Its Getting Late for Real Estate

"All good things have to come to an end."

Wise Philosopher ("Unknown")

"Don't stay too late, or you'll get in trouble."

Wiser Philosopher ("My Mom")

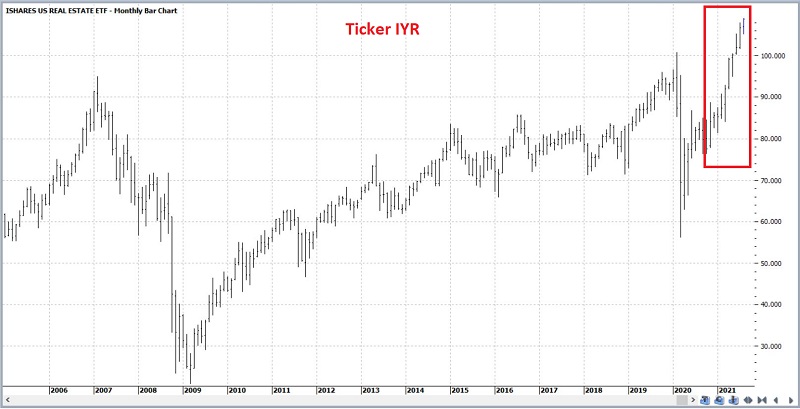

The real estate sector has just done something fairly rare. The chart below (courtesy of ProfitSource) displays the monthly price action for ticker IYR (iShares U.S. Real Estate ETF ) as a proxy for the real estate sector. As you can see in the red box at the far right, IYR just closed higher for the 10th consecutive month.

Is it possible that the real estate sector will "keep on rolling" higher? Of course (it's 2021, for crying out loud). And as an avowed trend follower, I am not one to "sell everything" just because something has supposedly "gone up too much."

Still, my mom was pretty smart. So, there's also that in the back of my head. But perhaps we should take a slightly more quantitative look.

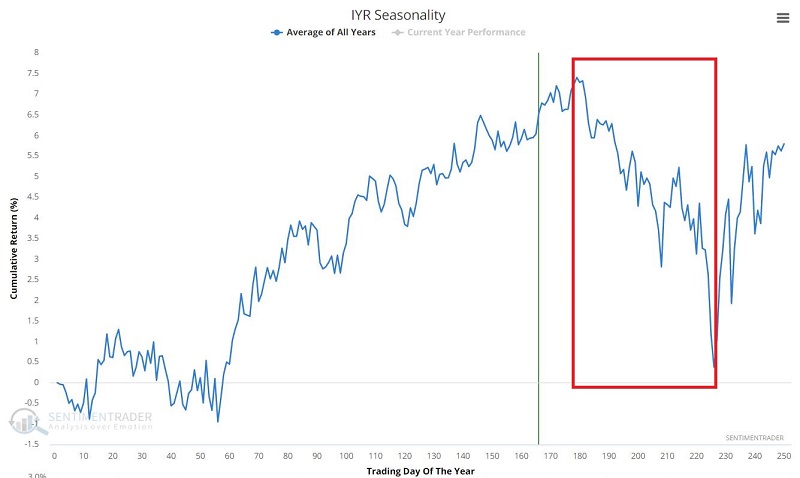

SEASONALITY

The chart below displays the Annual Seasonal Trend for ticker IYR. While the short-term seasonal trend is still slightly favorable for a few more weeks, there is, um, slight potential for trouble in the months ahead.

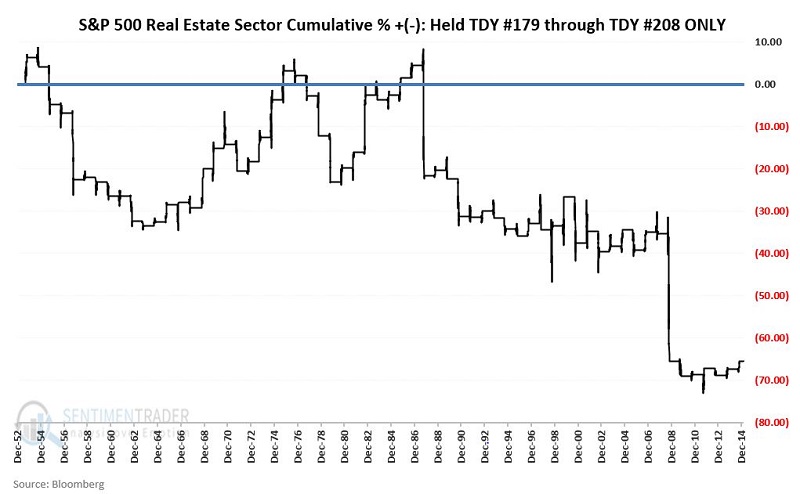

The chart below displays:

- The cumulative % +(-) for the S&P 500 Real Estate sector

- Since 1953

- If held ONLY from the close on Trading Day of Year #179

- Through the close on Trading Day of the Year #208

- Since 1953, the real estate sector has declined -69.3% if held long ONLY from the close on TDY #179 through the close on TDY #208

- Before "running for the hills," it should be noted that "wins" and "losses" on an annual basis are something of a "coin flip"

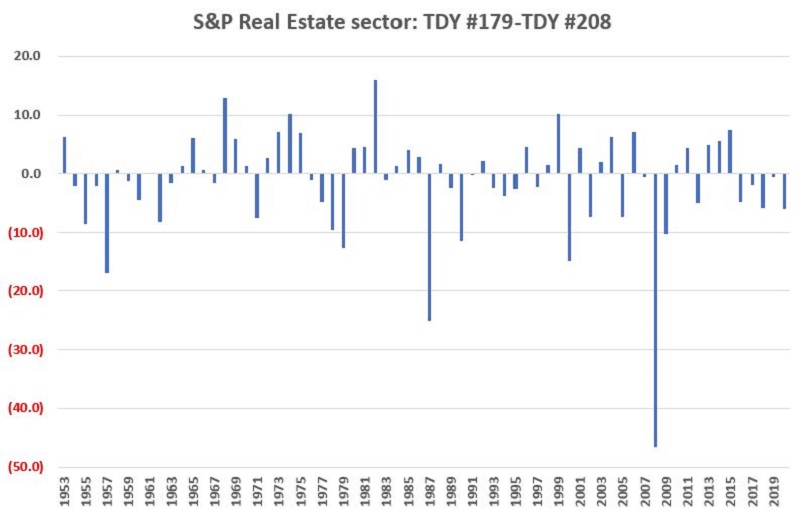

The chart below displays the year-by-year percent return for the S&P 500 Real Estate sector from TDY #179 through TDY #208.

The key points:

- Real estate DOES NOT decline every year during this time period

- The problem is that when this sector is bad, it tends to be very bad

For the record, during the TDY #179 through TDY #208 period, the S&P 500 Real Estate sector:

- UP 33 times

- DOWN 35 times

- Average UP = +4.8%

- Average DOWN = (-7.9%)

REGARDING 2021

So, will real estate swoop or soar - or do something in between - during this seasonally unfavorable period in 2021? There is no way to predict. But from a real-world trading perspective, there are a few things to consider.

It is interesting to note that despite the impressive nature of the relentless advance over the last 10 months for real estate, it just barely outperformed the S&P 500 Index (+40.4% for IYR versus +38.3% for SPX).

The chart below (courtesy of Stockcharts) displays the relative performance for IYR versus ticker SPY over the past 5 years, along with a 104-week exponential moving average.

Real estate relative performance has clearly picked up since January 1st, but the overall long-term trend still favors the broader market (SPY). The point:

- Despite the terrific performance since October, real estate has not been a massive outperformer

The "seasonally unfavorable" period this year extends from the close on 9/17/2021 through the close on 10/28/2021.