Golden Cross With A Rising 200-Day Average

The Dow Jones Industrial Average is about to enjoy a "golden cross", when the 50-day average crosses above the 200-day average. We've looked at this in various markets over the years, typically with the conclusion that it's mostly useless.

The wrinkle being discussed this time is that the 200-day average is rising, so that makes it different from the last cross in December. That one failed miserably, but the 200-day average was sloping down at the time.

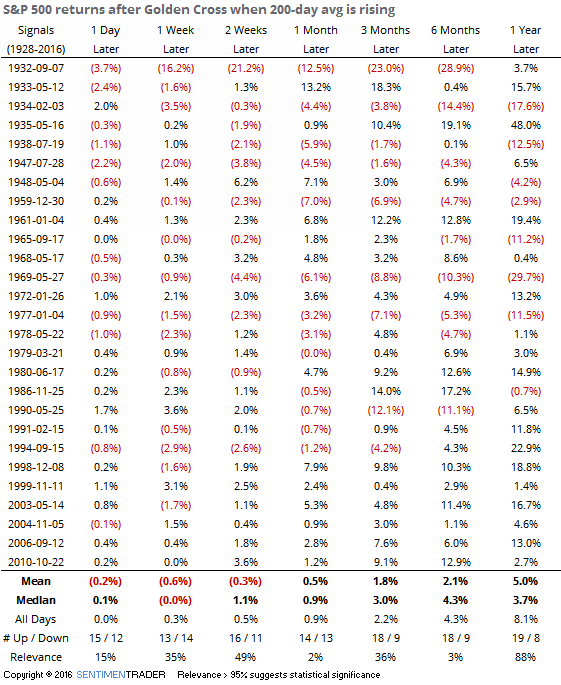

Using the S&P 500, let's go back and see if the slope of the 200-day average made any difference. We will consider the 200-day average to be rising if it's higher than it was 5 days ago and falling if it's lower than 5 days ago.

First, returns when there was a Golden Cross with a rising 200-day average:

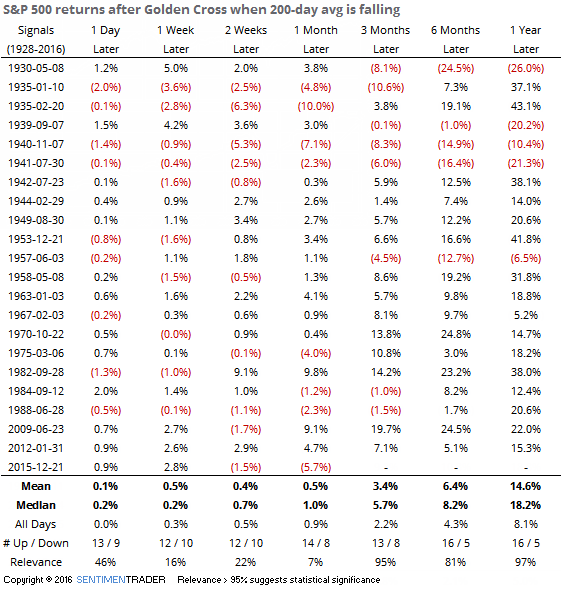

Now, with a falling 200-day average:

Per usual, conventional wisdom was wrong, or at least horribly inconsistent. Longer-term returns were actually better after a Golden Cross when the 200-day average was falling than when it was rising.