Looking for an intraday change

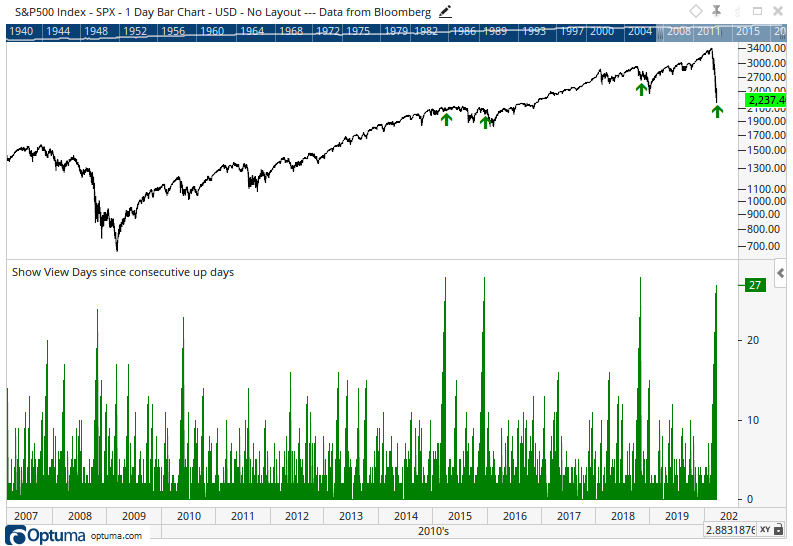

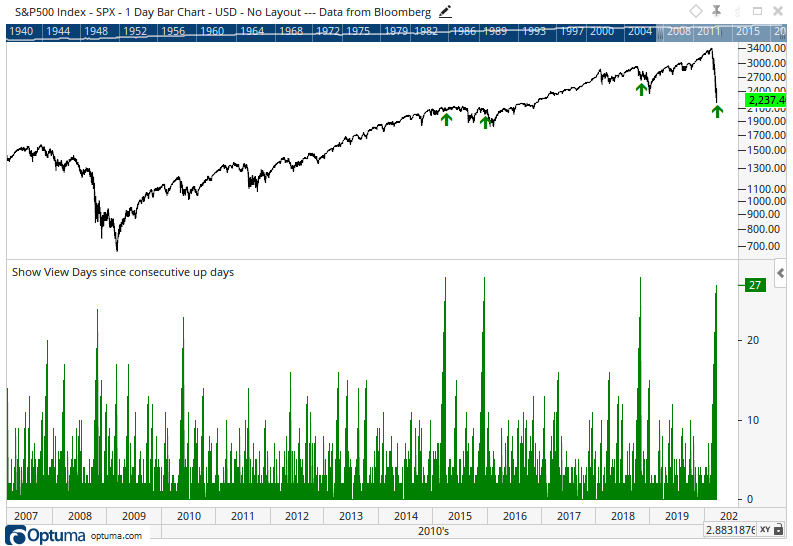

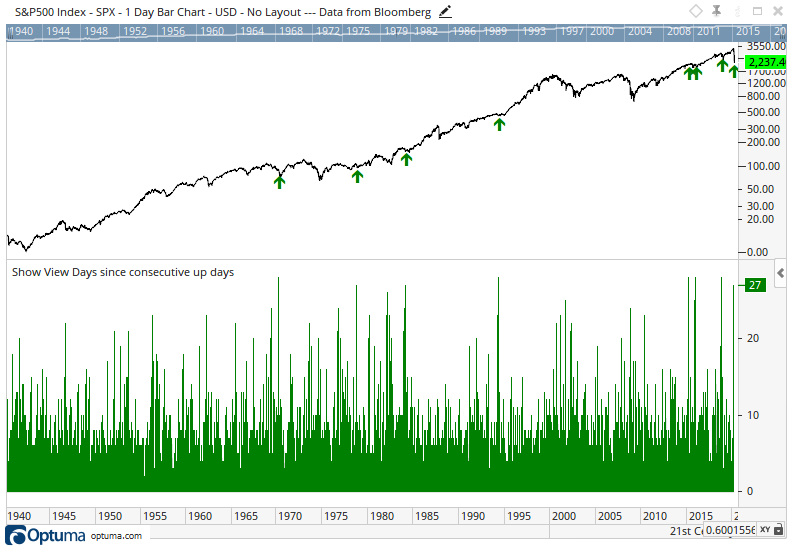

We all want to know if today is finally going to indicate a change in behavior. Almost every rally - even intraday - has been met and matched by sellers over the past few weeks. We haven't had back-to-back positive sessions for nearly 30 days, the 2nd-longest stretch in over a decade.

Actually, it's one of the longest streaks ever.

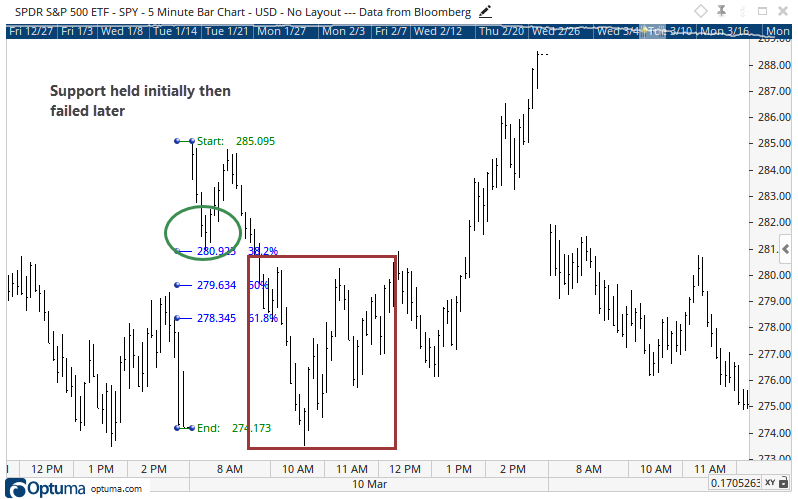

Based on where markets are trading now, we're looking at a very large positive gap up open. That could easily fade within minutes based on how volatile things have been, but as of now it's one of the few bright spots in what has been a dreary few weeks. The problem is that most of the days that have seen a big jump at the open have faded.

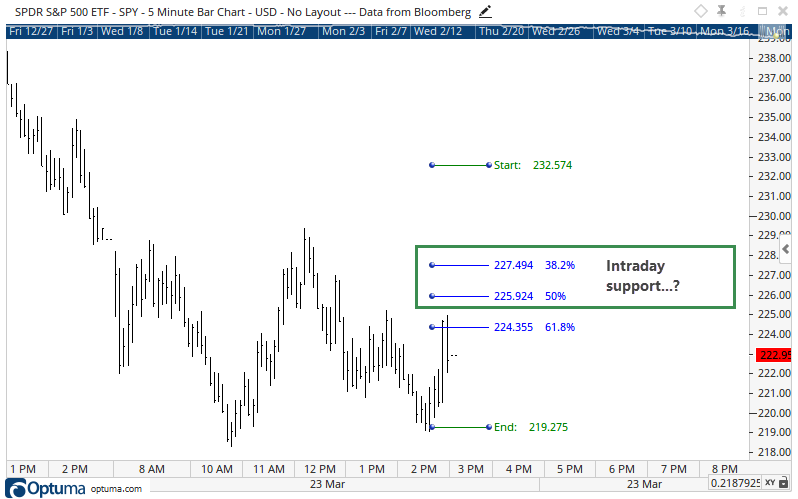

If we can rely on recent historical patterns, though, the first pullback might offer a clue. Each of the times we started off with a big gap up and ended up rallying more during the day, the initial selling pressure stopped once stocks gave back around 38% - 50% of their initial gains from the low point right before the prior day's close.

The days that ended up failing altogether also initially stopped at that approximate area, but then violated it later and went on to bigger losses.

Granted, it's a small sample, and who knows if we can count on historical comparisons, even from the last couple of weeks. If we can, then based very roughly on where stocks are currently trading, bulls should want to see buyers step back in if SPY drops to around 225-227 (again, very rough based on current levels).

If there isn't enough buying interest to hold even that level, then it does not bode well.