Keeping an eye on natural gas

The natural gas one-year futures spread as a percent of the first contract price has increased to a pay attention level, especially given the upcoming seasonal outlook. According to my calculation, the spread currently resides at 11.82% as of the close on 5/19/21. When the current spot price is higher than prices maturing in the coming months, the market reflects backwardation. Backwardation means that the current spot price is too high and is likely to fall in the future.

FUTURES CONTRACTS

- Generic 1st Natural Gas (NG1)

- Generic 13th Natural Gas (NG13)

SPREAD CALCULATION

Spread = (NG1-NG13)/(NG1)*100

Let's assess the future outlook for natural gas when the market is in backwardation and approaching the seasonally weak summer months.

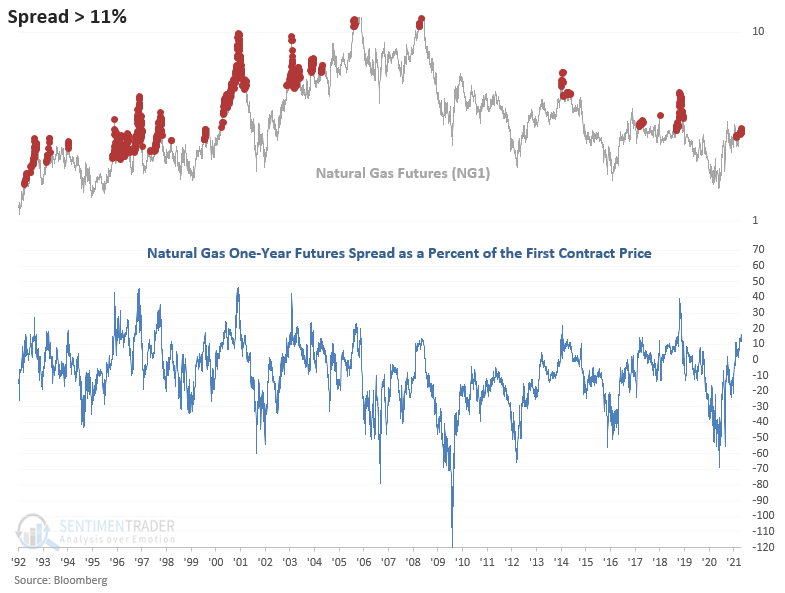

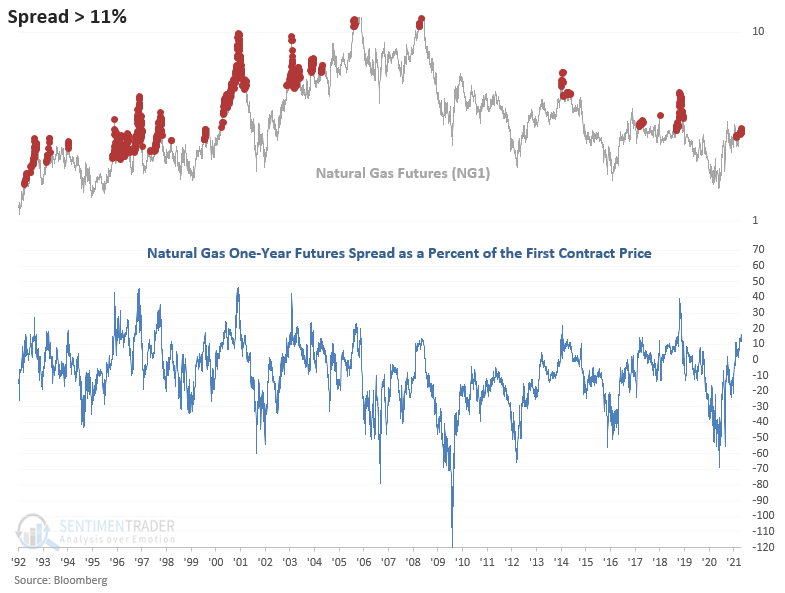

HISTORICAL SPREAD CHART

As shown in the chart below, the natural gas spread has reached one of the highest levels in the last decade. I would also like to highlight the character change in the data since the advent of fracking. Spread levels above 11% percent have been less frequent since 2004.

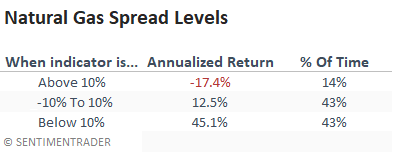

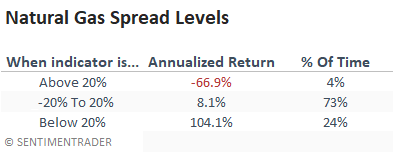

HISTORICAL ANNUALIZED RETURN SPREAD LEVELS

As shown in the table below, spread readings above 10% suggest poor annualized returns. If the indicator increases above 20%, watch out below.

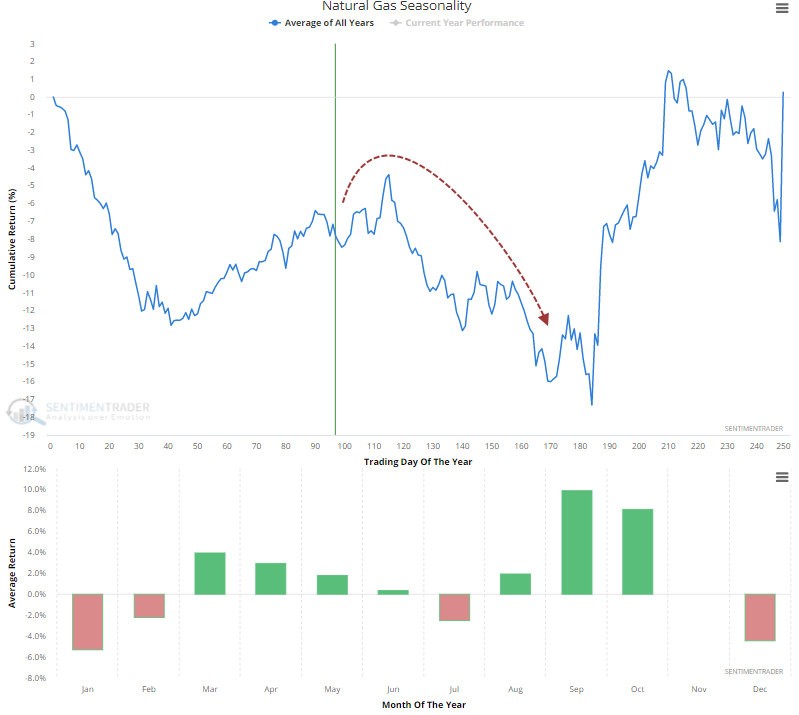

NATURAL GAS SEASONALITY

Natural gas has had a seasonal tendency toward weakness into June/July.

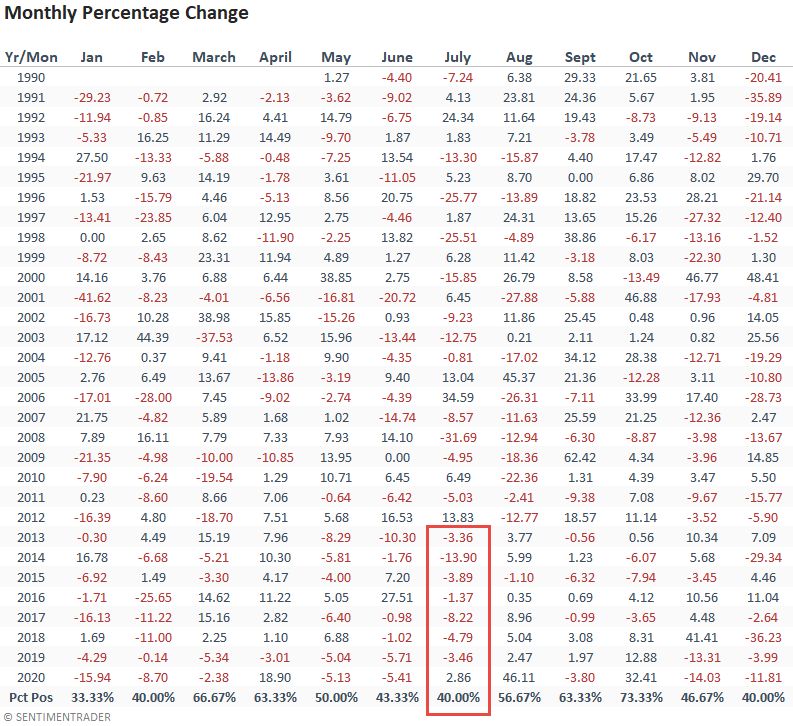

The table below highlights the seasonality trend for natural gas. July is one of the weaker months of the year, especially in the last eight years.

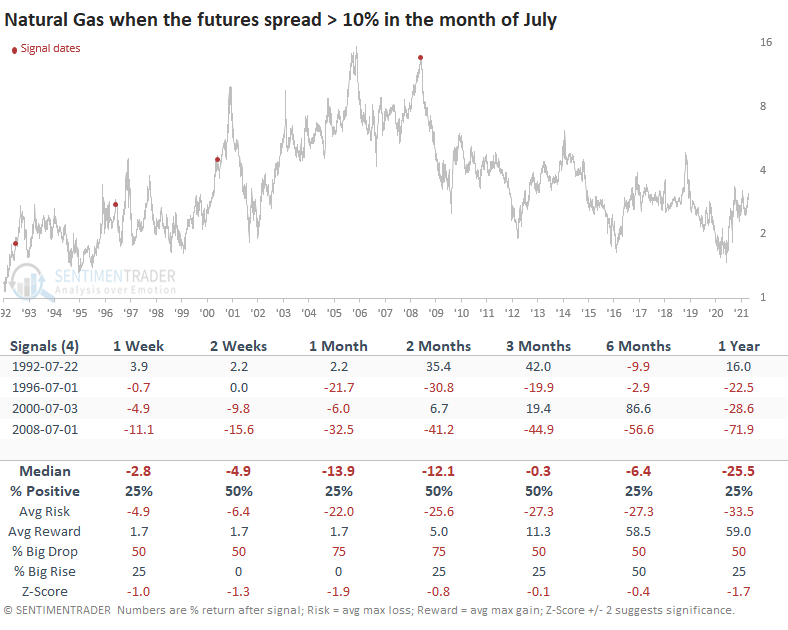

Let's combine the high spread level with seasonality to create a study that buys natural gas when the spread is greater than 10% in July.

I use a 1-month holding period to avoid repeats.

HOW THE SIGNALS PERFORMED - JULY

While the sample size is small, the returns are weak.

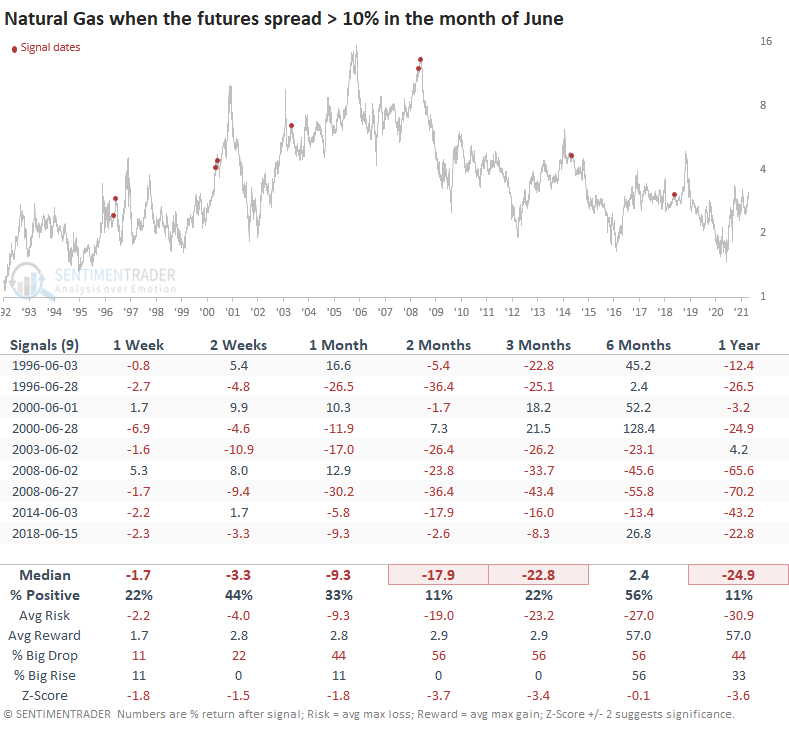

Let's conduct the same study, but modify the month to June.

HOW THE SIGNALS PERFORMED - JUNE

Except for the 6-month window, performance looks weak across all timeframes.

Please remember this study is not a trading recommendation. My note intends to highlight historical conditions that may or may not come to fruition in the future.