Just how bullish are Robinhood traders?

With a massive spike in people staying at home, the cancellation of virtually every sport, and a shutdown in traditional gambling, there has been a mass movement to trading. Nobody personifies this more than Dave Portnoy, perhaps the most destructive force for individuals' finances extant.

We've documented the rise in trading several times, especially the exponential growth in trades at retail brokerages and the historic volume of speculative options trading.

Another popular measure of this newfound love affair with trading is the growth in Robinhood accounts. Robinhood is "a pioneer of commission-free investing, gives you more ways to make your money work harder" and their user growth went exponential in March and April.

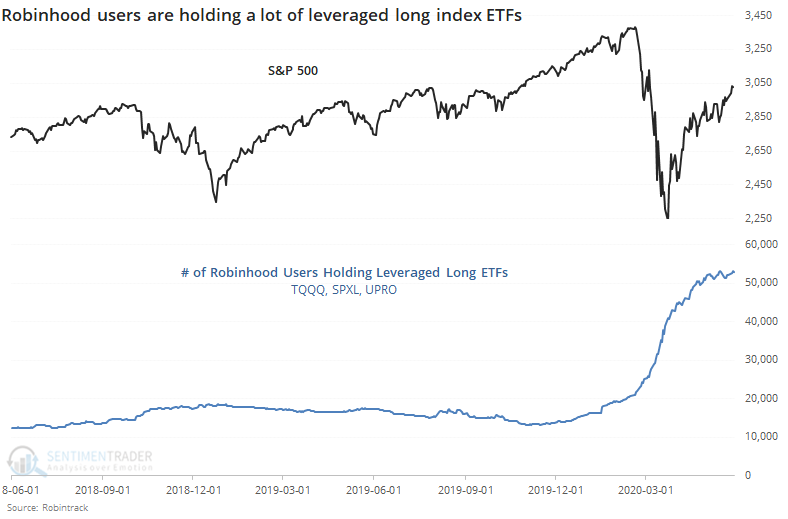

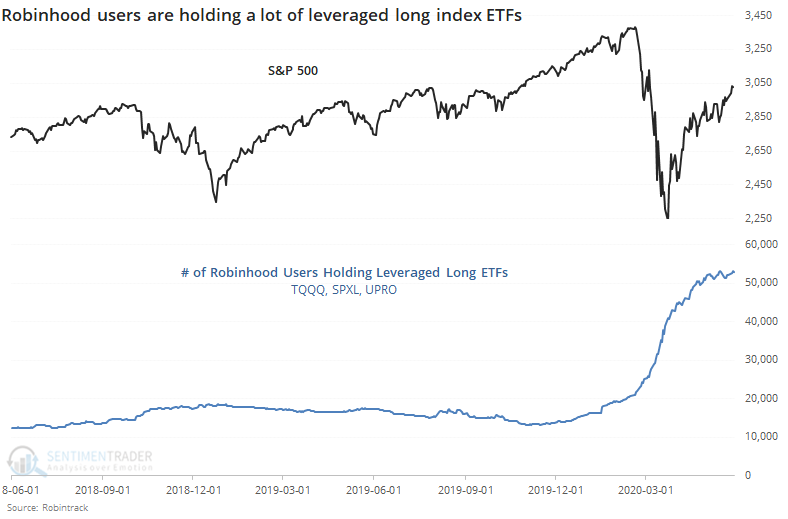

Using data from Robintrack, we can see that the number of users holding the most popular leveraged long ETFs has exploded.

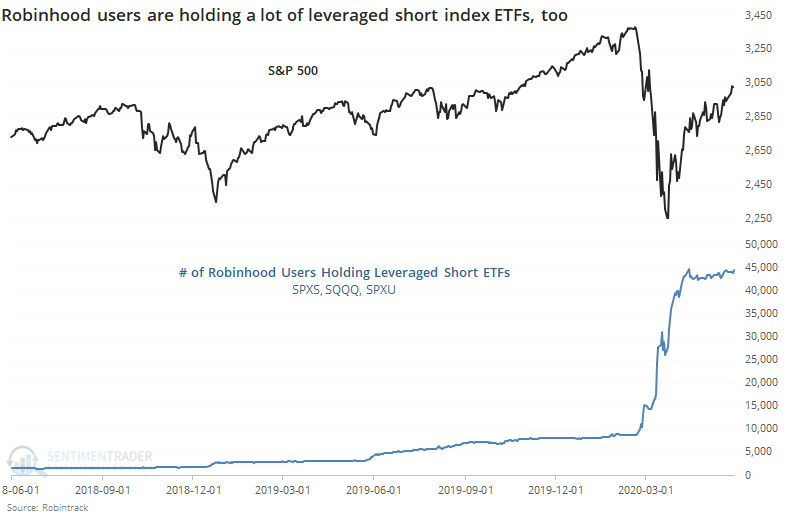

If we just stop there, we'd have to make the assumption that speculation is out of control. It would also be highly misleading since there has also been an explosion in users holding the most popular inverse ETFs. These are funds that rise when stocks fall.

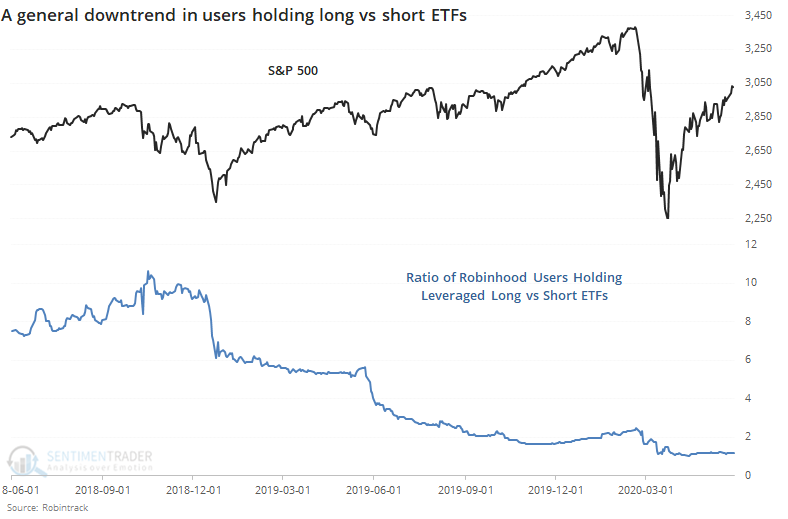

If we look at the ratio of users holding long versus short ETFs, then there has been a clear downtrend, as more and more users have discovered the uses (and pitfalls) of inverse funds.

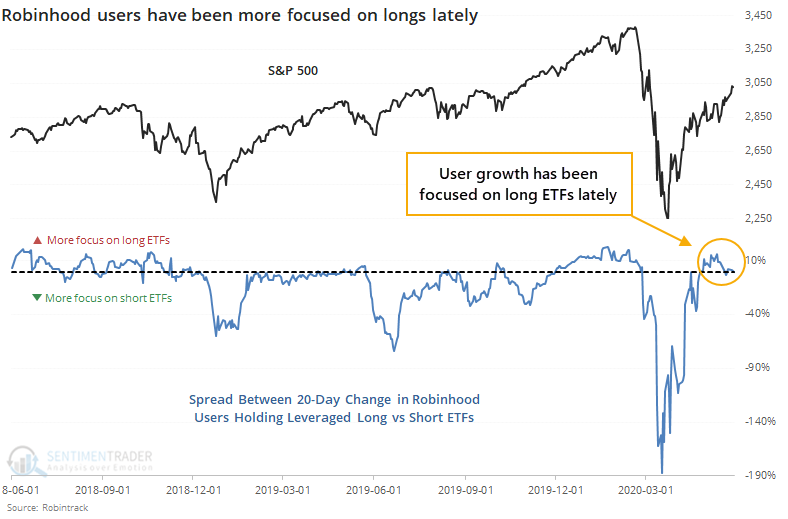

None of these are very helpful. So, let's look at the 20-day percentage change in users holding leveraged long ETFs minus leveraged short ETFs.

Here, we can see a more useful look at their behavior. When stocks dropped in late 2018, June 2019, and March of this year, there was an explosion of users holding the inverse ETFs relative to those holding long ETFs. It was an effective contrary indicator each time.

The opposite extremes were less clear, as were the extremes themselves. It was rare to see 10% or more growth in users holding long versus short ETFs, and the times it did, it preceded mixed-to-negative returns in the S&P 500.

In recent days, growth in accounts has been about equal between those holding long and short funds. It was skewed heavily toward long ETFs at the beginning of May but even though stocks have rallied since then, user growth has evened out.

We could maybe call this a very slight negative since there was that spike in interest in long funds a few weeks ago, but it's just not a strong enough indicator to consider it an edge.