Gold market recovering from March dislocations

There have been some odd, extreme moves in stocks over the past few weeks. And bonds, and currencies, and commodities. The forced selling in mid- to late-March triggered a lot of unusual trading activity and a breakdown in correlations.

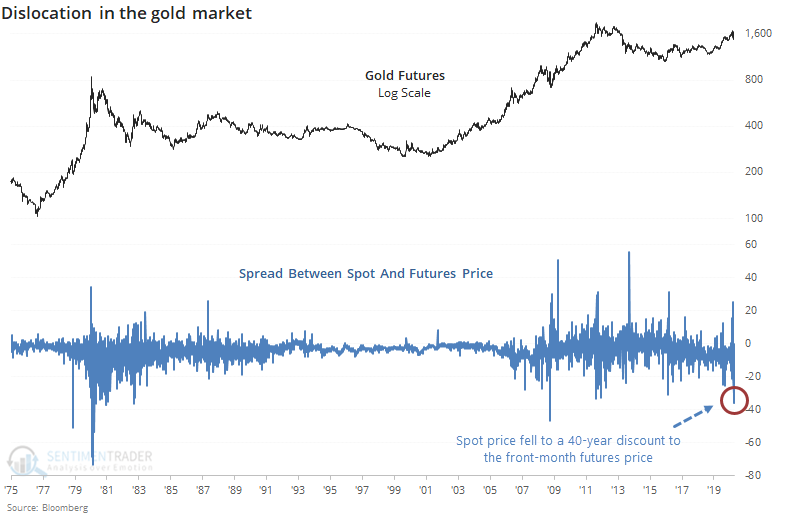

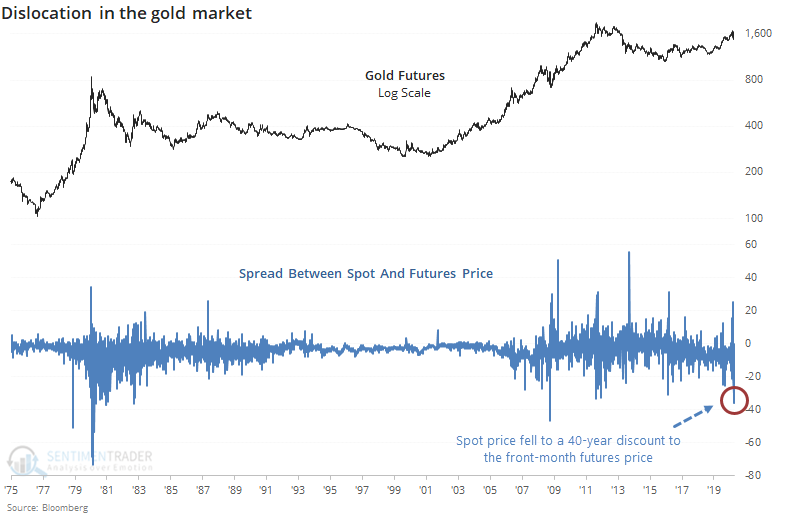

One of those correlations is that during times of duress in other markets, especially stocks, gold is supposed to be a safe haven. Yet it sold off along with stocks before recovering lately. That forced selling caused the spot price of gold to fall far below what futures traders were willing to pay.

This has been alleviated in recent days, and while it typically happened near peaks in gold, it was not consistent.

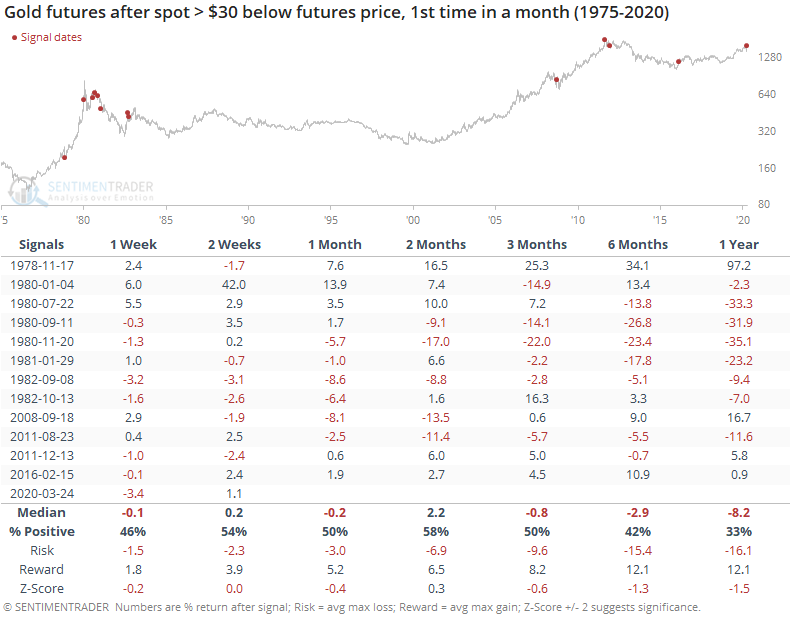

More recently, traders have been putting a higher price on near-term gold futures than the contract that goes out six months. This has been highly unusual over the past 40 years.

Looking at more recent years, it has been a mixed sign. While it was the case during the late run-up in 2009-12, it persisted while gold melted down after that peak. Very generally, a term structure like this would be considered a positive sign going forward.

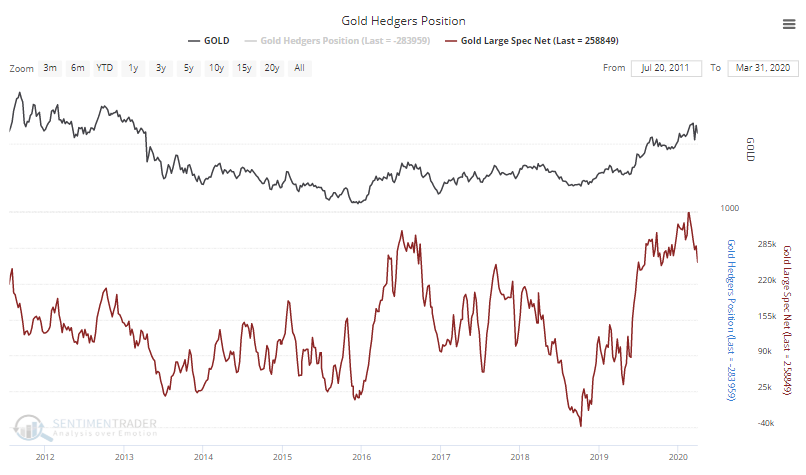

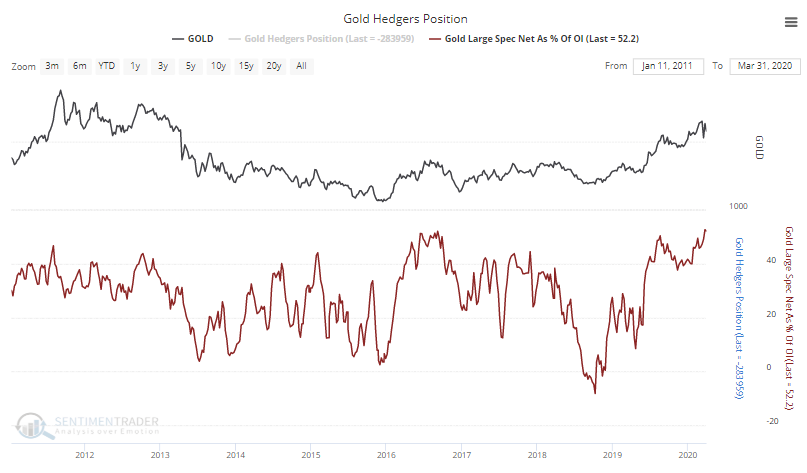

Large speculators have been scrambling to sell gold futures in recent weeks as the contract suffered volatility.

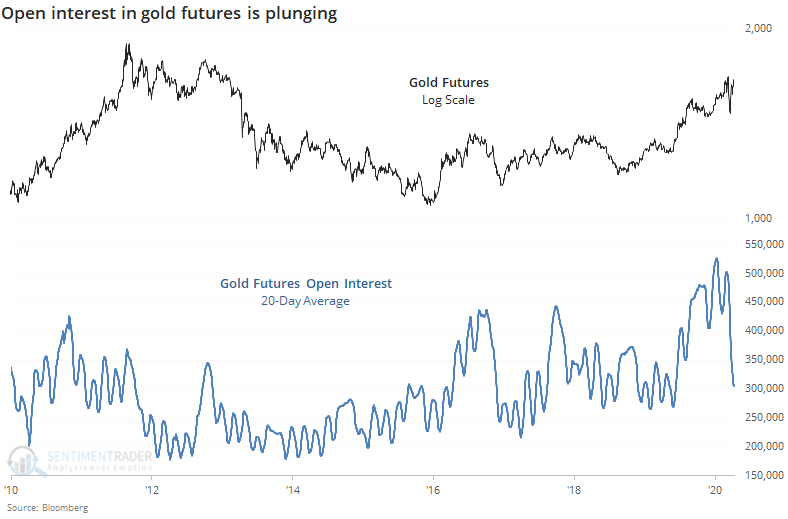

Even though speculators have sold some of their their long positions, overall open interest in gold futures is plunging. Low open interest is usually a sign of apathy and good for future returns, but it's coming off a record high, so a mixed picture there.

That means their net position as a percentage of open interest has continued to climb as is now at a record high. This is not good.

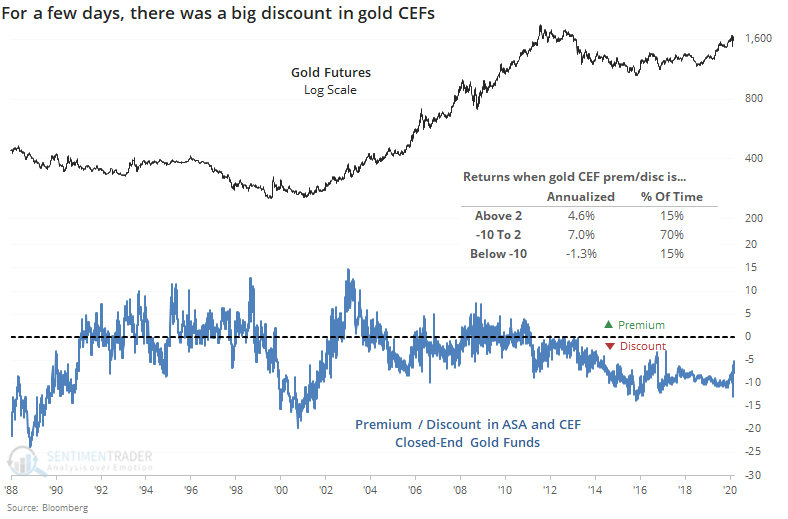

The confusion in the spot and futures markets caused traders to sell some of the oldest closed-end funds like ASA and CEF. During the tumult, they dropped to discounts of more than 12% from their net asset values (on average between them). The funds have spent about 15% of their time with a discount lower than -10% or higher than +2%.

Big discounts weren't necessarily a sign of a bargain in gold (and big premiums not a consistent sign of excessive optimism) but very roughly, times when the CEF discounts were at their greatest, gold did well going forward over the past 25 years. It wasn't a help in the early 1990s.

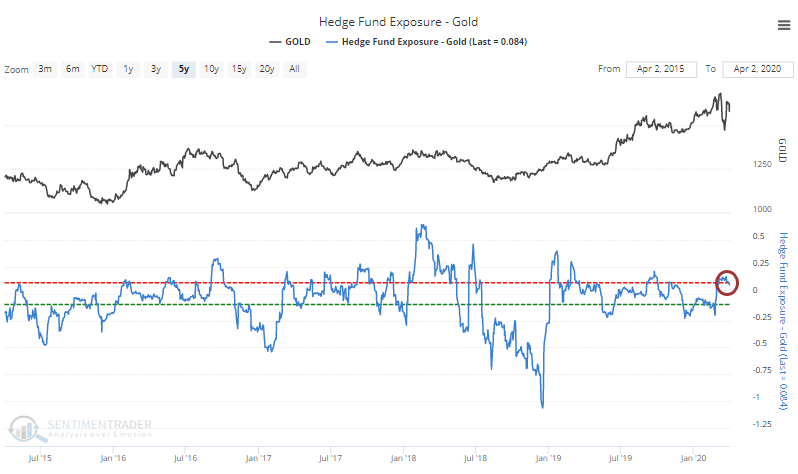

A rough estimate of hedge funds' exposure to gold has remained relatively high in recent weeks. It's not high enough to consider it a negative, but it's not a positive either. The best risk/reward points for the metal typically occurred when exposure was heavily negative.

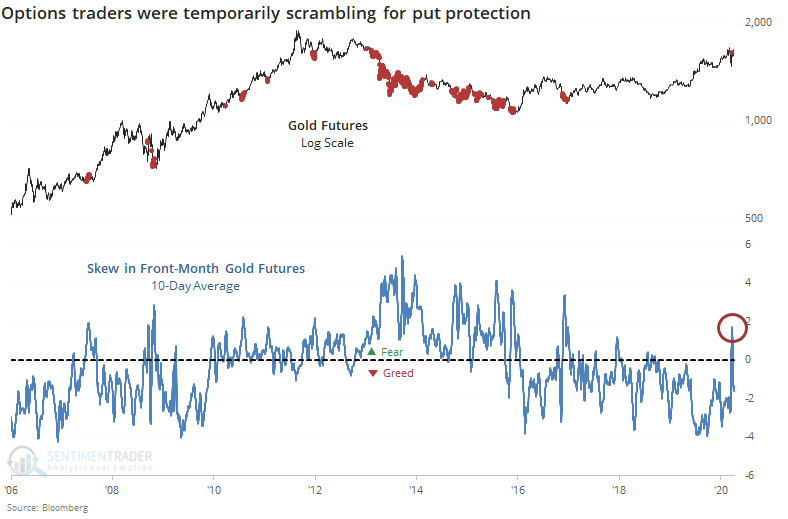

During the worst of the volatility, options traders in gold futures were scrambling for protection, and paying up for it. The skew between puts and calls had spiked, though that has since relaxed. It's usually been a good sign when fear like that was prevalent.

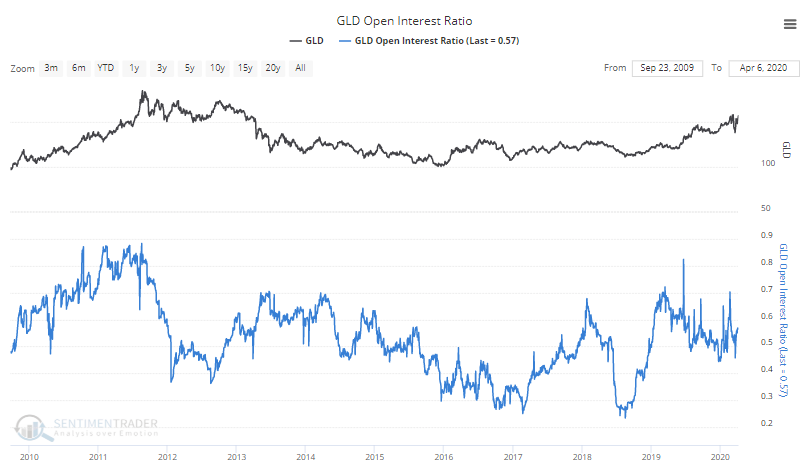

The go-to fund for ETF traders in gold is usually GLD, though that fund's dominance is being tested. The open interest in puts versus calls in that fund is about average based on its range over the past decade. When there have been relatively fewer calls open relative to puts, it's been a better sign.

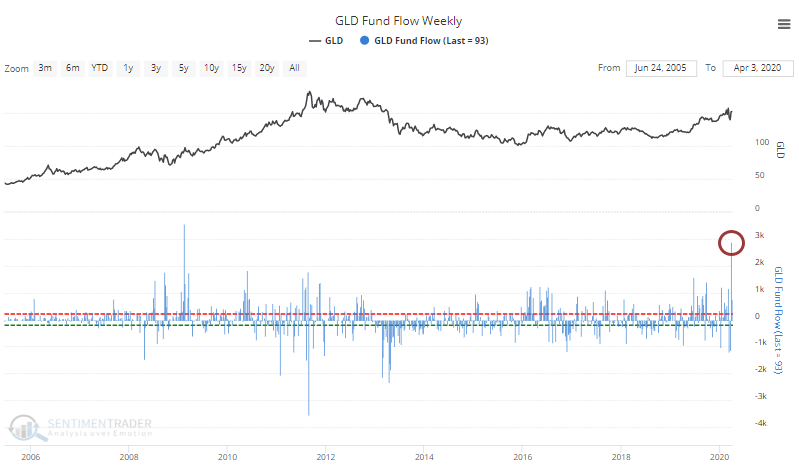

The fund has seen a big inflow in recent weeks. That could be due to the fund created units to meet demand from short-sellers, but fund flows in GLD seems more "natural" than some others, simply meaning we usually see inflows when GLD rises and outflows when it falls. There is a modest contrary nature to the flows, which would be a minor negative here given the recent surge in inflows.

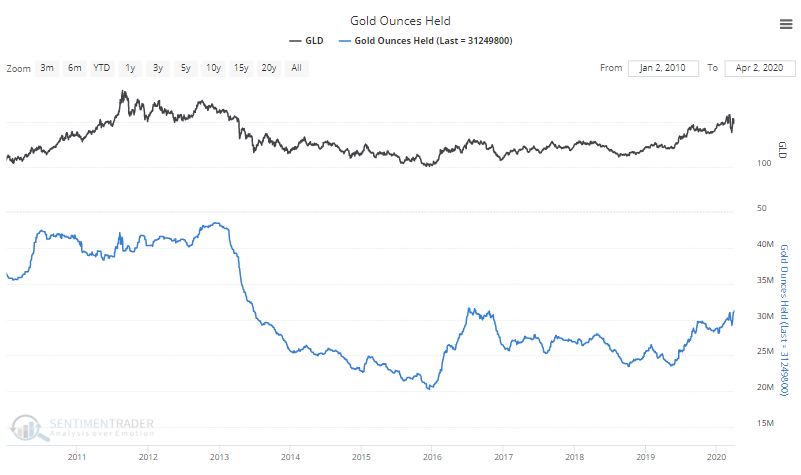

The big inflow means that the number of ounces held by the fund has hit a multi-year high. It still remains off the highest level from earlier in the decade, though.

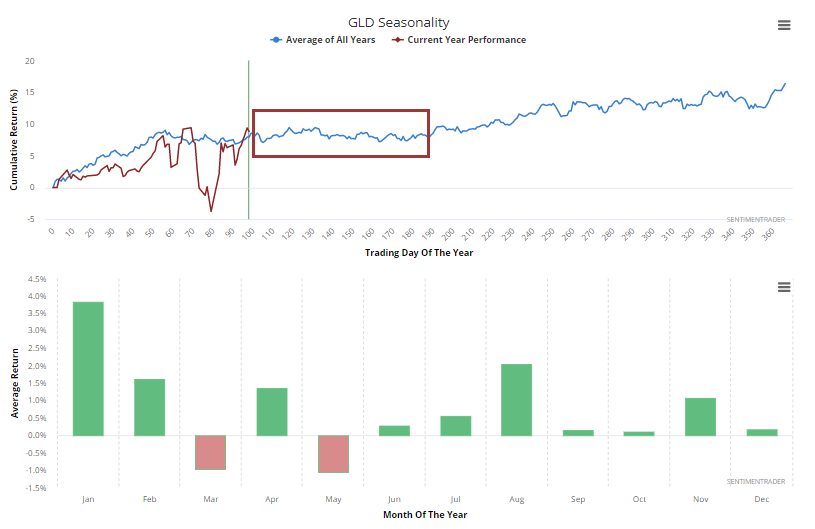

GLD has mostly followed its seasonal pattern, which turns a little rockier over the next few months.

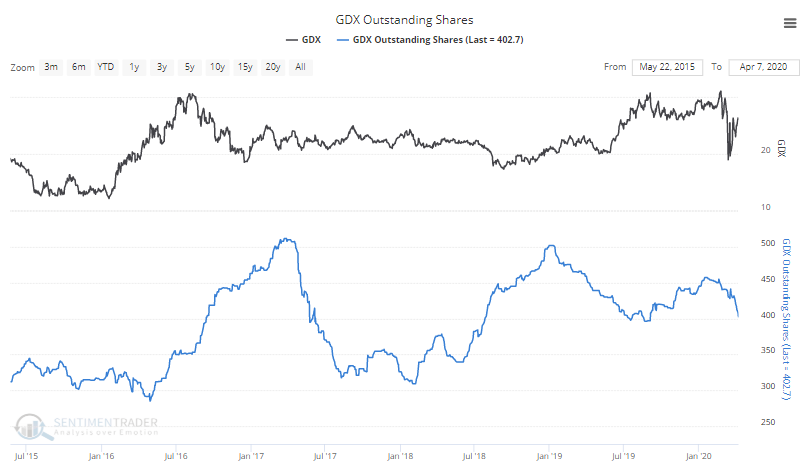

For the miners, they got the worst of the confusion in gold along with the plunge in stocks. That caused outstanding shares in funds like GDX to decline as the fund traded at a record discount to its net asset value.

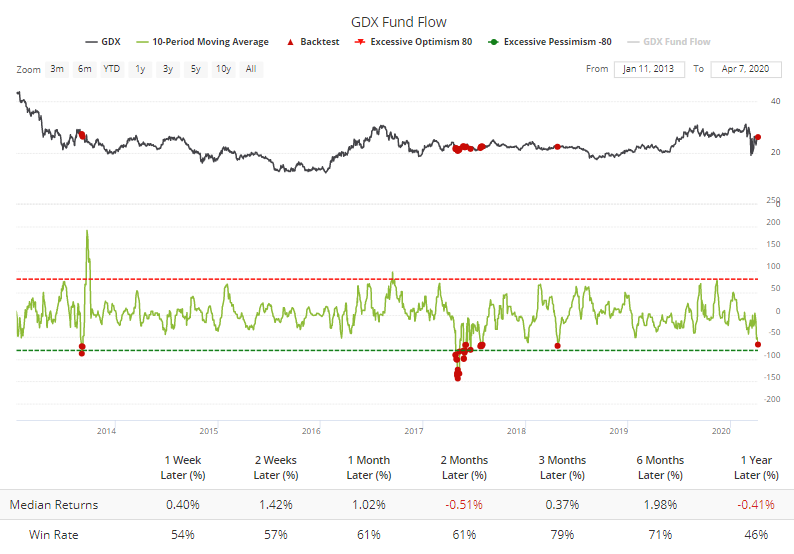

The drop in shares meant a net outflow, and over the past 10 days the fund has leaded an average of more than $65 million in assets per day. According to the Backtest Engine, this has been a mild positive the few other times it got this bad, but it's not a strong indicator.

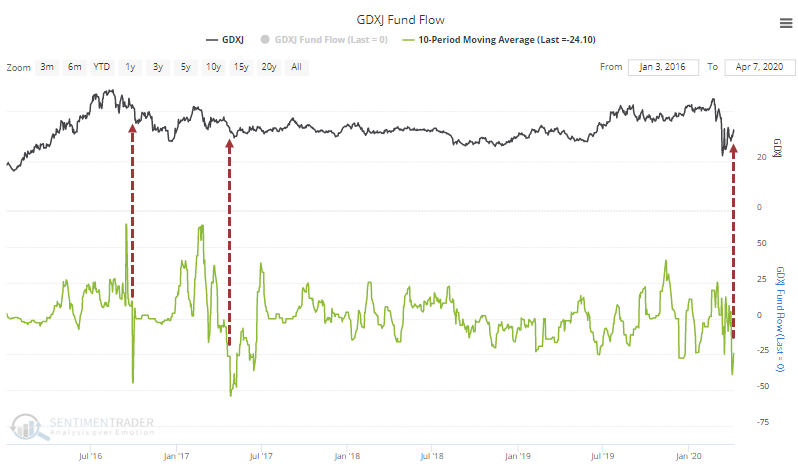

The junior gold miners tend to be more volatile, and the fund flows reflect that. The GDXJ fund has also seen a big outflow, but again it's hard to read much into this.

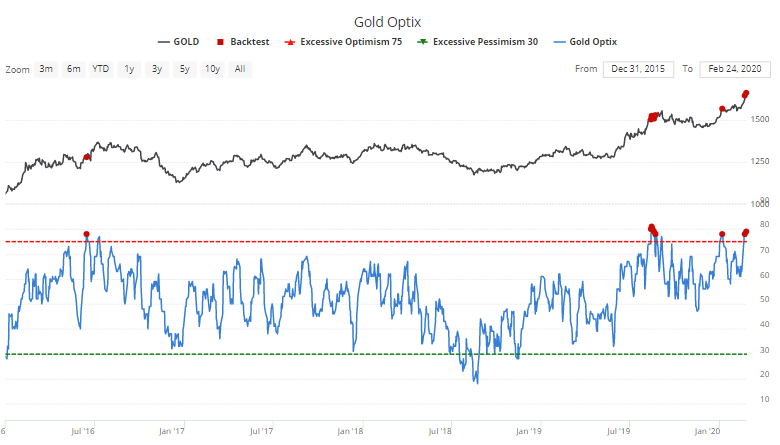

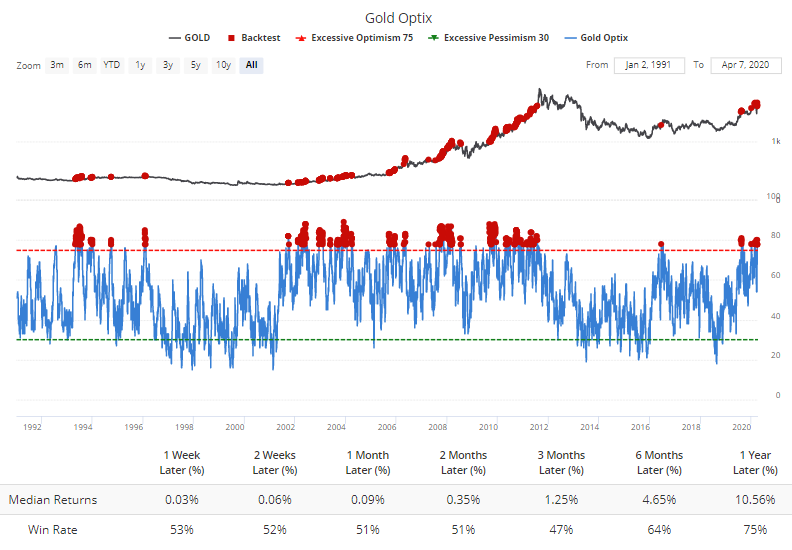

For gold itself, the overall Optimism Index, which incorporates many of these measures, recently hit 78%, after which it has been tough for gold to maintain upside momentum in recent years.

Since the most optimism is usually seen during bull markets, some of the highest readings occurred in the mid-2000s, so future returns weren't terrible...they weren't great, either. Essentially flat over the next few months according to the Backtest Engine.

The most comprehensive of these metrics is the Optimism Index, and it's still at a high level, which has preceded flat returns over the short- to medium-term, even during the roaring 2000s bull market. That's the biggest knock against the metal right now. The dislocation in March temporarily triggered some near-panic readings, but those have quickly evaporated, and didn't usually give strong signals anyway. The surge of ETF flows and massive long position by speculators are other worries.

Overall, there isn't much of anything to suggest an edge for long positions, and if anything it would tilt to the negative side. The biggest factor is what investors feel will happen with growth and inflation once we get through the pandemic, and that has the potential to swamp any other technical, fundamental, or behavioral factors. So far, there isn't a strong sign that the metal is immune to these factors (it still hasn't been able to rally strongly in the face of excessive optimism), but it's something to watch for in the coming weeks.