Gold optimism finally takes a header

Warning signs have been triggering in gold, silver, and mining stocks for a few weeks, especially after it looked like they were firing on all cylinders.

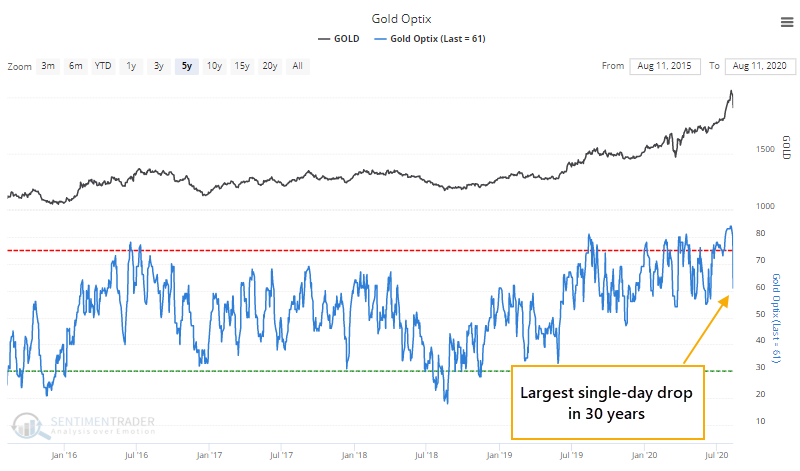

Reality hit hard on Tuesday and optimism about the metals took a header. In a premium note, Troy mentioned that the Optimism Index for gold fell the most ever in a single day, cratering from above 80 to barely above 60.

It fell a bit further and the Optimism Index has now cycled from well into excessive optimism back to neutral. Since 1990, this has typically meant the metal had more work to do to shed all of that optimism.

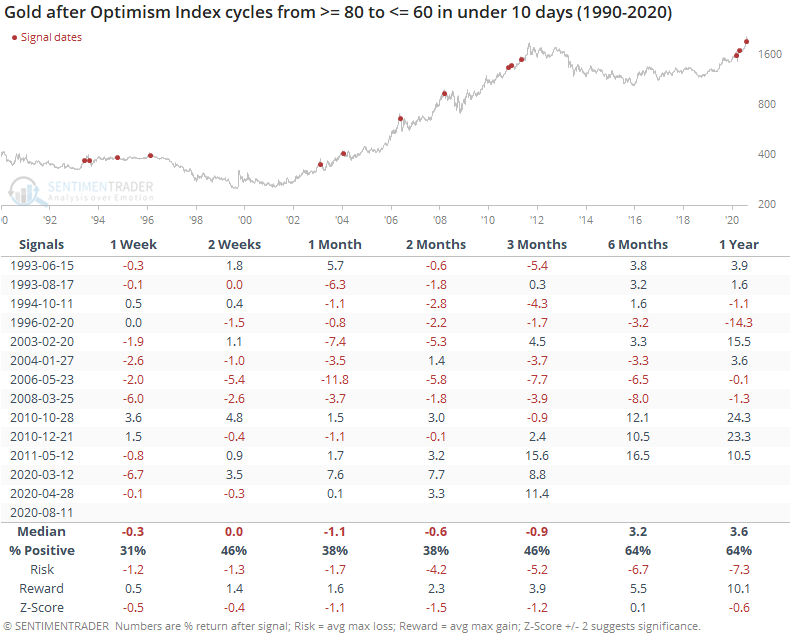

When the Optix fell from 80 or above to 60 or below within two weeks, it rarely snapped back immediately. All but three of the signals showed a loss somewhere between 1-3 months later, though it's interesting that the three exceptions are the last three signals, including two in 2020 alone. Perhaps that means the market environment is changed and gold isn't playing by the rules that governed it in recent decades but suggesting "this time is different" is an awfully high hurdle.