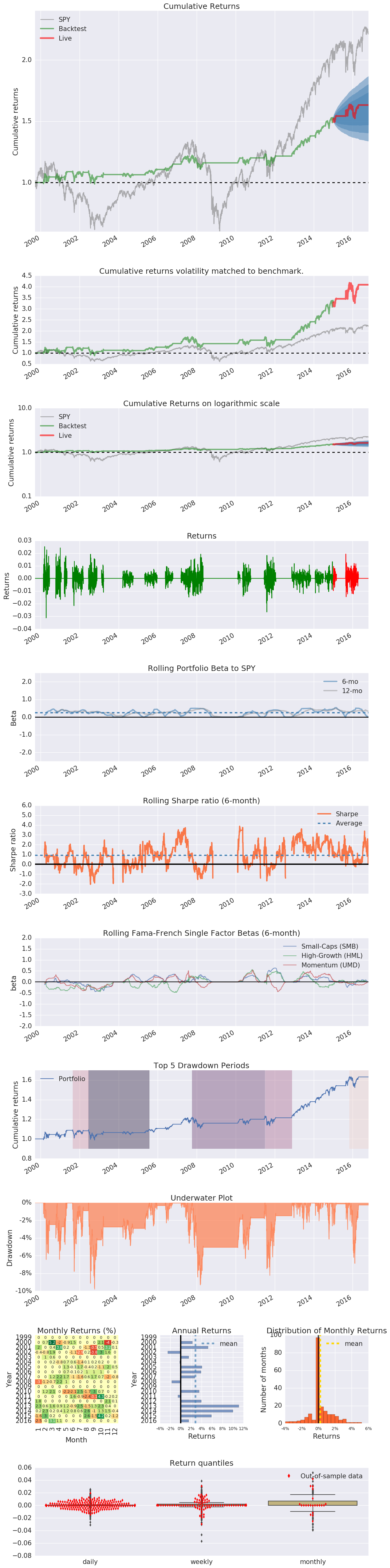

This simple strategy delivers some pretty good results with some volatility (see cumulative return volatility compared to benchmark chart below). Overall, following the smart money delivers excellent results (2.91% annualized without leverage). Performance charts for this strategy are provided below with in-sample and out-of-sample data (out-of-sample is all dates after Jan 1 2015). Note: Out-of-sample returns are ~4% compared to the 2.91% returns found in-sample.

[caption id="attachment_917" align="aligncenter" width="600"] Figure 4: Performance Charts for the Smart Money Model[/caption]

Figure 4: Performance Charts for the Smart Money Model[/caption]

Check back next week for another look at using the Smart Money model as a signal.