Industrial stocks storm back

Industrials are surging relative to the rest of the market. This is taken as a good sign for the market as a whole because investors are moving out of the formerly hot sectors and into ones that benefit most on an economic recovery.

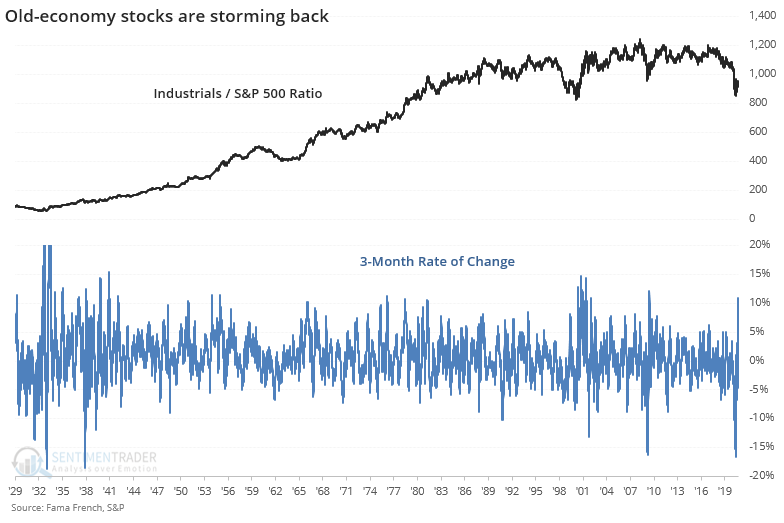

We can see below how much the ratio between these stocks and the broader market has swung. A rise of 10% or more, like we've seen in recent months, is historically extreme dating back to 1928.

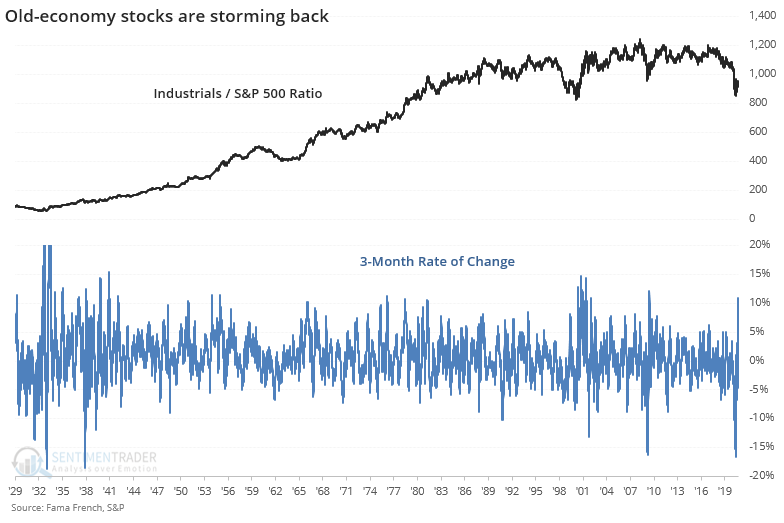

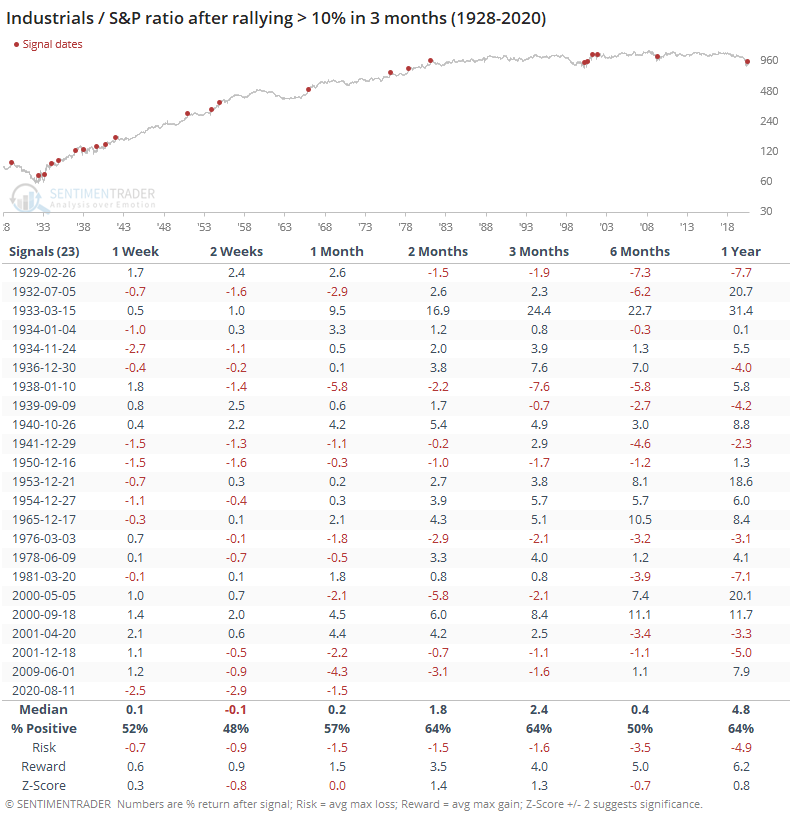

When these stocks rebounded by this much, relative to the broader market, it has preceded decent shorter-term returns for the broader market and poor long-term ones. The positive 6-month returns came mostly after protracted declines in the 1930s, 1950s, and in 2009.

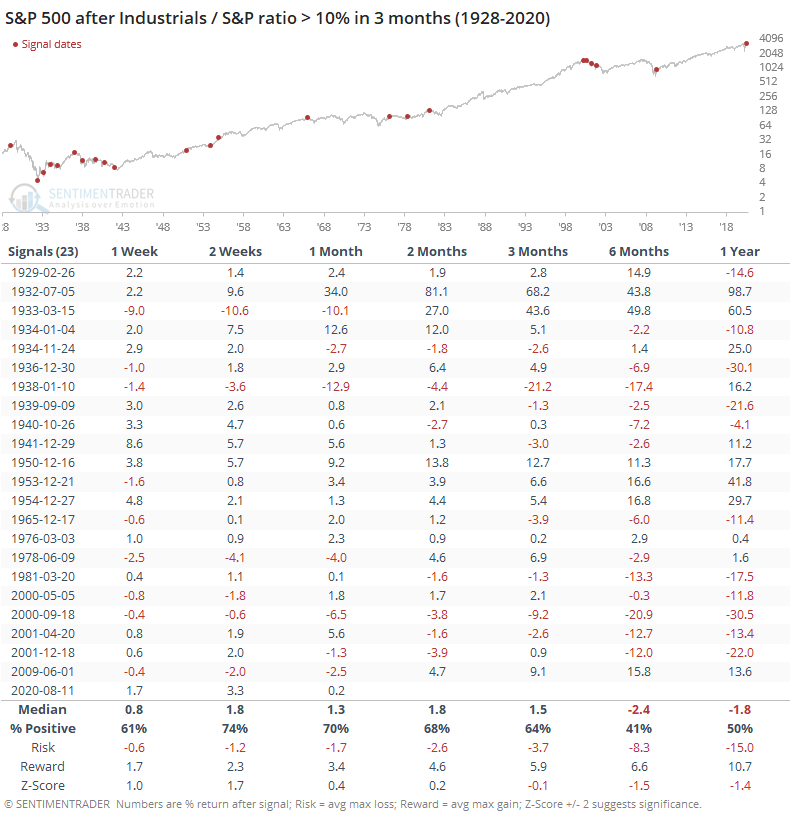

The ratio between them was mediocre. There was a modest tendency for industrials to keep outperforming the broader market but it was slight, and not much beyond random.

The best argument about better longer-term returns is that the last time the ratio cycled from -10% to +10% was in June 2009, though even that didn't preclude the ratio from falling over the next few months.

What's being taken as an even better sign is that the average industrial stock has jumped relative to the average stock in other sectors. The equal-weighted industrial index has also surged relative to the equal-weighted S&P 500.

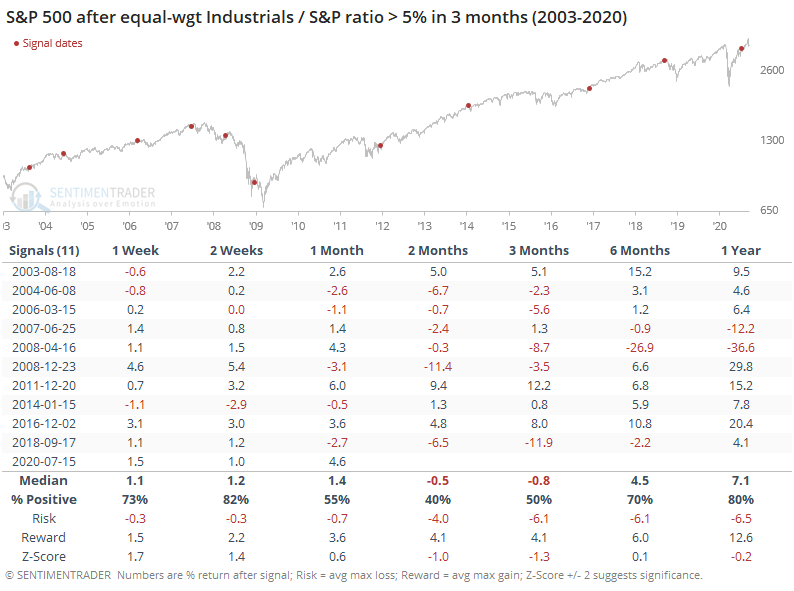

These indexes only go back to 2003, so history is limited and dominated by bull markets. Regardless, the S&P 500's returns over the medium-term were mediocre at best.

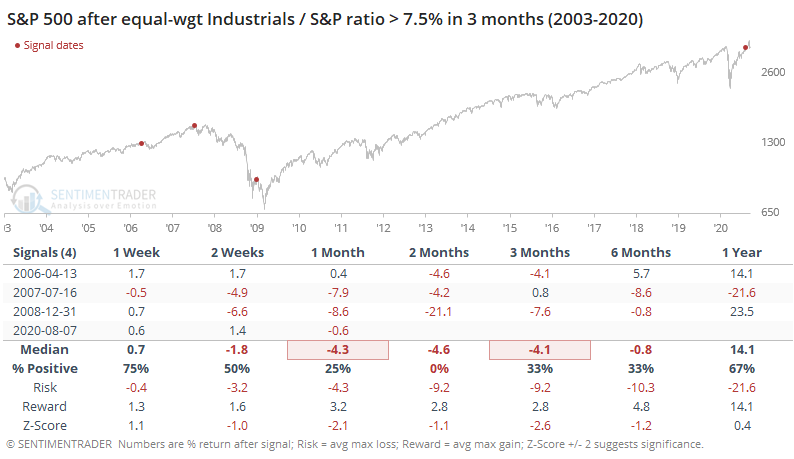

This time, the swing has been even more impressive at +7.5% and returns after the few precedents were even worse.

There are all kinds of smart-sounding reasons why the surge in this ratio should be a good sign for the broader market. Cherry-picked examples from a few charts can "prove" those theories correct. But when we look objectively at a long history, it becomes a lot harder to rely on this as a reason to believe the risk/reward is more positive now than it was months ago. Maybe this will be one of those times when a massive relative surge in industrial stocks proves to be a good sign. It's not the base case.