Funds Trading At Extreme Premiums/Discounts

One of the screens we like to run is funds that are trading at an extreme to their net asset value (NAV). Closed-end funds (CEF) are often driven to premiums or discounts to their underlying value according to demand from retail investors, and when they reach an extreme, can be an effective contrary indicator.

Because of their structure, ETFs don't often trade at extreme premiums or discounts, and they're not always related to sentiment when they are, but still when we see a fund trading with a temporary dislocation to its underlying value, it can present an opportunity to see it move the other way.

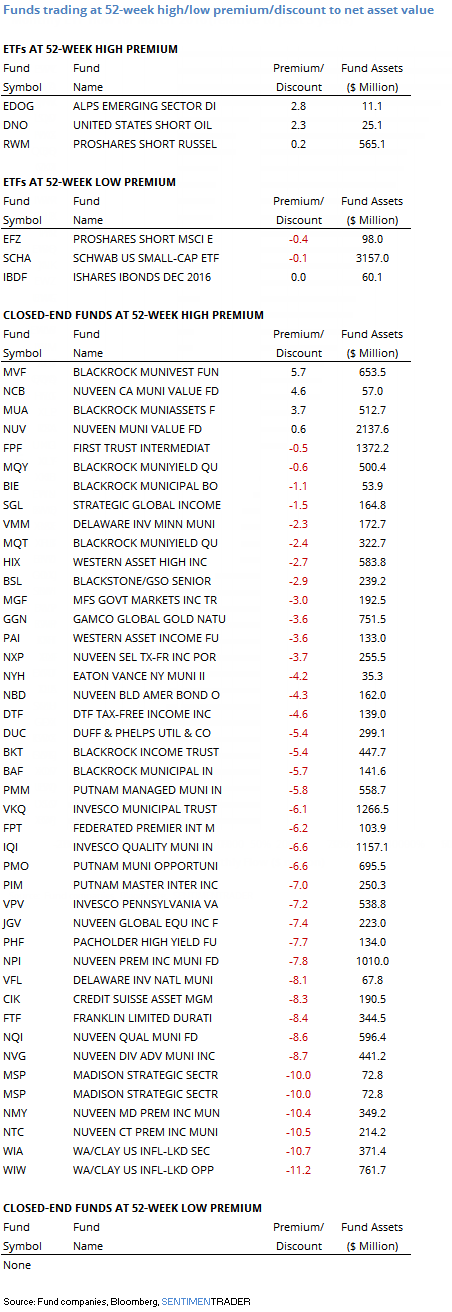

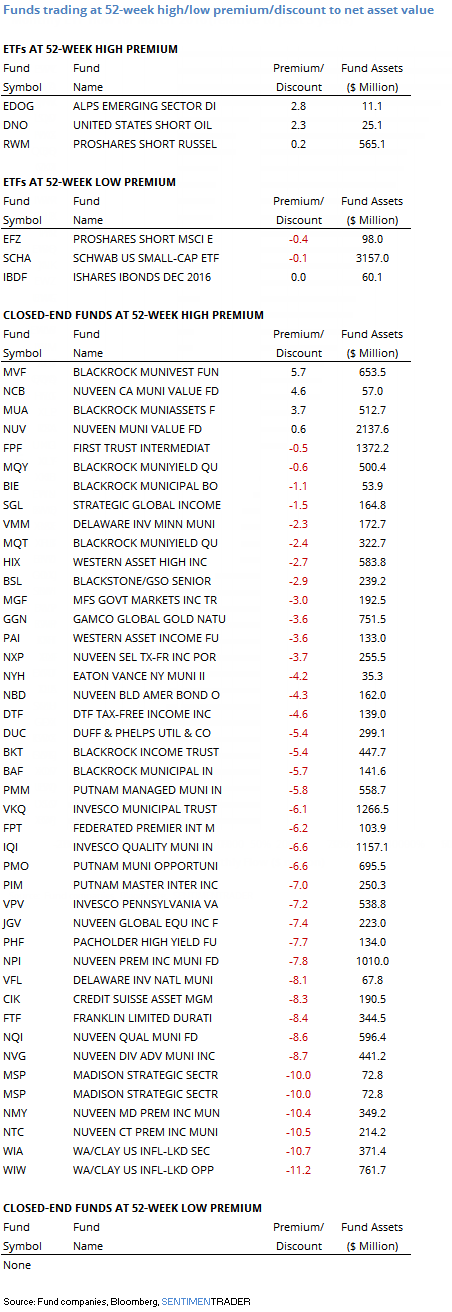

The tables below show ETFs and CEFs trading at a 52-week high or low premium/discount to their net asset value. Watching these screens can present interesting trading opportunities and sometimes a way to catch overriding themes (like the large number of muni funds now trading at 52-week high premiums).