Lots Of Up Days Without Much Impact As Dollar Hits Overbought And VIX Spikes

This is an abridged version of our Daily Report.

All icing, no cake

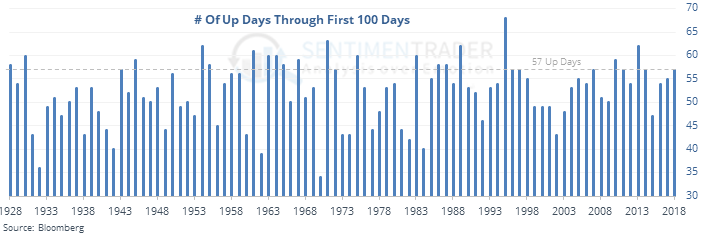

The S&P showed a gain on 57 out of the first 100 days this year, one of its best “first 100 days” ever.

Even so, it showed a meager year-to-date gain, suggesting that all those up days didn’t pack much punch. Similar years led to mixed returns, but mostly ignore the usual negative seasonality during the summer months.

Overbought buck

The Relative Strength Index on the U.S. dollar has become overbought for the first time in years. That has led to continued gains in the dollar in the weeks ahead every time. Assets with an inverse correlation, like gold and oil, had a tough time holding any gains.

This is kind of what panic looks like

Tuesday’s post-holiday sell-off saw one of the largest intraday spikes in uncertainty on record. The VIX jumped more than 40% at its high during the day, the 17th-largest spike out of 7,153 trading days. Stocks tended to rally strongly after other large spikes in the VIX, especially longer-term.

Ahia, Italia

The Optimism Index on the Italy fund, EWI dropped to 1 on Tuesday, essentially showing maximum short-term pessimism. It has gone this low 32 other times since 2000, rebounding over the next 3 days 72% of the time according to the Backtest Engine.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |