Major Volatility As Gold/Silver Ratio Climbs

This is an abridged version of our Daily Report.

A correction-ender

Monday's reversal completely erased the losses from Friday, marking the third day in a row with a 2% move.

Coming after pullbacks in bull markets, sessions like Monday tended to lead to more gains in the medium-term. The last three sessions have been so volatile that we've only seen similar behavior near the end of prior bear markets. Also, other times when fewer than 25% of securities on the NYSE managed to rise (like Thursday and Friday) then more than 75% of them did (like Monday), stocks tended to rise in the months ahead.

Silver trying for a comeback

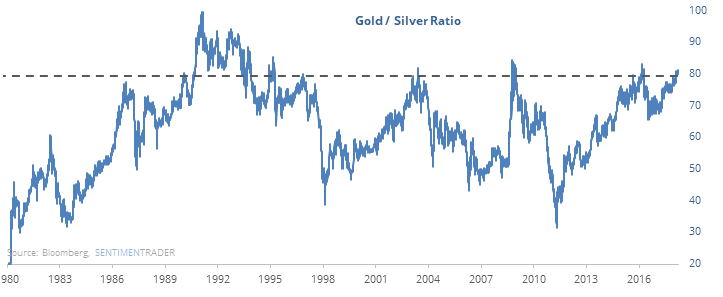

The ratio of gold to silver has hit a historic extreme, often taken as a negative sign for stocks.

Historically, it has been the exact opposite, with higher stock prices a year later almost every time. In the latest week, "smart money" traders reduced their short exposure to silver to the lowest ever.

Tech reverses tumble

The Nasdaq 100 sprinted more than 3.5% higher on Monday after hitting a one-month low on Friday, though it still held on to its long-term uptrend.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.