Investors have never been so hungry to lose money

The hunger for new issues is voracious and bankers trying to pad year-end bonus numbers can't keep up. Their new stocks are making money, but the companies themselves certainly are not.

Here's the Wall Street Journal, writing about DoorDash (abbreviated, with highlights added):

"DoorDash Inc. delivered for investors, surging 86% in its stock-market debut on Wednesday. The seven-year-old company ended its first trading day valued at about $71.8 billion, higher than many of the restaurant companies that depend on its couriers. The San Francisco-based company has never turned an annual profit, but a surge in demand during the Covid-19 pandemic has helped to transform it."

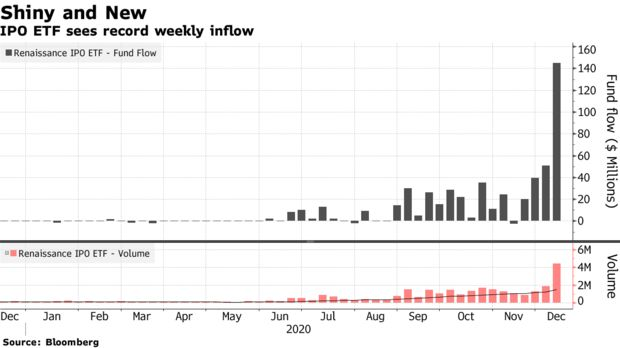

Using Bloomberg data going back to the early 1990s, let's look at the total number of U.S. listed initial public offerings that showed a negative net income at the time of the offering. If they didn't report financials at the time, then we ignored the listing.

Over the past year, there have been 88 IPOs that showed a negative number on the net income line. That exceeds all other rolling one-year periods except for 2000.

But that year also had quite a few IPOs that were actually making money at the time. If we look at a ratio of money-losing to money-making companies that issued shares, the current environment stands out.

Part of the reason why so many companies are going public without turning a profit first is that they just haven't had time to do so. The median age of a company going public over the past year is barely 5 years old. The CDC suggests that a human child doesn't understand the concept of the future tense until their 5th year. Maybe companies aren't much different.

What else is happening

These are topics we explored in our most recent research. For immediate access with no obligation, sign up for a 30-day free trial now.

- A look at the ratio of money-losing to money-making companies going public

- The low average and median age of IPOs is stunning

| Stat Box More than 30% of stocks on the Shanghai Composite exchange are now oversold, despite that index still holding above its 200-day moving average. Over the past 5 years, there have been 25 days with a similar condition. A month later, the Shanghai was higher after only 8 of those days. |

Sentiment from other perspectives

We don't necessarily agree with everything posted here - some of our work might directly contradict it - but it's often worth knowing what others are watching.

1. Investors in tech stocks have a lot of faith that these companies will be able to deliver. They're willing to pay $25 for every $1 in sales, which is up from less than $5 a few years ago. That's a whole lot of faith that companies will not only be able to continue to increase revenue, but actually turn that into profits, which, you know, used to be the entire point of a business. [WSJ]

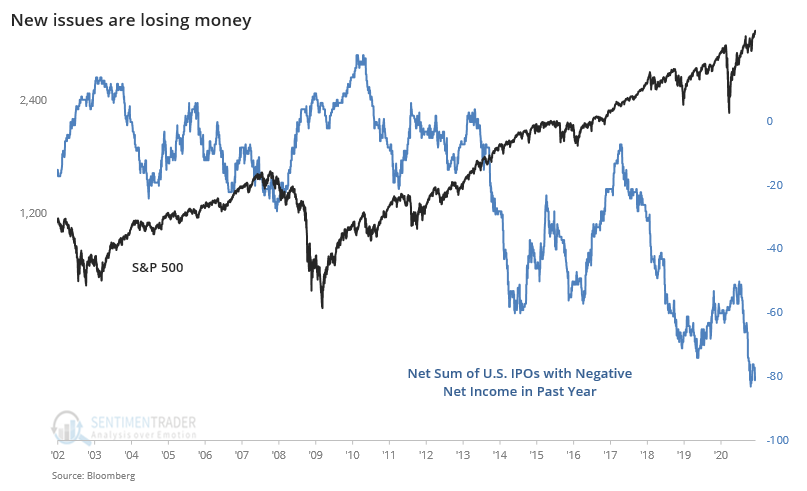

2. Not only are investors willing to buy unproven companies, they're willing to buy things that aren't really companies at all, just concepts. There has never been a time when investors were so willing to fund blank-check companies in hopes of striking it rich with an undiscovered gem - even though these things are much more likely to give riches to their founders. [Wolf Street via Daily Shot]

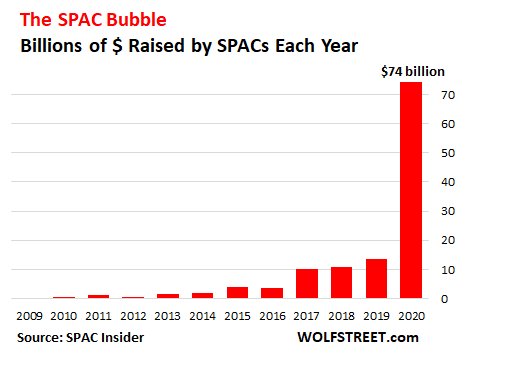

3. Not only are investors shoveling money into these unproven businesses, they're throwing money at the most popular fund that bets on them once they hit public markets. [Bloomberg]