Historic sentiment across several sectors and countries

After highlighting extremes in tech and healthcare, several other sectors and countries are registering extreme sentiment readings.

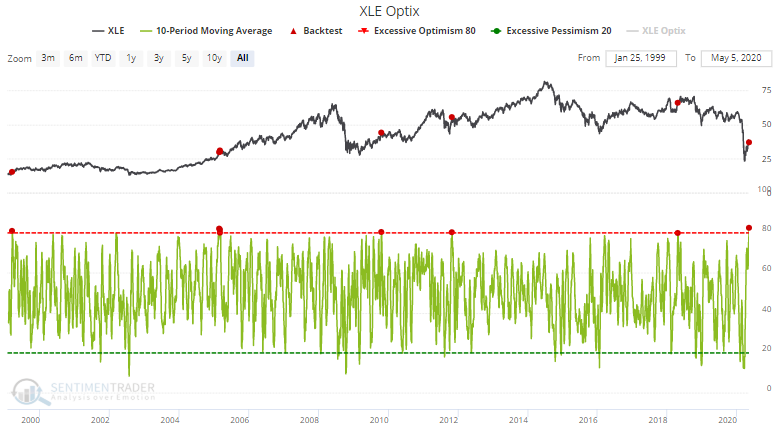

For example, XLE Optix's 10 day average is above 80:

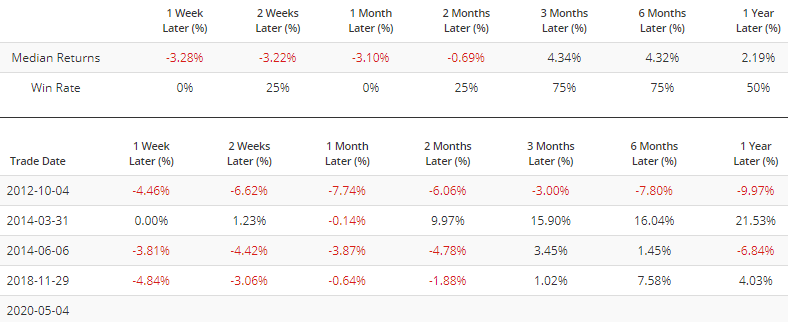

This usually led to at least a short term pullback in energy stocks:

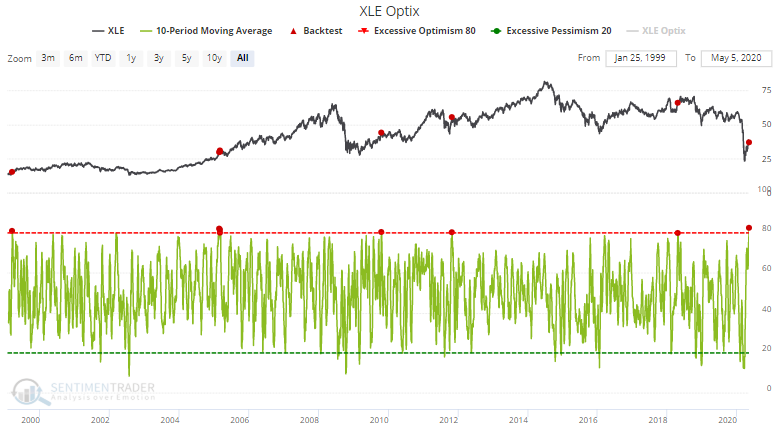

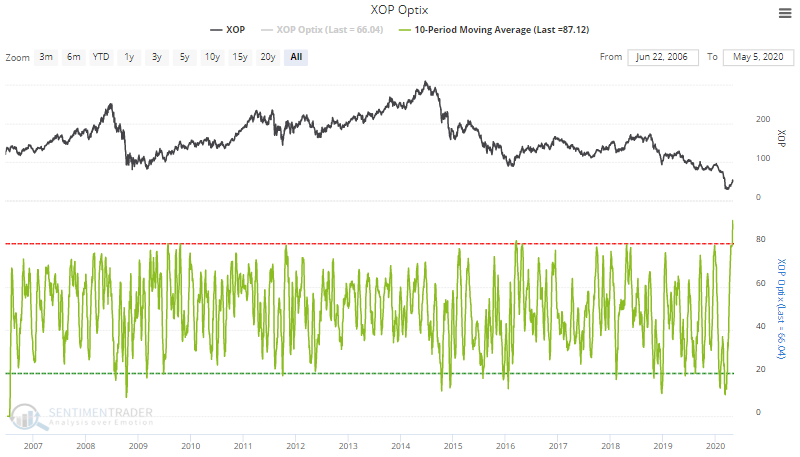

Similarly, XOP Optix's 10 day average is at the highest level ever:

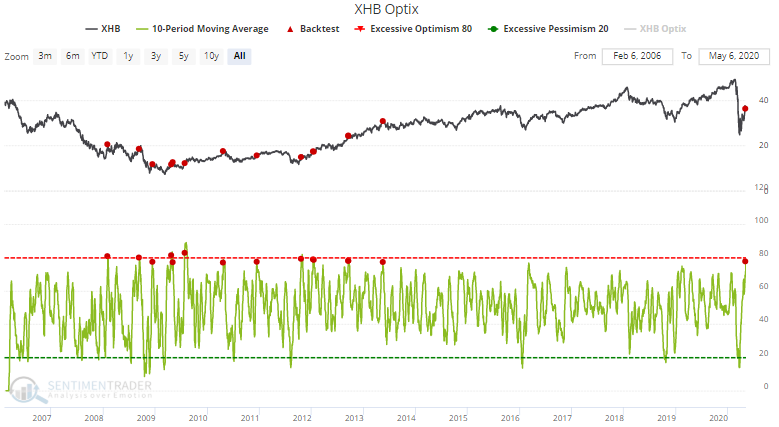

Meanwhile, the rebound in homebuilders has pushed XHB Optix's 10 day average to 77:

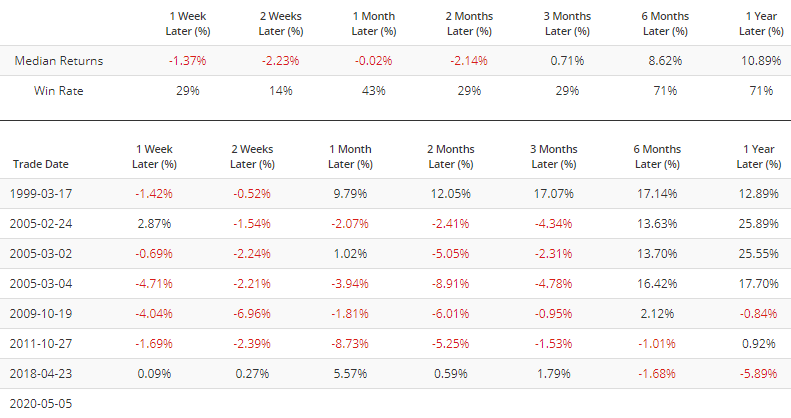

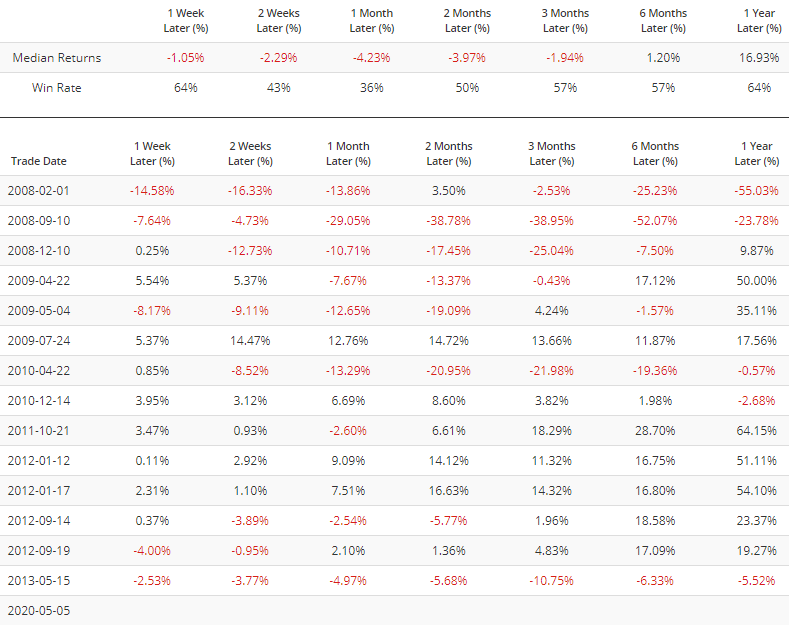

When this happened in the past, homebuilders often pulled back over the next month:

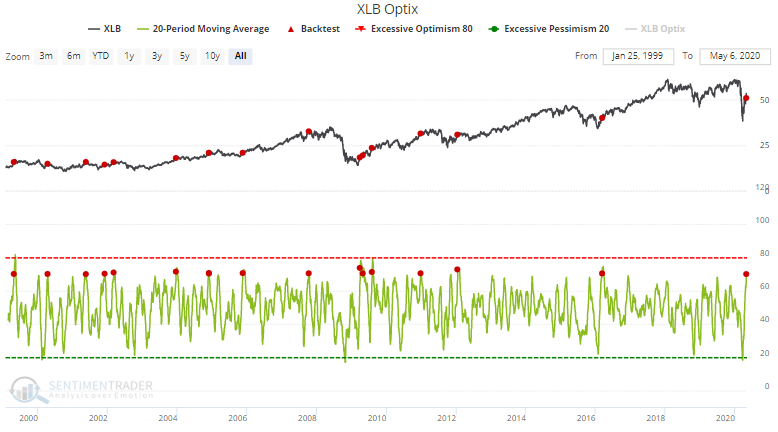

XLB Optix's 20 day average is at 70:

This sometimes (but not always) led to a short term pullback:

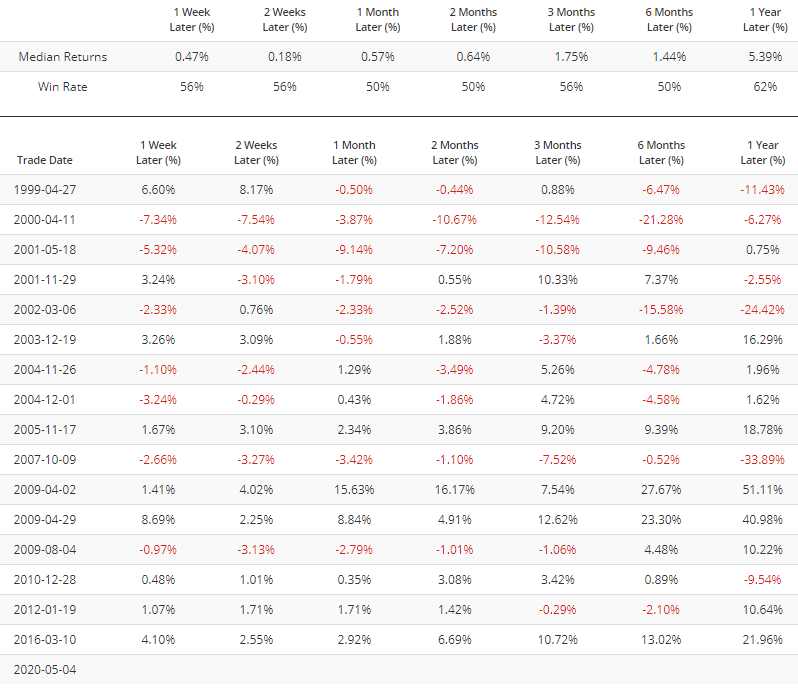

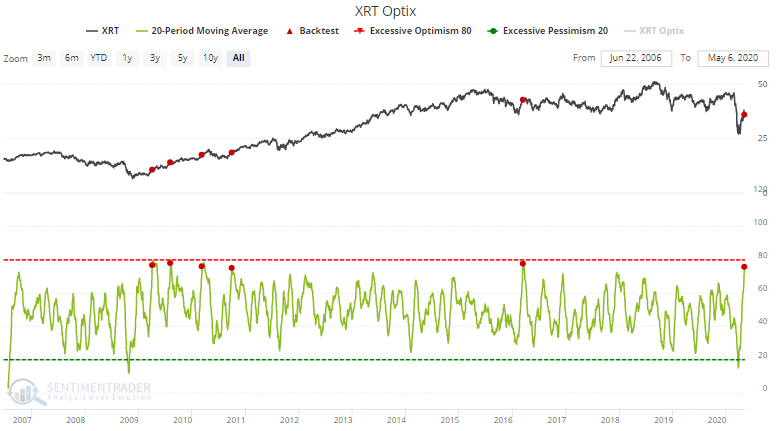

The 20 day average for XRT Optix is at 75:

More often than not this DID NOT lead to a short term pullback for retail stocks:

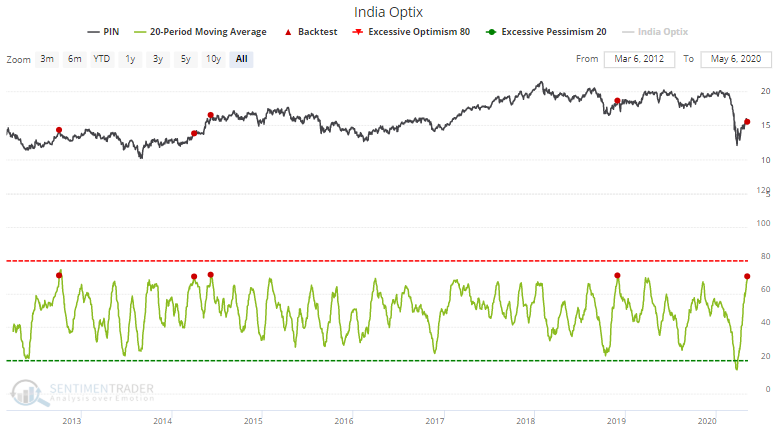

And India Optix's 20 day average is at 70:

This always led to a short term pullback in Indian equities: