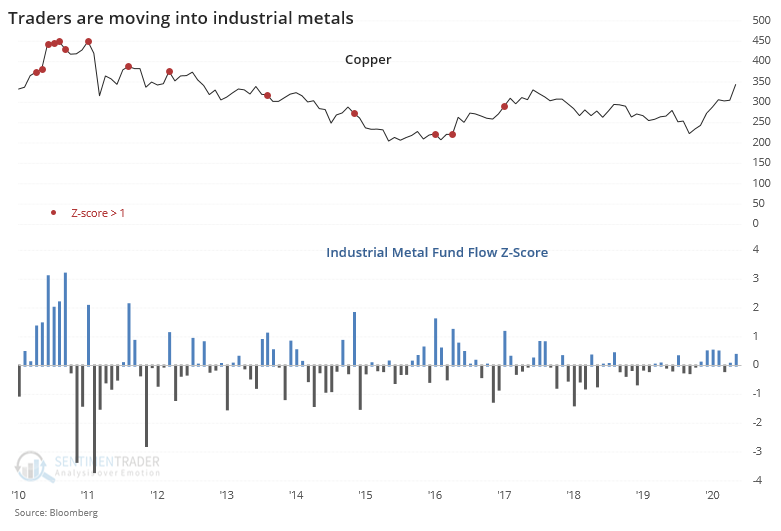

Industrial is hot; precious is not

Traders in ETFs are often considered to be hot money, chasing trends and getting out at the first sign of trouble. In precious metals, that seems to be the case, and they pulled out in a big way over the past month.

The folks at Arbor Research noted that the z-score on precious metal fund flows hit -2. The z-score measures the current flow relative to the average and standard deviation of previous flows. The more negative the number, the more significant it might be.

At the same time, they've moved into funds that focus on industrial metals, like copper. It's not all that extreme given some wild gyrations in 2010 and 2011, but it's still positive.

That means the difference in z-scores between precious metals and industrial metals has dropped to a significantly low level, well below -2. When that's happened before, the ratio of gold to copper tended to rise in the months ahead.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A more in-depth look at fund flows in gold funds

- Traders have been fleeing GLD in particular

- Small speculators in gold futures haven't quite given up the ghost

- Seasonal influences over the next month in gold are impressive

| Stat Box According to Blomberg data, there have been 69 trading days this year that saw at least one IPO priced in the U.S. and that reported net income over the past year. Out of those 69 days, 8 of them saw more IPOs that managed positive net income over the past 12 months while 57 days saw more IPOs that lost money than made money. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

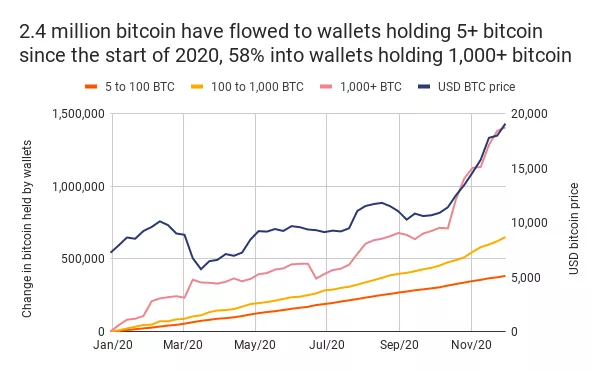

1. Bitcoin bulls insist that the latest leg of the rally has been driven by sophisticated institutional investors, and not mom-and-pop retail noobs. They seem to be right...but that that doesn't necessarily mean that large investors can do no wrong. [Chainanalysis]

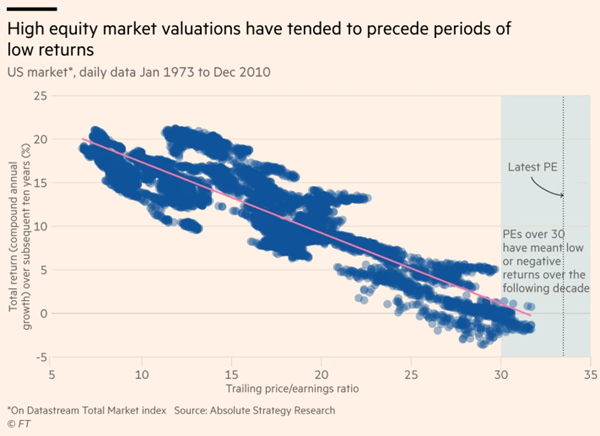

2. Part of the popularity of alternatives is due to seeming excesses in valuations of stocks. When investors have paid up for future earnings potential, their returns have been terrible, a concern given where we are now. [Financial Times]

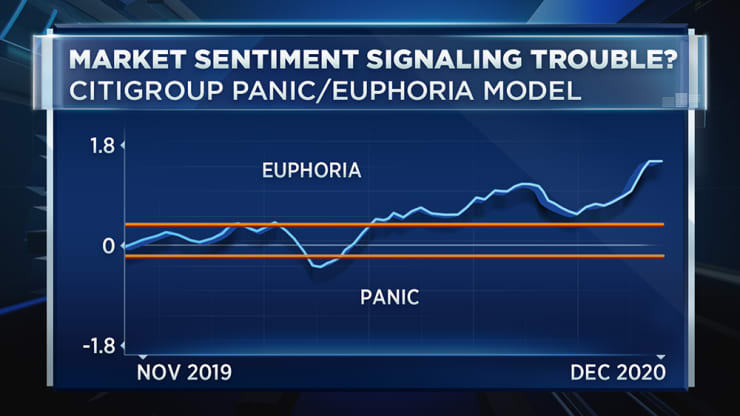

3. Those valuations have been achieved because investors are "off the charts bullish." [CNBC]