Love for everything tech

When it comes to trading, news headlines are a good way to get a sense of what's on everyone's mind. And right now investors' love affair with tech is real:

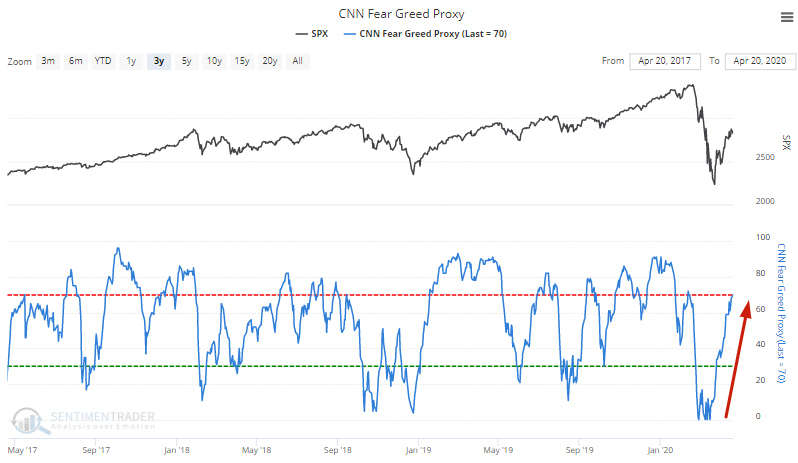

Tech's rally has pushed the broad market higher, and in some ways, sentiment is creeping up. For example, our CNN Fear & Greed Index proxy has risen to 70:

Tech's rally has pushed the broad market higher, and in some ways, sentiment is creeping up. For example, our CNN Fear & Greed Index proxy has risen to 70:

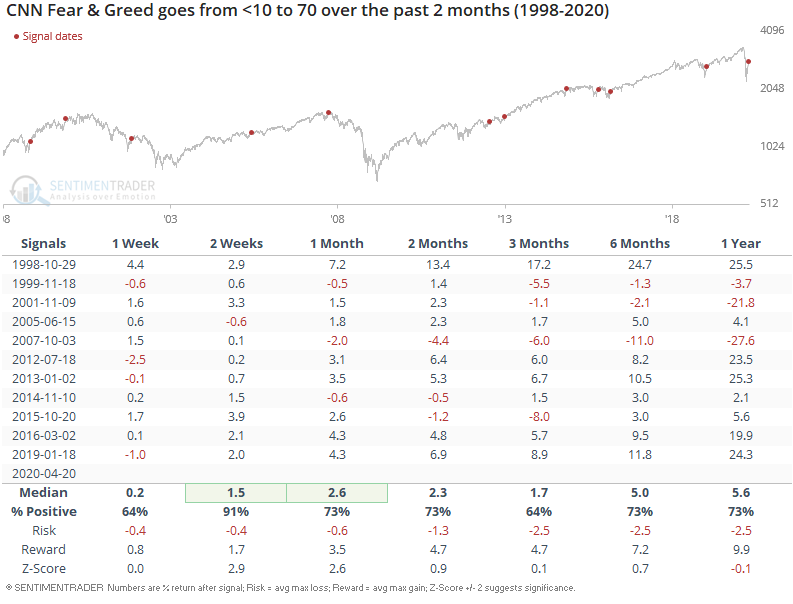

While it's easy to assume that this is a short term bearish sign for stocks, that hasn't always been the case. In fact, more often than not the S&P rallied over the next 2-4 weeks:

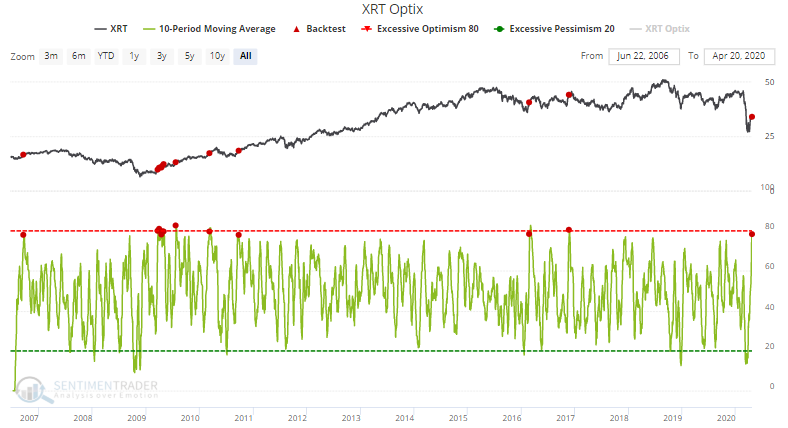

Certain sectors continue to exhibit extreme optimism. For example XRT (retail) Optix's 10 dma at at 78:

When this happened in the past, XRT went up more often than down over the next few weeks and months. Eventually there was a pullback, but it was hard to say "when".

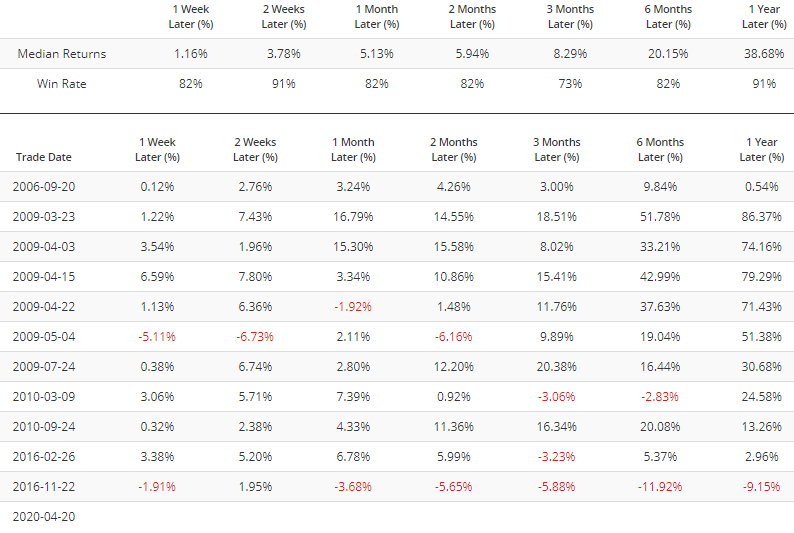

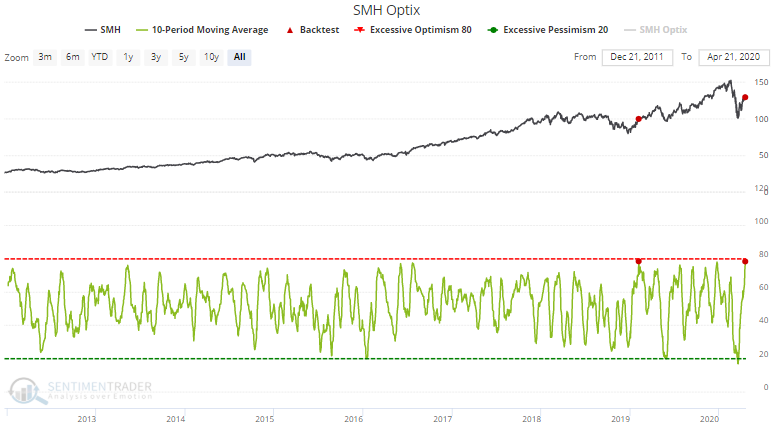

On the other hand, SMH (semiconductors) Optix's 10 dma is at an extremely high level (78). The only other time this happened in the past saw semiconductors consolidate sideways for the next few weeks.

I've shown several short term bearish stats over the past few days, whereas the ones today aren't really short term bearish. What gives?

In my opinion it is incredibly hard to predict the short term, regardless of how much confidence you have in your outlook. Too many unpredictable factors can impact the market's direction in the short term.

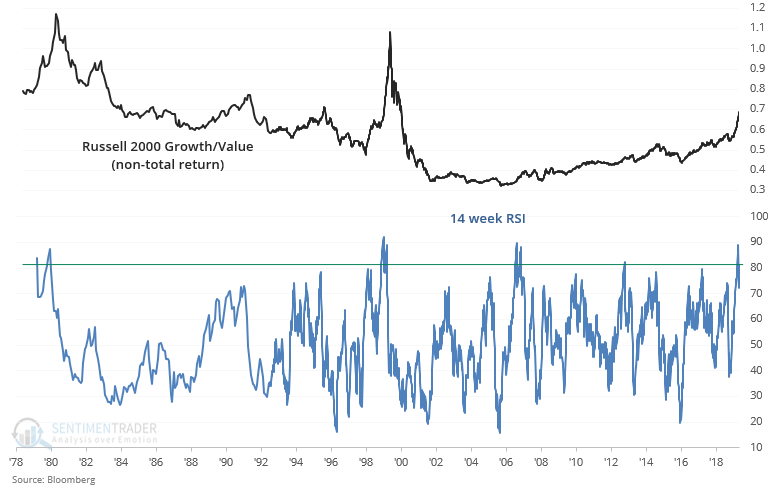

Many of the sectors with the highest sentiment right now are related to tech. As the WSJ mentioned, tech & growth stocks have significantly outperformed value stocks. The Russell 2000 Growth/Value ratio's 14 week momentum remains consistently high around 81:

Such strong growth outperformance usually led to problems for stocks over the next year:

This happened in:

- February 1980: stocks crashed in March 1980

- October-November 1980: stocks tanked from 1981-1982

- 1990-2000: top of dot-com bubble

- 2007: stocks crashed aftwards

- September 2013: stocks did not fall