Investors Are Leaving Early

Leaving early

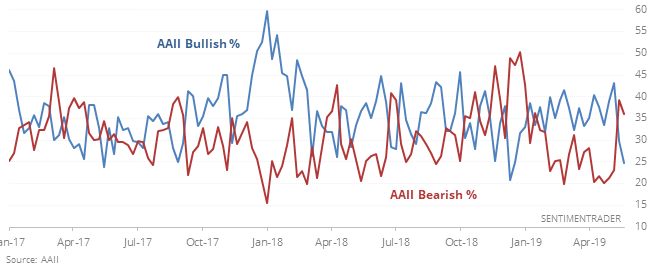

When stocks fell more than 10% into mid-December last year, it was easy to forgive individual investors who turned negative. This week, they were almost as negative as they were then, despite the S&P being less than 2.5% off its high.

Other times of premature negativity typically didn’t work to their advantage. As a medium- to long-term sign, it’s a good one for stocks, especially relative to potential risk.

Bear-level fear

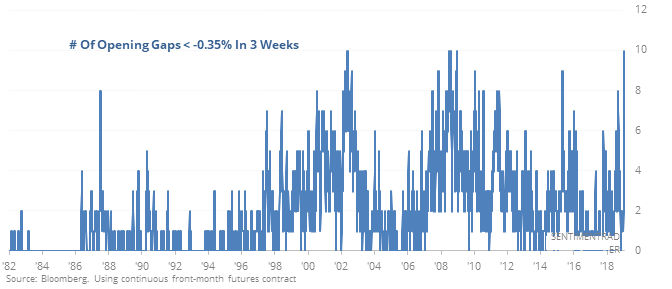

Yet again on Thursday, traders got anxious overnight and pushed the futures market to a large loss at the open of regular trading hours. That’s the 10th time in the past three weeks.

Since 1982, that has only been seen near the bottoms of the bear markets in 2002 and 2008.

Low volatility, high returns

Low volatility stocks within the S&P are hovering new their highs while their high-beta brethren are now more than 10% off theirs. This kind of extreme difference in risk preferences has happened 10 other times since 1990. For high beta stocks, it wasn’t a good sign as they continued to show weakness. For low volatility stocks, though, they were higher three months later 9 out of 10 times.

Small stocks suffer

The Russell 2000 fell to its lowest level in three months while the S&P has held more than 2.5% above its own low. The lagging small-caps were not a leading indicator – the S&P rallied over the next 2 months 70% of the time.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.