Internal momentum shows good gains

During October and November, we looked multiple times at the broadening of the rally, including historic thrusts of overwhelming buying interest. Those are the kinds of readings that can overwhelm sentiment extremes like we've recorded in recent weeks.

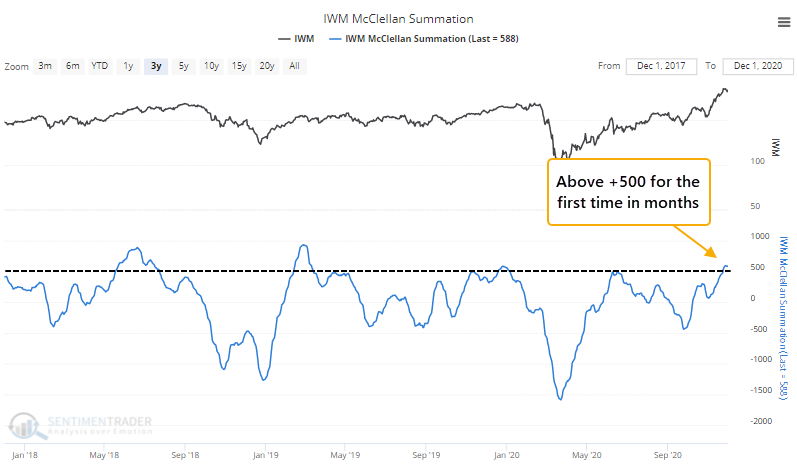

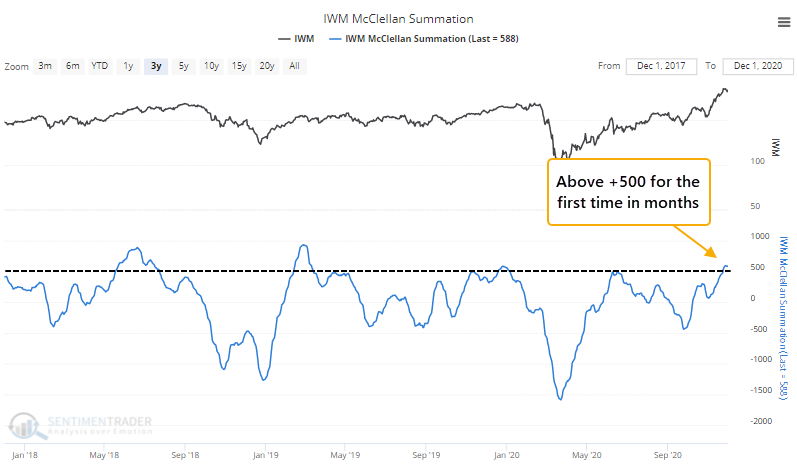

The improvement in some of these figures was due in large part to a renewal of interest in smaller stocks. The Cumulative Advance/Decline Line for the Russell 2000 is near a decade-long high thanks to the recent surge that also pushed its McClellan Summation Index above +500 for the first time since the beginning of the year.

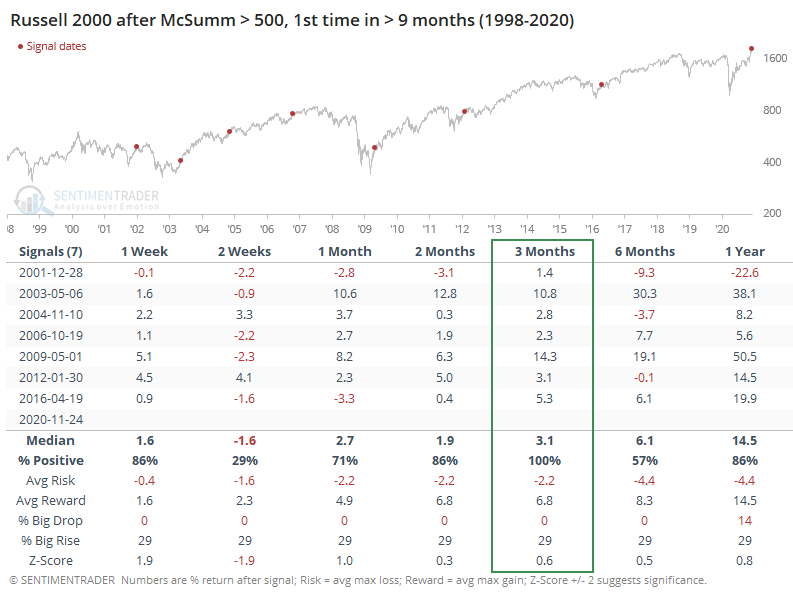

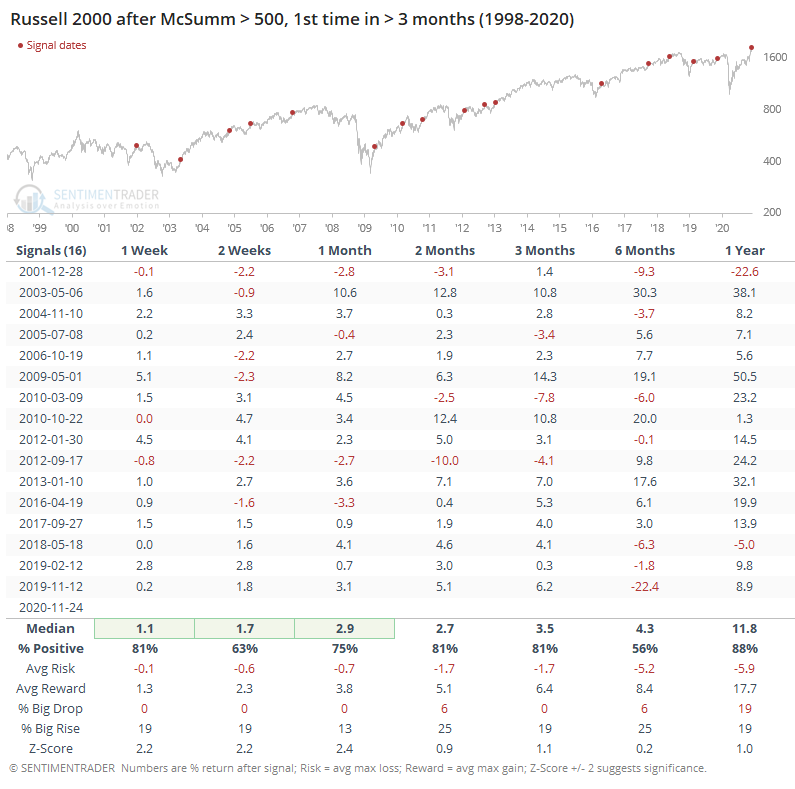

When its Summation Index moved above this threshold for the first time in more than 9 months, the Russell continued to gain every time over the ensuing 3 months, even after accounting for frequent shorter-term weakness.

If we look at lesser extremes in order to generate a larger sample size, it was still quite positive.

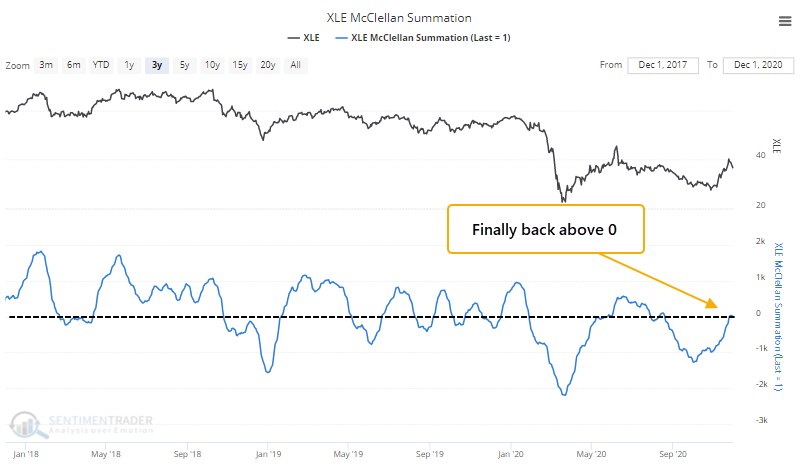

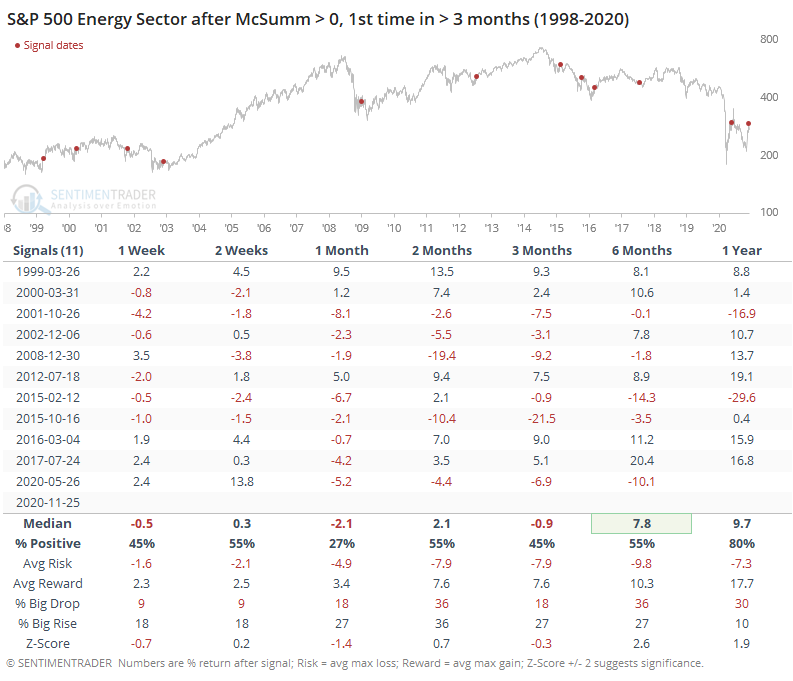

The snapback in smaller stocks happened along with rebounds in many beaten-down sectors like energy. The Summation Index for that sector finally managed to poke above the zero line.

It has not been easy for energy shares to maintain any positive momentum in recent decades. When internal momentum finally recovered after months of negativity, selling pressure has usually followed, but with better-than-random results over the next 6-12 months.

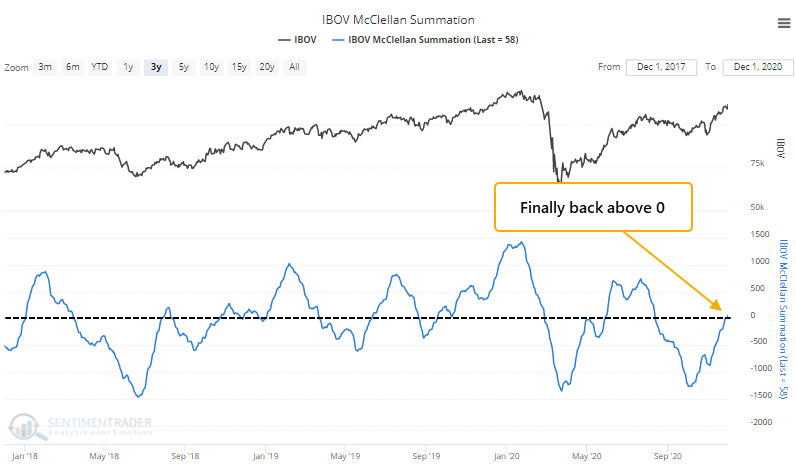

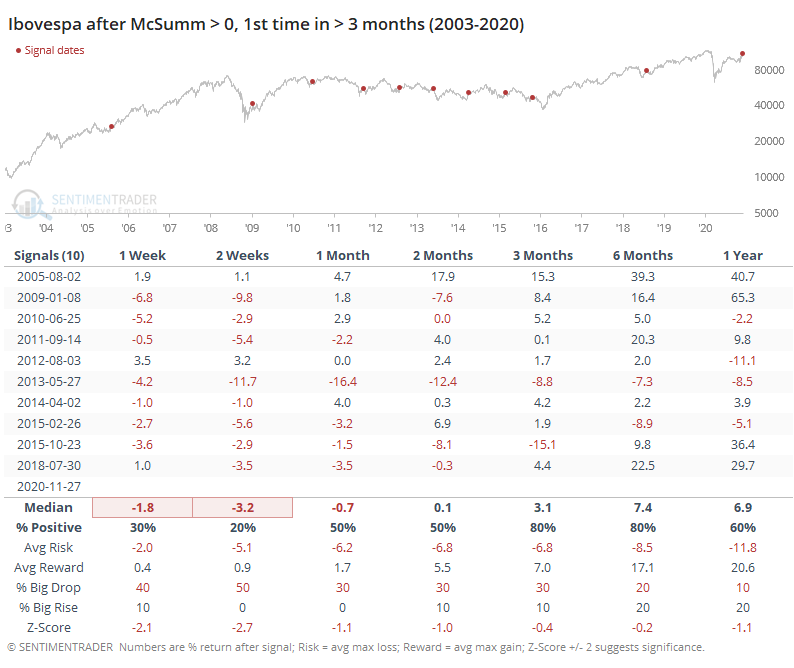

Some non-U.S. markets are closely tied to commodity markets and have a relatively high correlation to sectors like energy. As that sector has tried a recovery, so has Brazil's Ibovespa index, whose Summation Index also just climbed above zero.

These stocks have had great difficulty holding onto this momentum in the short-term, but it was a good medium- to long-term sign.

All but 2 of the signals showed losses during the next 2 weeks, but also all but 2 of them showed gains over the next 3-6 months.

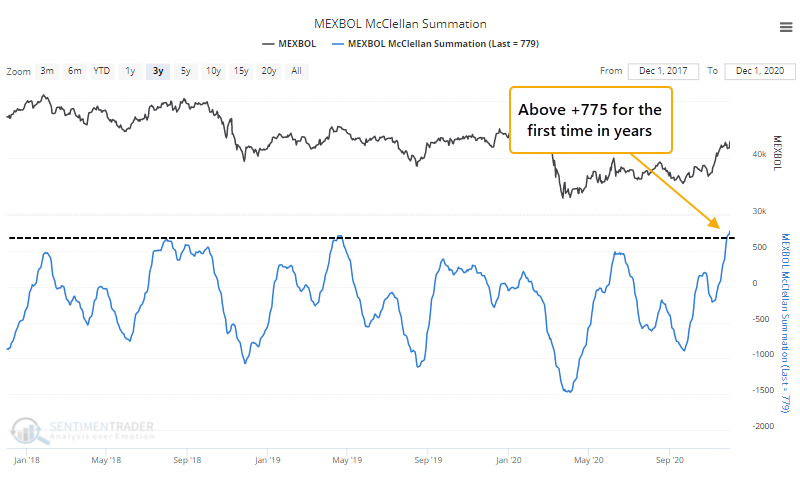

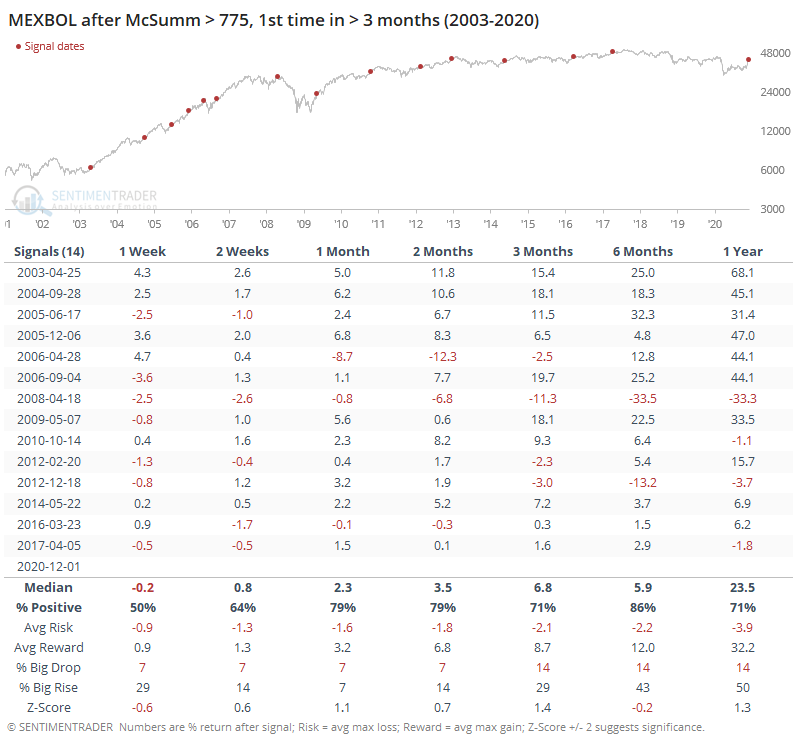

Some of the strongest internal momentum is in the Mexican MEXBOL index, where the Summation Index has moved above +775, its highest level in years.

Here, too, we saw some short-term weakness but it was a good medium- to long-term sign.

The recovery in some of these markets is the most impressive in months, or even years. While some weakness was common, it was generally confined to the first month or so after the recovery reached its current level. On a medium- to long-term basis, most of these showed strong results.