Industrials Sink As Markets Head Into Worst Six Months

This is an abridged version of our Daily Report.

Making stuff isn’t paying off

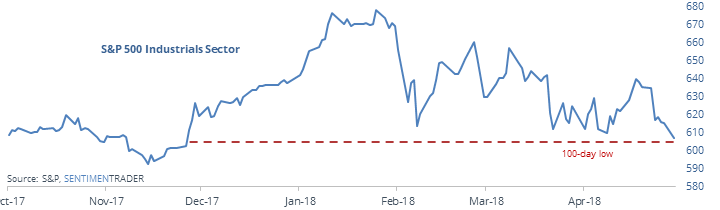

Industrials stocks that “make stuff” have struggled and just hit a 100-day low.

The S&P 500 is still hanging above its long-term 200-day average, but the lag in Industrials is a concern. Over the past 20 years, a new low in Industrials led to losses in the S&P almost every time.

Hiding during the summer

Stocks struggle during the summer when the start the year on a bad note, otherwise not so much. Among other markets, bonds did okay while several energy markets consistently struggled. Among sectors, the most defensive ones saw the least difference between the best and worst six months.

About that weak spot

Seasonality is an iffy concept in stocks, so we’re not going to press the “worst six months thing” too far. There have been quite a few questions about if the S&P is negative YTD through April, what May looked like. It was up 44% of the time and through June 41% of the time.

Loving lumber

Lumber is the most-loved commodity once again, with an Optimism Index nearing 90.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |