Hedge Funds Exposed To Dollar While Consumers' Optimism Time-Shifts

This is an abridged version of our Daily Report.

Riding the buck

Hedge funds have the largest exposure to the dollar in four years. Their returns over the past month have been highly correlated to moves in the buck. They also have a near-record inverse correlation to gold, which has preceded reversals in the metal the few other times they were so heavily inverted.

Market capped

Apple hit a trillion-dollar market cap, but it’s a dubious distinction. Other companies that first reached notable milestones soon suffered massively.

Enjoy the present

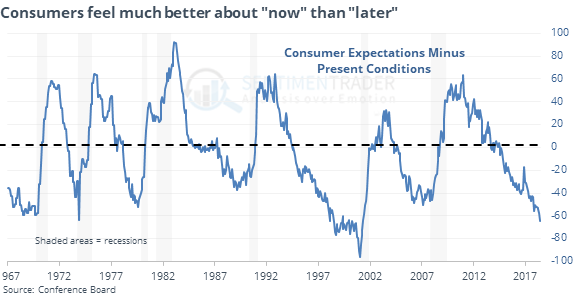

Consumers feel better about the present than the future to a near-record degree.

When this spread has started to reverse, stocks struggled, especially Tech.

Dip-buying binge

For the second time in a month, the S&P 500 fund, SPY, gapped down at the open below the prior two days’ lows, then reversed to close above those days’ highs. Since 1993, it has happened 14 times.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |