Junk Bond's Warning Sign

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

Bond market warning

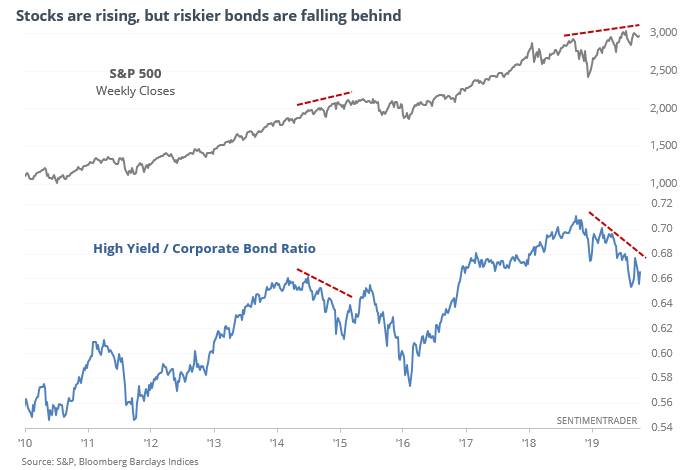

Stocks have held up well lately, more or less, but high-yield (junk) bonds are under-performing relative to other parts of the corporate bond market.

The cliché is that bond traders are smarter than their stock market cousins, so this should be a troubling sign.

We looked at all times since 1990 when the S&P 500 was within 2% of a 52-week high (on a weekly closing basis) and the high-yield ratio was within 2% of a 52-week low. A few times, it preceded large declines. But there were too many false signals to consider it a consistent warning sign.

Gold and U.S. Dollar

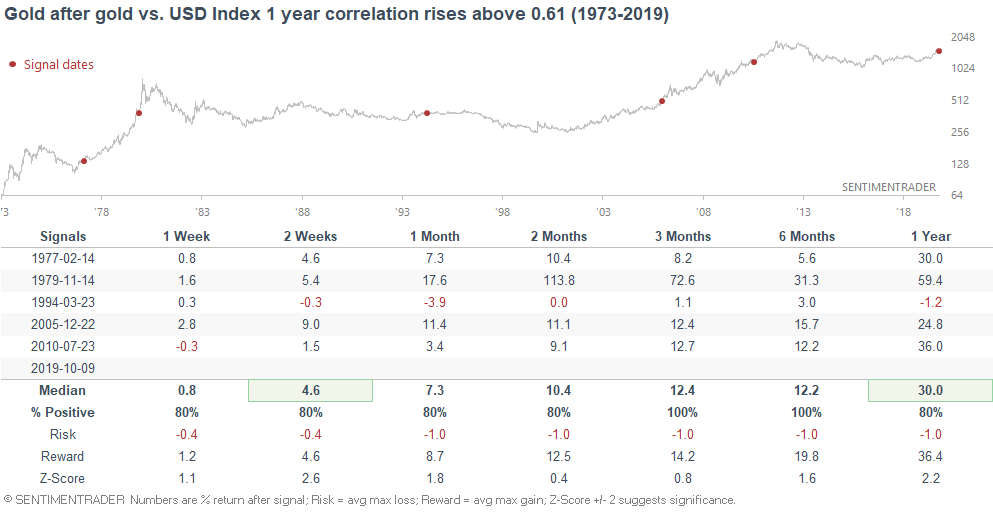

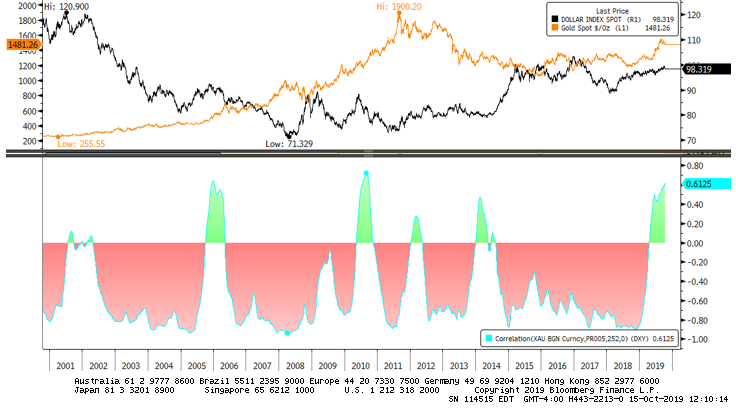

Both gold and the U.S. Dollar have been trending higher over the past year, presumably on trade war fears and global economic policy uncertainty. As a result, the 1 year correlation between gold and the U.S. Dollar Index has risen above 0.61. This is using their values, not price changes.

When gold and the dollar were this tightly correlated in the past, the U.S. Dollar Index performed poorly on virtually all time frames, whereas gold usually performed well over the next year. So at least the gold bugs have that.