Improving economic data

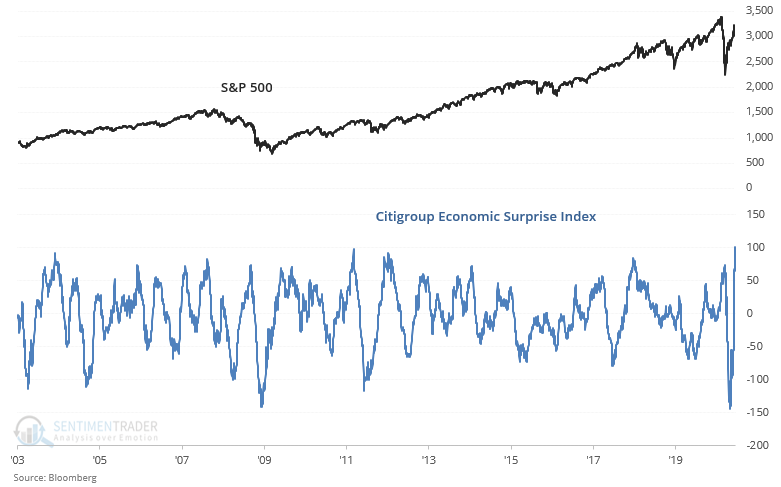

U.S. economic data is improving after months of historically awful readings. The Citigroup Economic Surprise Index, which tracks economic data relative to expectations, has hit an all-time high as the U.S. economy recovers.

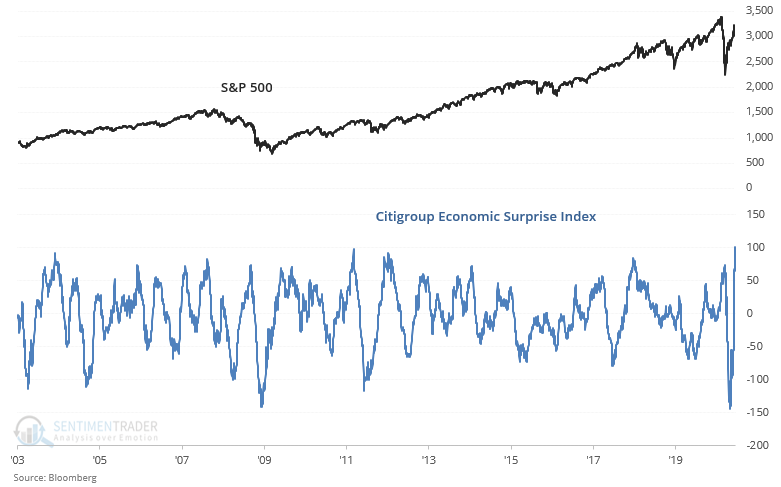

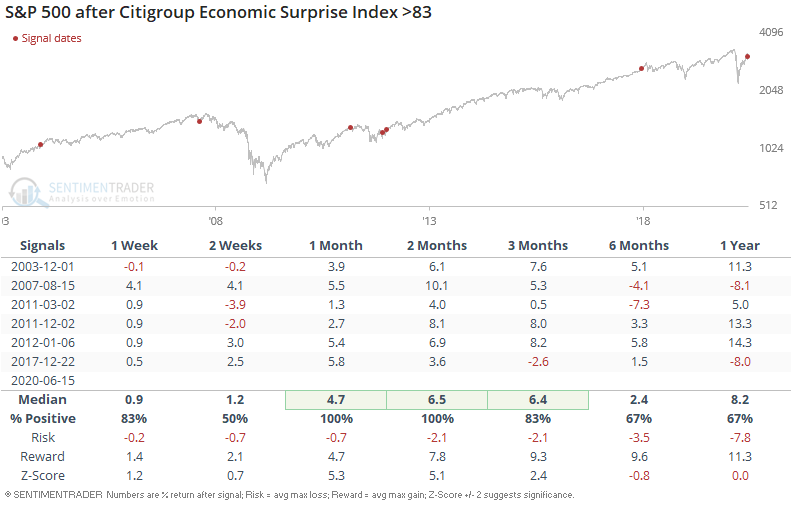

Less extreme readings were universally bullish for the S&P over the next 1-2 months:

As a result, it was mostly bearish for VIX over the next 1-2 months. The single major exception was in December 2017, after a year of extremely low volatility and an incessant stock market rally. The market environment between December 2017 vs. today is clearly different:

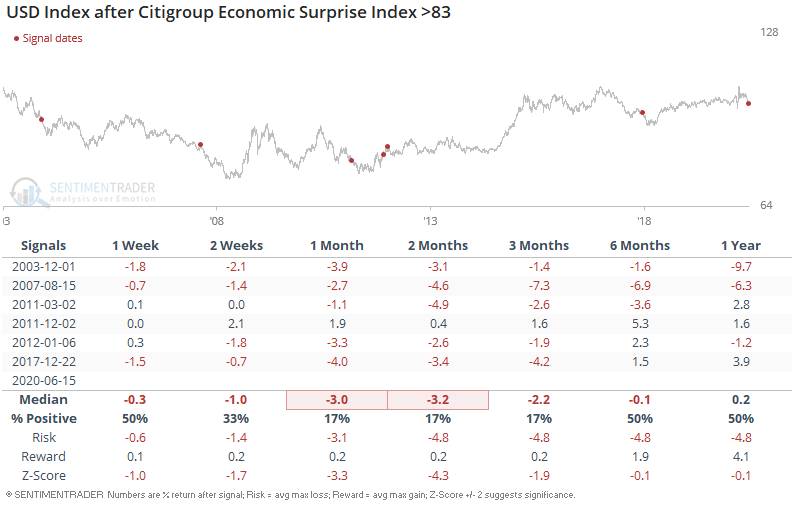

As for the U.S. Dollar Index, this was mostly bearish for the USD over the next 1-2 months:

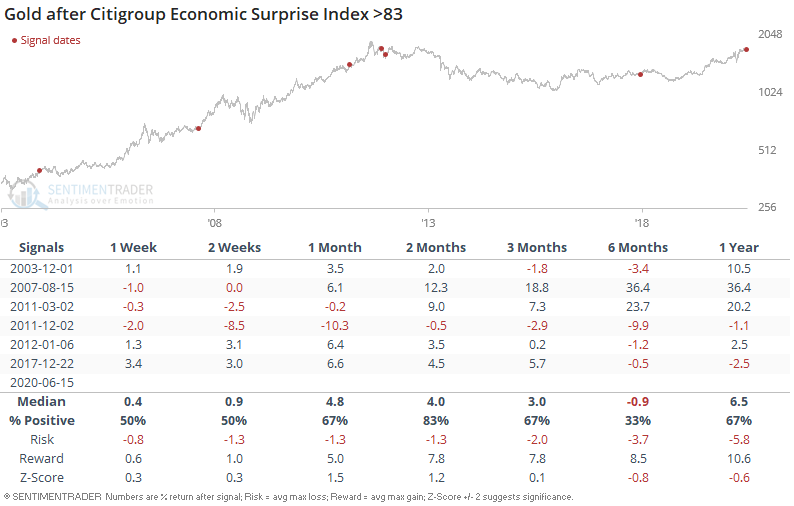

And it was mostly bullish for gold over the next 2 months:

Recently there's been this narrative going around the internet that the bear market is over, and this is the start of a new bull market (i.e. today is just like 2009). I strongly disagree.

From a valuations perspective, today is NOTHING like 2009. Valuations may not matter on a 1 year, 2 year, or even 3 year basis, but it does matter on a 5-10 year basis. If valuations are sky-high, it is simply not possible to have a massive 10 year bull market. If valuations are high, it means that the stock market's earnings' yield is low, which implies that long term forward returns will be poor-mediocre. (Real estate investors will understand this intuitively. High valuations in stocks is like a low cap rate in real estate. If you buy and hold a piece of real estate with a low cap rate, your returns will be poor unless someone else is willing to pay even more for your real estate and push cap rates even lower).

The following chart illustrates the S&P 500's price/earnings ratio

*This is for estimated earnings (estimated earnings for the current fiscal year).

As you can see, valuations today are MUCH higher than in 2009. This isn't to say that stocks ca'tn surge for another 1-2 years: it certainly did from 1998-2000. But high valuations prevent a massive bull market like 2009-2020 from reoccurring.