Gapping After A New High

It's hard to not be suspicious of using price-based patterns when we seem to be continually seeing violations of prior historical patterns.

It's entirely possible that the rise of quant-based trading has rendered many of these patterns unusable, either because they've been discovered and traded upon, or simply changed the dynamics underlying price activity. This has been especially true of very short-term movements. Medium-term and longer have been less impacted.

With that caveat in mind, stock futures are once again pointed higher this morning, despite (or because of) the overnight news flow.

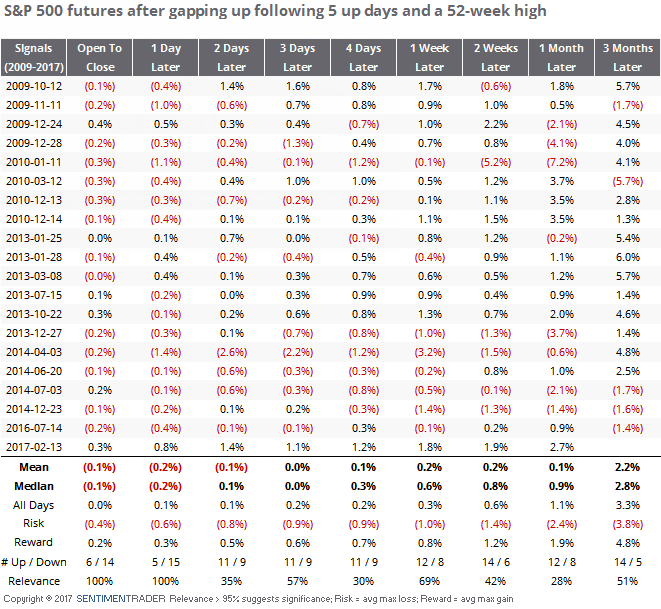

Here is how the S&P 500 futures have performed after gapping up the morning after a new high and what had already been 5 straight up days. The table is focused only on occurrences during the bull market since 2009.

Even during the remarkable 2013-14 run, stocks took a short-term breather most of the time after such gap opens, at least over the next day or two.

Granted, all the other short-term price-based studies we've looked at in recent days suggested the streak should have ended at 3 days. Then 4 days. So we're on the cusp of continually trying to push against a failed pattern, which can result in the dreaded "tilting at windmills" situation, especially as volume drops off and out-of-office email responses pile up ahead of the Memorial Day holiday.