Hard Economic Releases Keep Disappointing the Experts

When economic releases beat economists' expectations, they raise their forecasts for the next releases. Like investors, economists suffer terribly (in aggregate) from recency bias.

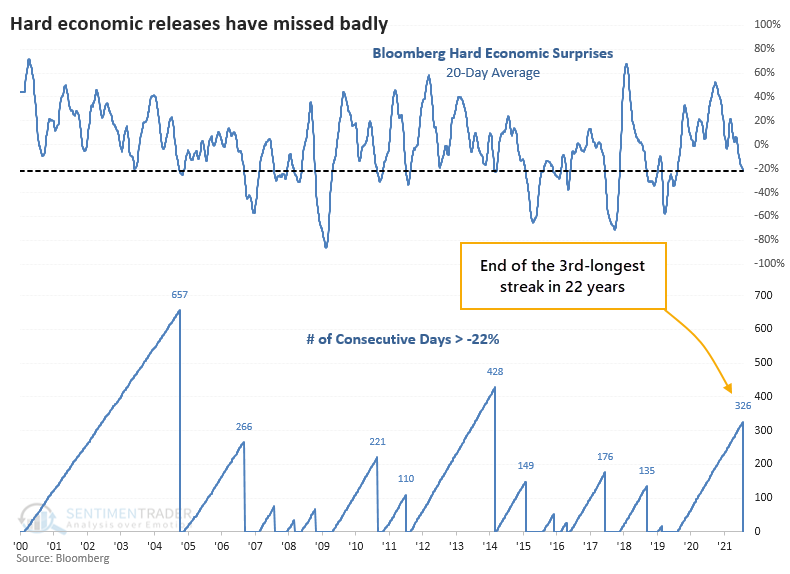

And recently, that bias has been ugly. Hard economic releases covering topics like labor conditions, housing, and industrial performance, have missed expectations by an average of 22%. It's been more than a year since the gauges of the "real" economy have disappointed by so much.

The 20-day average of Bloomberg's real economic surprises has eclipsed -22% for the first time in well over a year. This ends the 3rd-longest streak of "not really bad" surprises in over 20 years.

STOCKS "MEH," BONDS "UGH"

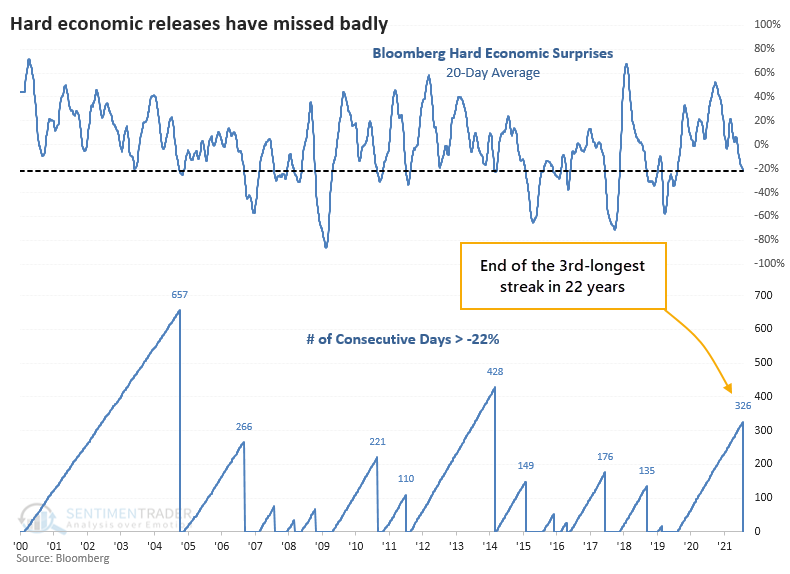

For equity investors, this was not necessarily a good reason to sell.

Despite a string of disappointing economic news, the S&P 500 tended to hold together. There were a couple of larger interim losses in the fall of 2011 and winter of 2018, but otherwise, stocks gained by at least a modest amount in the months ahead. Over the past decade, the S&P's returns were only modest at best during the next couple of months, though.

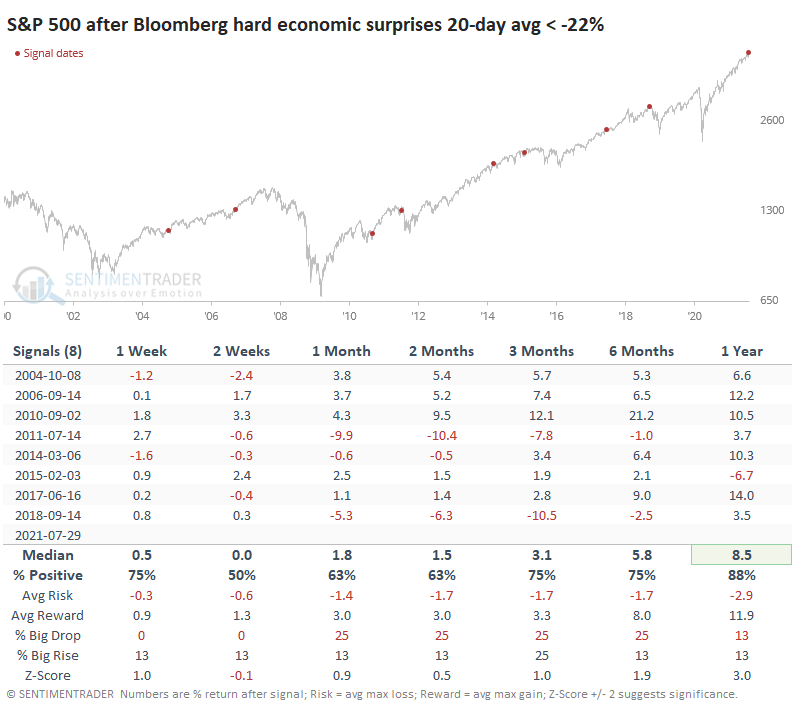

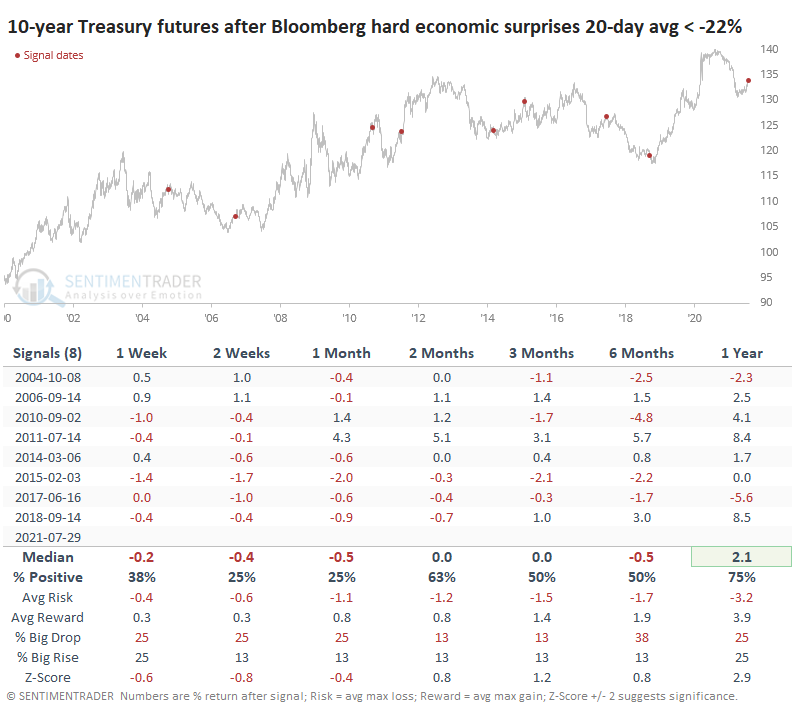

We might expect such soft performance in economic indicators to lead to a bump in bond prices (lower yields), but we would be wrong. The opposite was more the rule than the exception. Prices on 10-year Treasury futures showed a loss every time sometime between 2-4 weeks later.

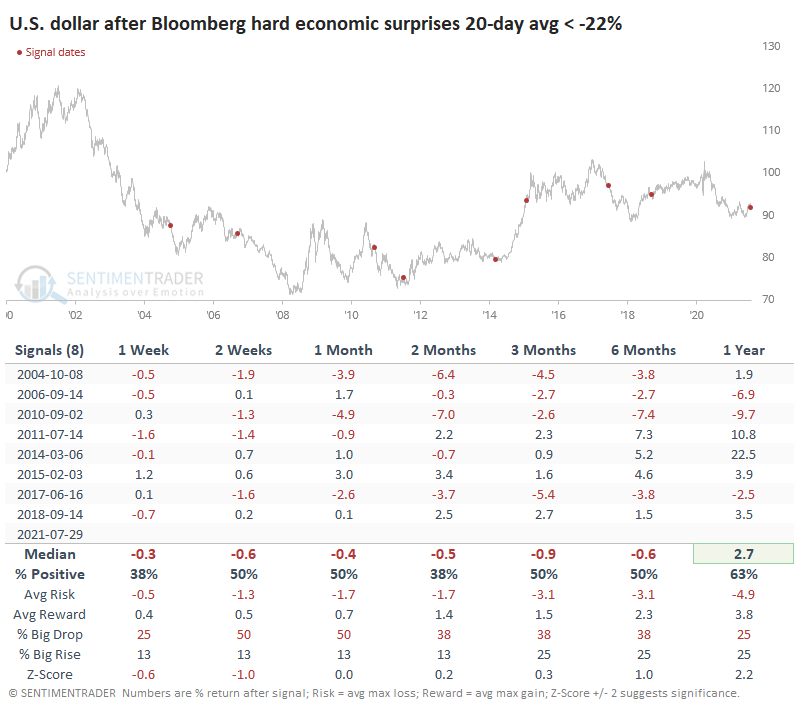

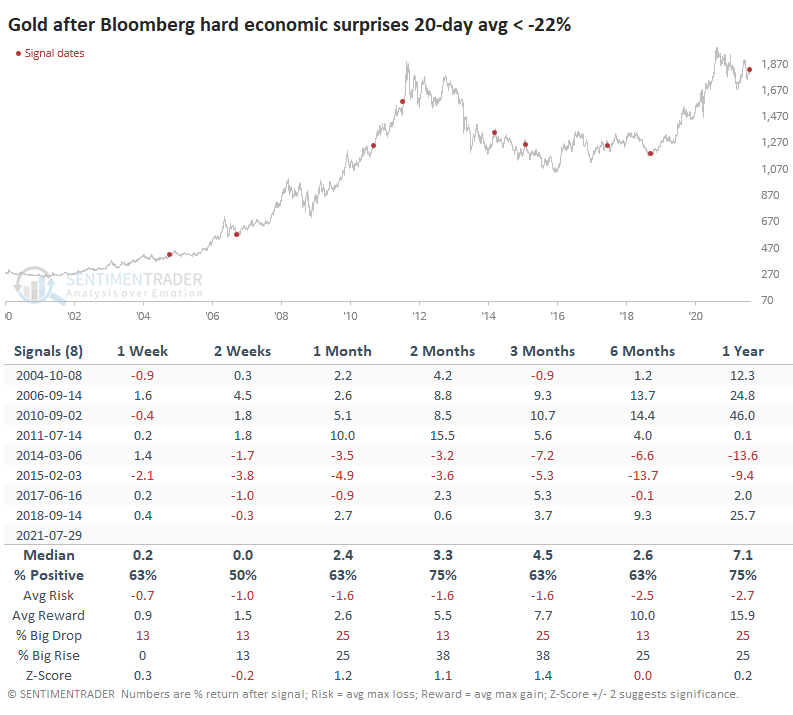

DOLLAR DOWN, GOLD UP (MOSTLY)

The U.S. dollar tended to weaken in the shorter term, then rally.

Gold did just fine, though the last four signals preceded at least short-term losses.

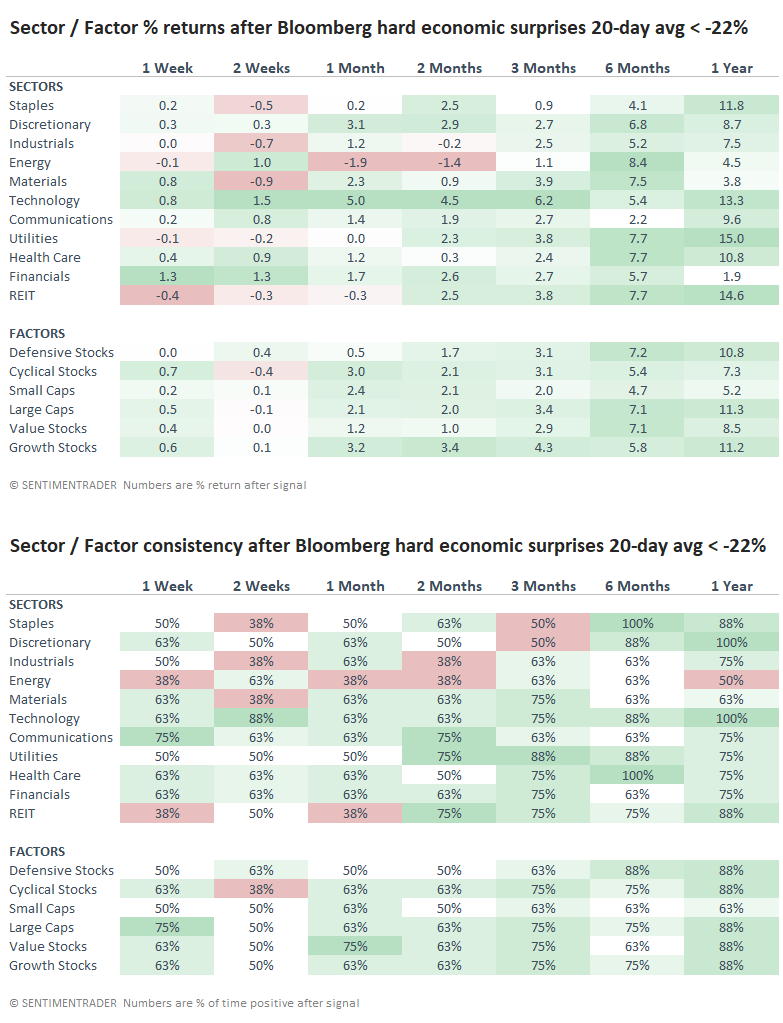

These signals preceded relatively weak returns for Energy stocks, while Technology did well. That doesn't fit very well with some other studies that have triggered lately.

Over the past decade, large disappointments in real economic indicators have served to put a temporary brake on stock prices, so that's a minor concern here. It's not consistent enough to be a solid reason to sell. Ironically, it's been a better sell signal for bond prices.