Let's assume the worst

Let’s assume the worst

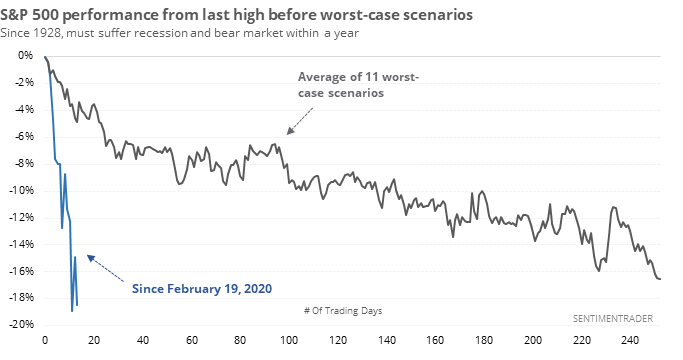

It’s quickly becoming more common to see calls that we’re in the midst of a bear market, wrapped by a likely recession. The two don’t necessarily go hand-in-hand, but bear markets within recessions do tend to be worse.

So, let’s assume that’s the case. Below, we can see how the average "worst case" unfolded.

In recent comments, we’ve seen multiple times that swift, severe panics like we’ve seen over the past couple of weeks are NOT usually how bear markets begin. They tend to be a much more drawn-out affairs.

Mini-crashes like we’ve seen are much more likely to be seen within ongoing bull markets.

When we take a deeper dive into individual cases, we can get a better handle on the probabilities over various time frames.

Few uptrends

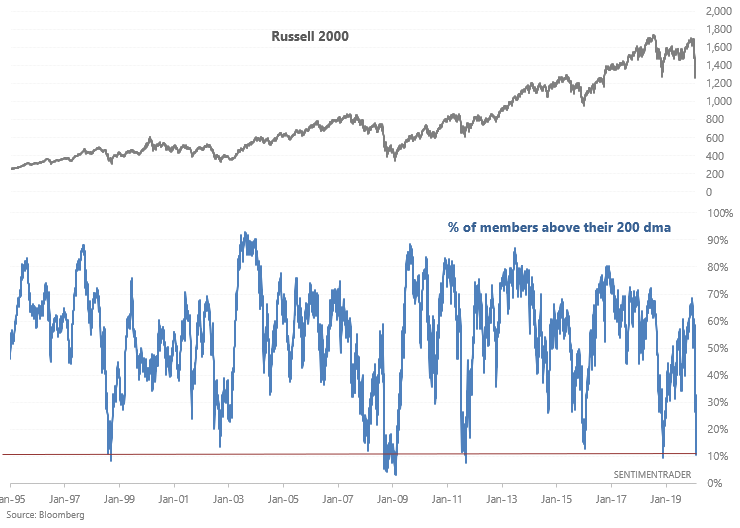

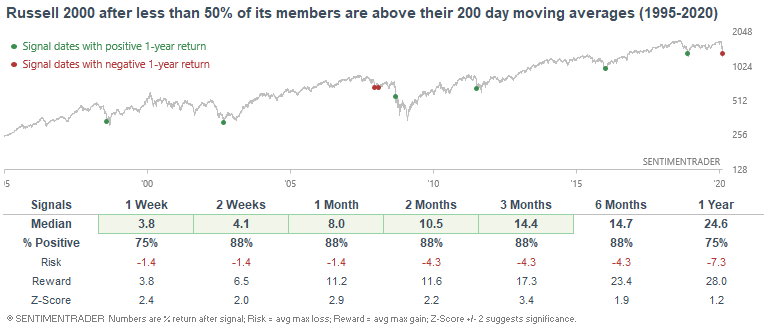

Global equities continue to slide. With the S&P 500 down -20% from an all-time high, fewer than 15% of its members are above their 200 day moving averages. Similarly, fewer than 15% of the Russell 2000's members are above their 200 day moving averages.

When this happened in the past, the Russell 2000's returns over the next 1-6 months were almost always bullish, with the big exception of October 2008.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- What happens after the Dow Industrials fall 20% into a new bear market

- There has been a surge in 52-week lows among junk bonds

- Wall Street analysts are panicking

- SPY's volume is going through the roof

- There has never been a worse stretch of negative opening gaps

- Wednesday saw the most focused selling outside of the day following 9/11

- There has been a historic cluster of 90% down days

- Copper's death cross

- More than half of our indicators are now showing pessimism