Highly valued and with few consequences

Investors are pushing the valuation of stocks to extreme heights, and not even having to suffer much volatility along the way. That started to change in a minor way over the last 2 sessions, so we'll have to see if it lasts.

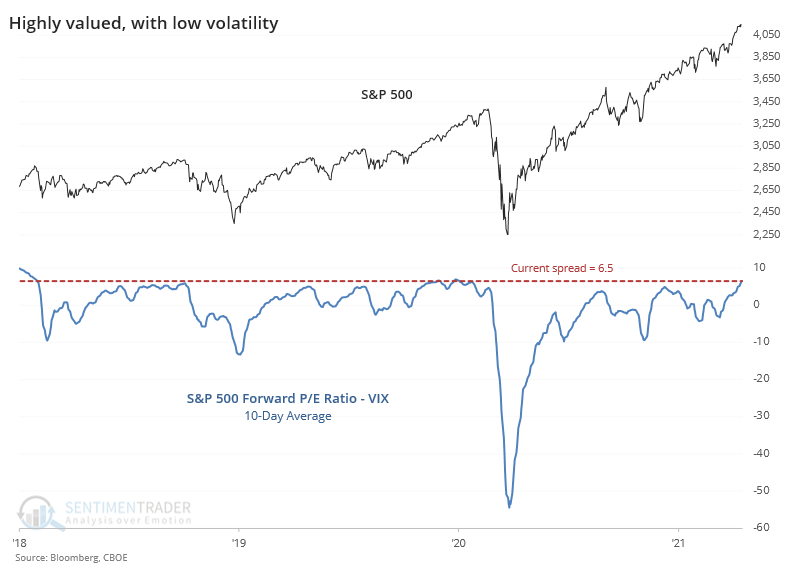

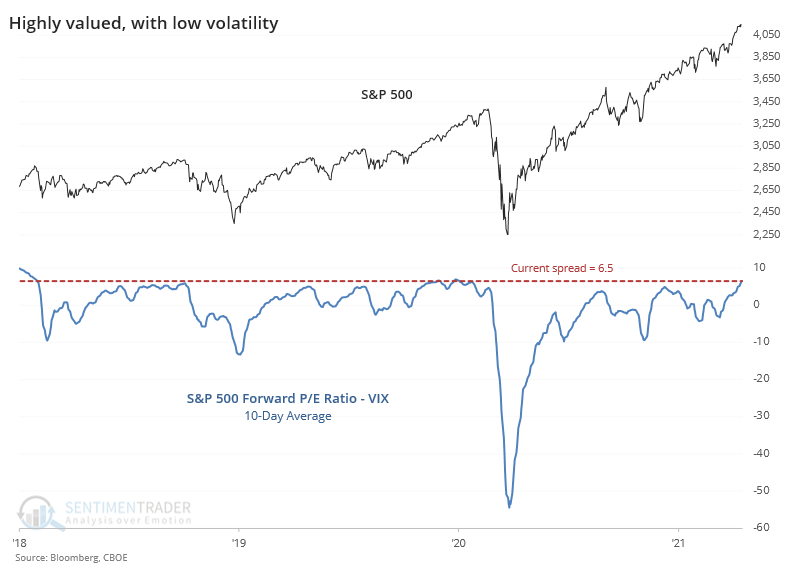

One of the ways we've looked at a shorthand for sentiment over the years is by comparing the S&P 500's forward price/earnings multiple to the VIX "fear gauge." The higher the ratio, the more investors are getting away with pushing valuations higher without much of a consequence.

A 10-day average of the spread between those two factors just reached its highest level in a year. This has now been added as a premium chart for daily updates and backtesting.

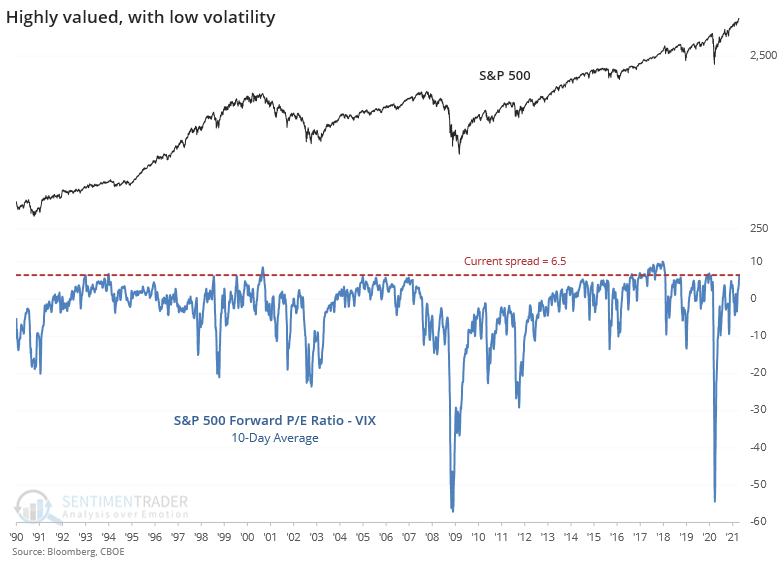

Zooming out over the past 30 years, the current spread is still among the highest readings.

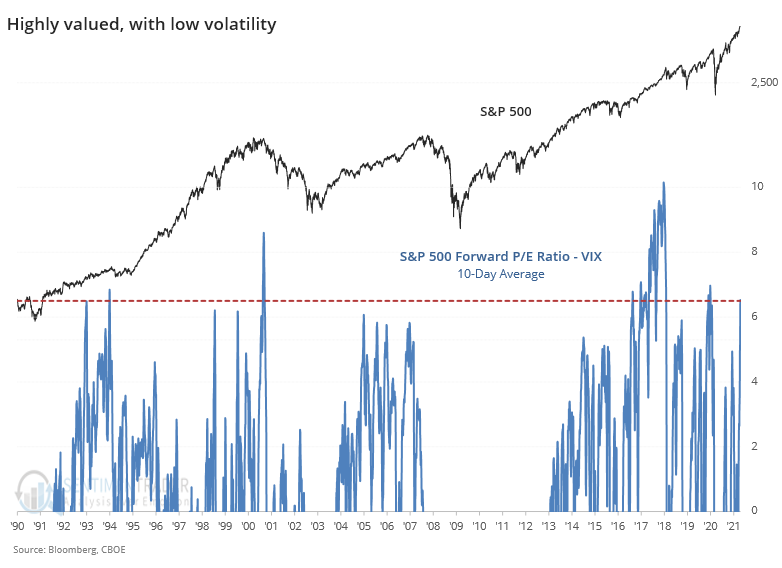

Some of the big selloffs really skewed the negative stretches for this spread, so if we only look at the positive ones, then the current extreme sticks out a bit more.

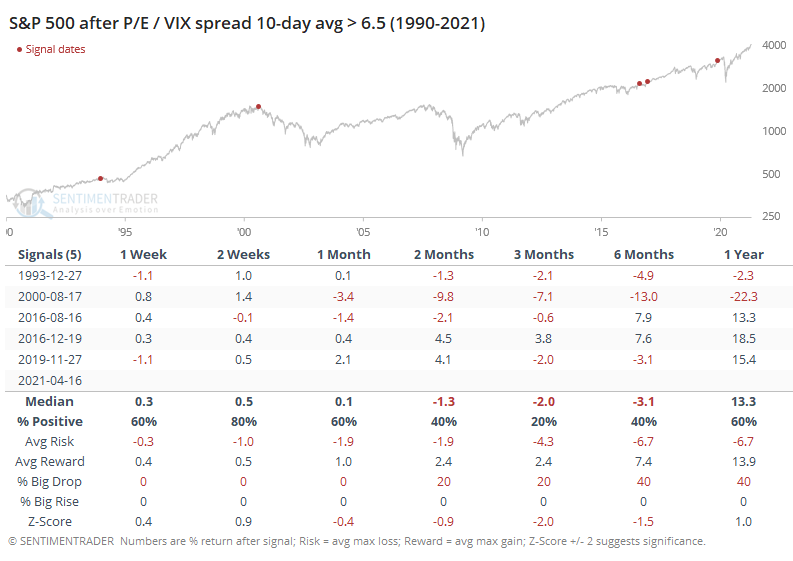

After other times the 10-day average of the spread reached its current level, the S&P struggled, except for the "nothing matters" market of 2017. Certainly, it's hard to rely on a small sample size, especially when one of the signals was a big outlier.

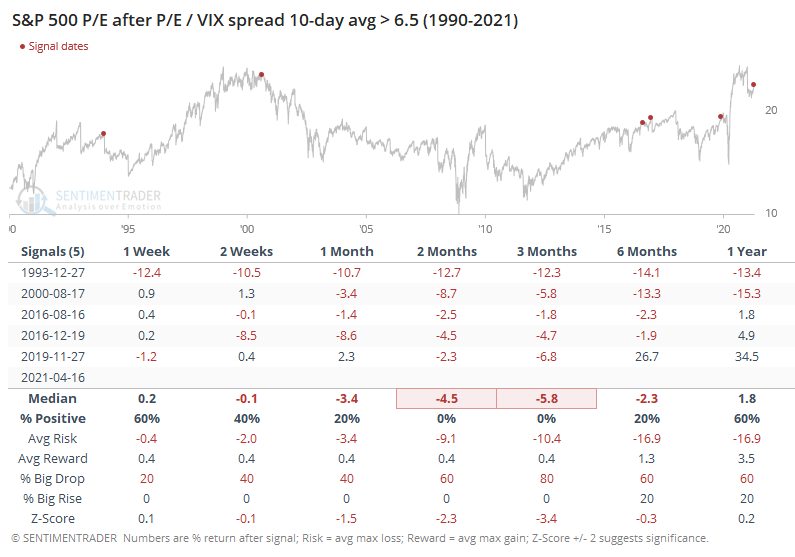

Notably, the S&P's price/earnings multiple declined every time, even after the 2017 signal. This was not a good setup if you want to believe that investors will be willing to keep pushing valuation multiples higher.

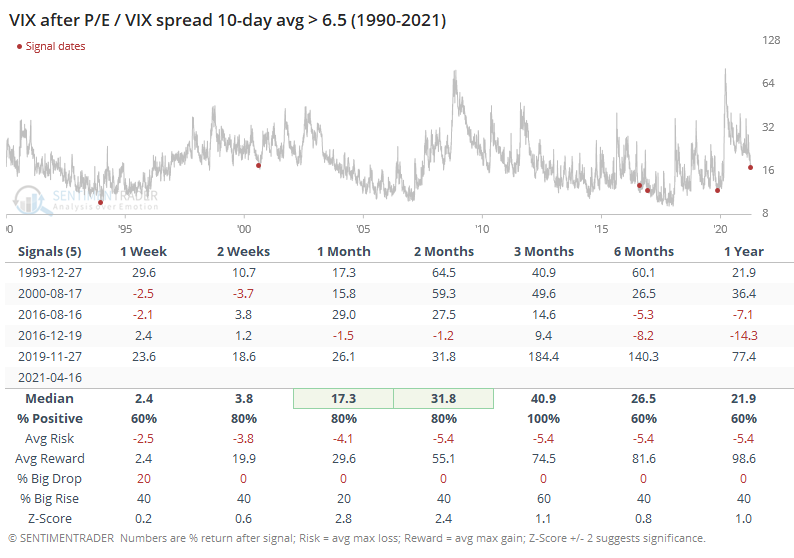

Also notable is that the VIX rose every time. Even during the 2017 mo-mo market, the VIX managed to rise over the next few months.

These calm conditions in the VIX are focused mostly on the nearer-term. Traders are pricing in a higher likelihood of bigger movements in the months ahead, so the VIX Term Structure is extreme. That didn't matter at all in 2017; other years typically saw any further gains given back.

We've seen before that valuations are exceptionally high and it has only gotten more extreme. One change since then is that investors have become much more complacent with those valuations, assuming they will just keep growing. That's when it becomes dangerous.