Just a Quick S&P 500 Seasonality Reminder

My favorite line regarding seasonality remains:

"Seasonality is climate, not weather." Michael Santoli, Senior Markets Commentator at CNBC

Seasonality tells you what you should generally expect. It does NOT tell you what IS going to happen. That said, it can be instrumental in helping to set one's expectations.

PAST AND PRESENT: A QUICK REVIEW

Historically the stock market has performed:

- Much better during November through April

- Than during May through October

But on a year-by-year basis, this can vary a great deal. And in the past decade:

- The May-Oct period has seen a gain about 80% of the time

So, each time the market fails to behave badly "when it's supposed to" (May-Oct), the easier it becomes to dismiss the warning.

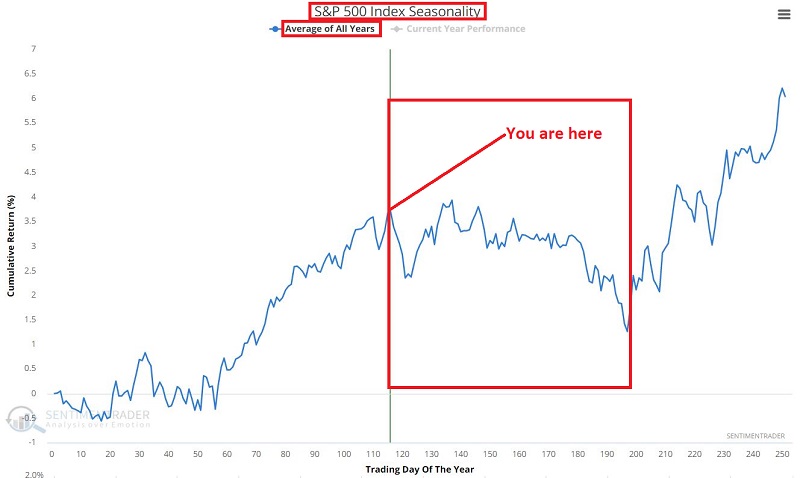

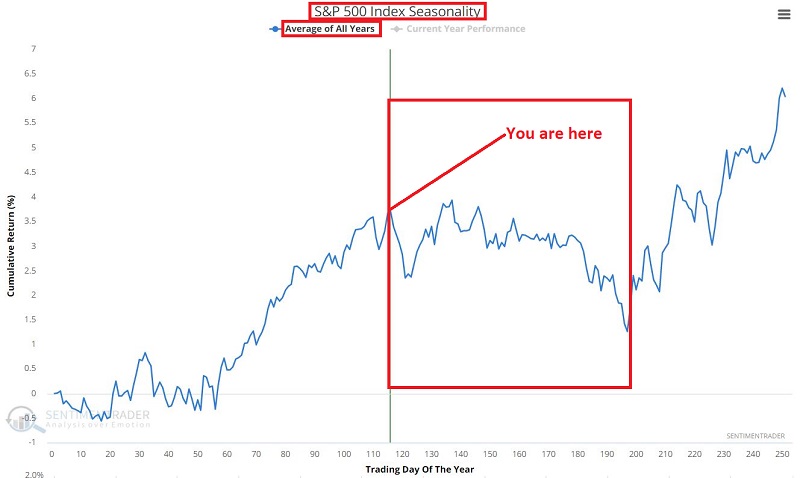

All that said, please take note of the S&P 500 Index Seasonality chart below.

The implications are that we may see:

- A downdraft of some significance in the near-term

- Not a lot of new upside in the months ahead

- And a potentially bigger decline as we head into mid to late October

Is that how it will play out? Sorry folks, "climate, not weather," remember?

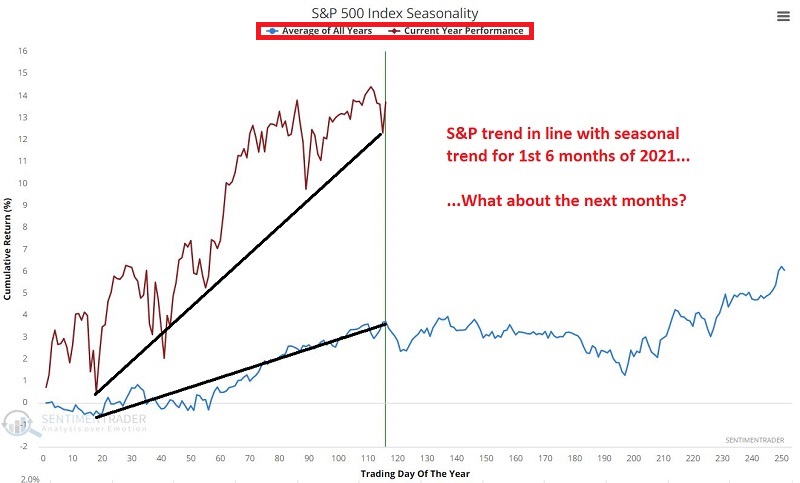

The stock market could easily rally to nominal new highs in the month ahead. However, do also note in the chart below that the S&P 500 Index has tracked its annual season fairly closely (in terms of the trend - and to a much greater magnitude) so far in 2021.

Will this continue? Same answer as the question above.

SUMMARY

Investors and traders have gotten very used to the "one-way ride" in the past year - and most of the past decade. But the stock market is NEVER a one-way street forever. So this seems like an opportune time for investors and traders to assess their risk exposure and plan to mitigate excessive risk.

Just in case the weather takes a turn for the worse...