Lots of shorts in the UK

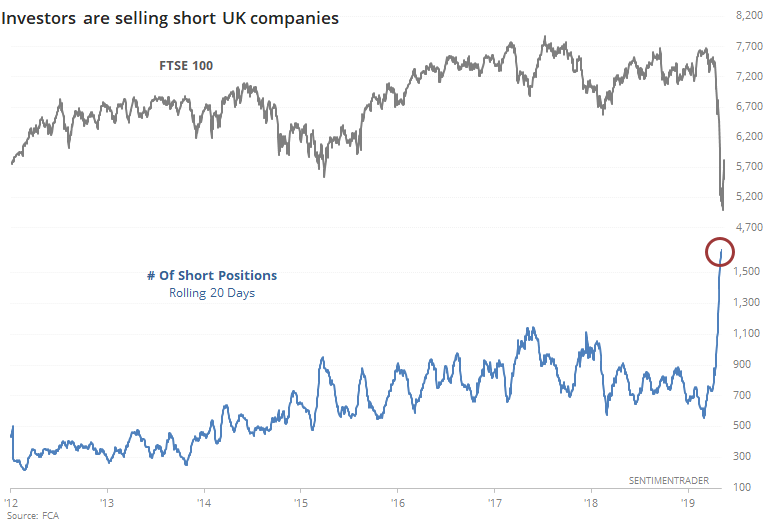

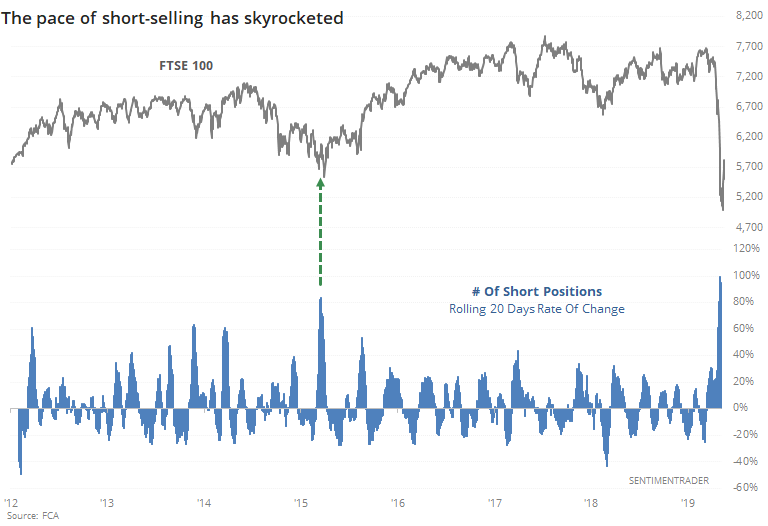

In the United Kingdom, traders have place a lot of bets that shares have further to fall.

According to a Marketwatch article, heading into March, investors had pulled back from selling short shares in the UK, hoping to buy them back later at a lower price.

In January and February 2019 there were 906 and 865 short positions respectively reported to the Financial Conduct Authority. The corresponding figures for the first two months of this year were 719 and 833 respectively, which is a decline of 219 or 12%.

That changed in a major way in March. Through Friday, the number of short positions has blossomed to the highest in at least 7 years.

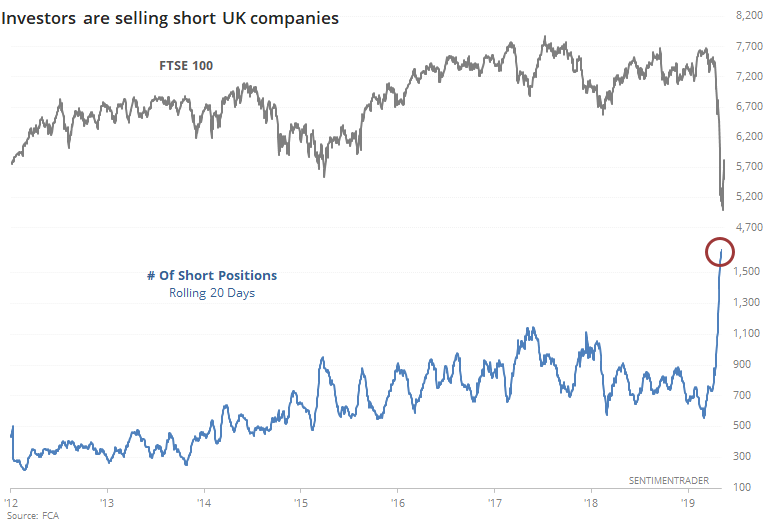

If we look at the rate of change in the short-selling, it has skyrocketed, with the number of short positions doubling from a month ago. The only other time period that neared this level of aggression was early February 2016.

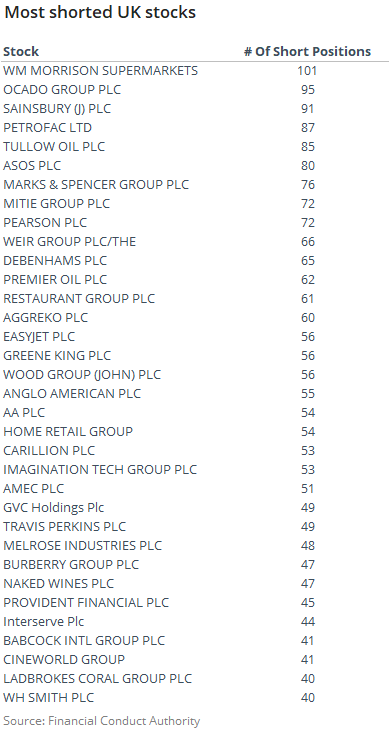

The short positions were dominated by a couple of dozen stocks.

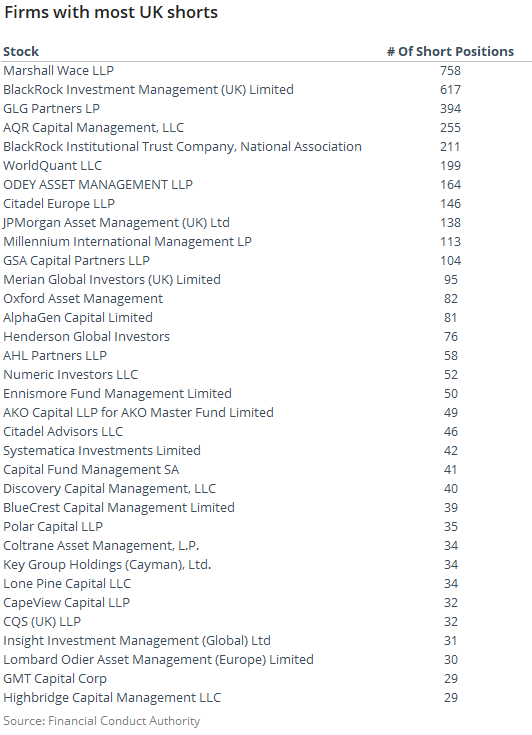

And they were instigated by only a handful of firms.

Like a lot of other things lately, we're relegated to a sample size of 1, so that makes it much more difficult to have high confidence in any conclusion. Based on the history available, this kind of short intensity should be a good sign for the FTSE going forward.