Index Corrections As Panic Spreads

This is an abridged version of our Daily Report.

Corrections

After ending long streaks in uptrends, the Russell and Nasdaq fell into corrections. That has typically led to a poor risk/reward in the months ahead for both.

Panic

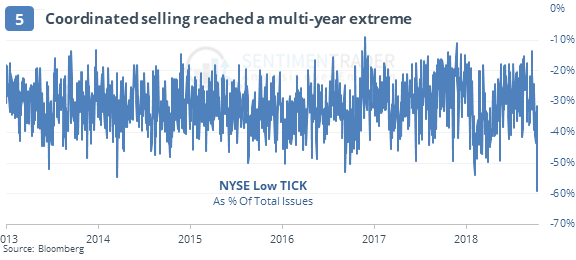

The selling pressure on Thursday generated at least a couple readings of panic. Inverse ETF volume exploded, as program selling reached multi-year highs.

That was fast

The S&P 500 fell more than 2% on back-to-back days, falling to a multi-month low, and not seeing a positive day for at least the past week. Since 1950, that has happened only four other times.

Assumptions are dangerous

The McClellan Oscillator is now showing an extreme oversold reading near -100. It’s assumed that the more negative the reading, the more oversold the market is, and more bullish for future returns. The Backtest Engine shows that’s not the case.