Gold's surge in assets

Despite some signs of shorter-term speculative activity in stocks, there still seems to be some apprehension among some, as safe-haven assets like gold continue to hold up.

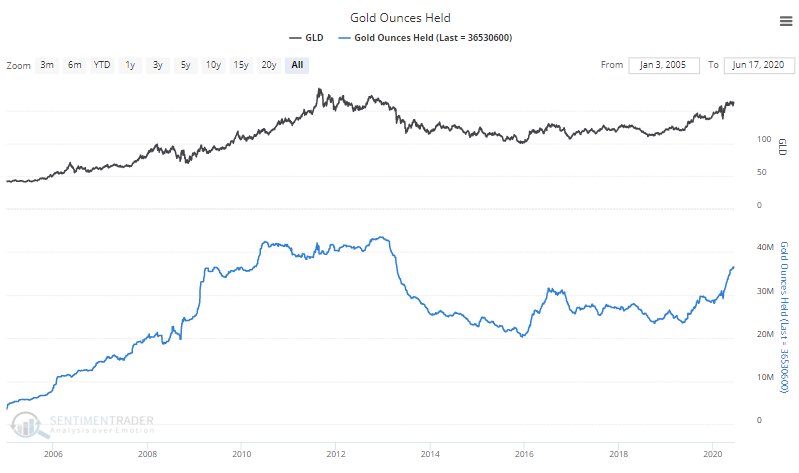

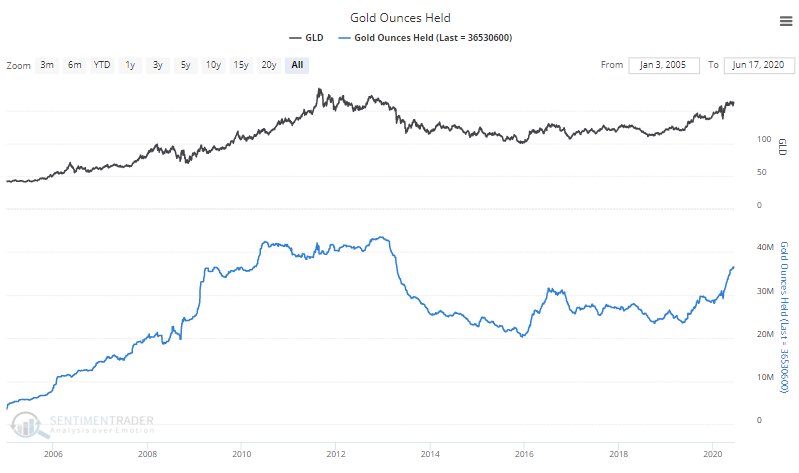

Assets are pouring in. Bloomberg noted that on Friday, gold exchange-traded funds added nearly 1 million troy ounces to their holdings, nearly 1% of their asset level.

Assets in GLD have surged, and other funds have added even more.

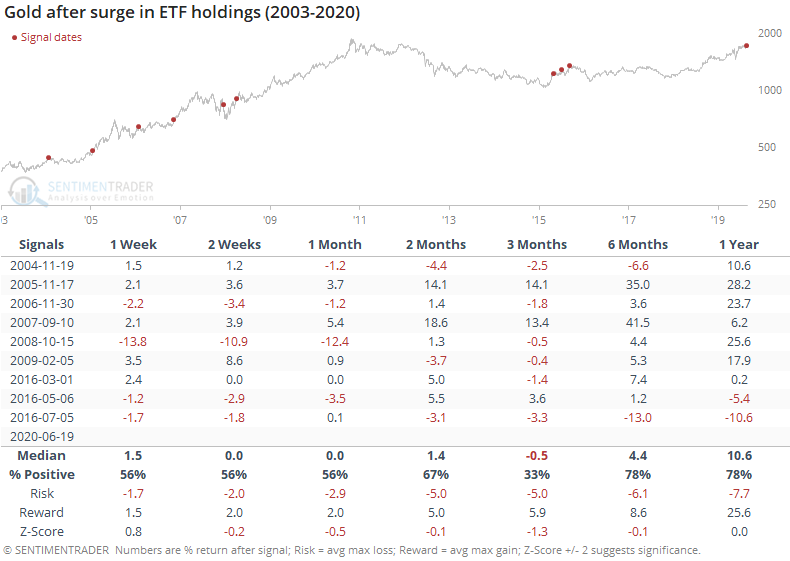

While this seems like it's a sign of too much confidence in the yellow metal, it hasn't been a great predictor. Below, we can see every time that total ETF holdings of gold surged over time frames including 1 day, 1 week, 1 month, and 3 months.

When it happened in 2016, gold struggled on various time frames, and it ended up leading to years of mediocre returns. But it also triggered a handful of times during the large bull run in the mid-2000s, with no clear detriment. Over the next three months, gold tended to fall, but there were two big exceptions to that, in November 2005 and September 2007.

The surge in assets is a mild warning sign, but not consistent enough to believe it will necessarily halt the rally.