Managers are reducing exposure

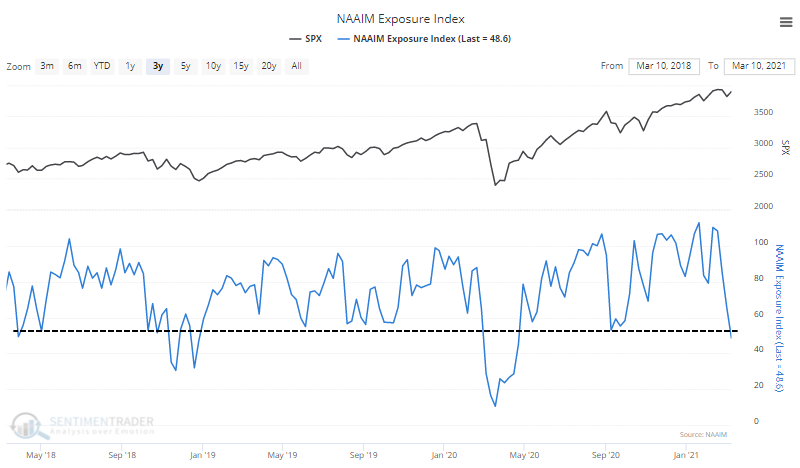

There is some excitement out there that the active managers in the NAAIM survey have greatly reduced their exposure to stocks. After being leveraged long, now the average manager is less than 50% exposed.

This ends the 5th-longest streak above 50% in the survey's history. But like we've seen time and time again, the best returns aren't usually seen during periods of declining optimism, it's during low-and-rising optimism.

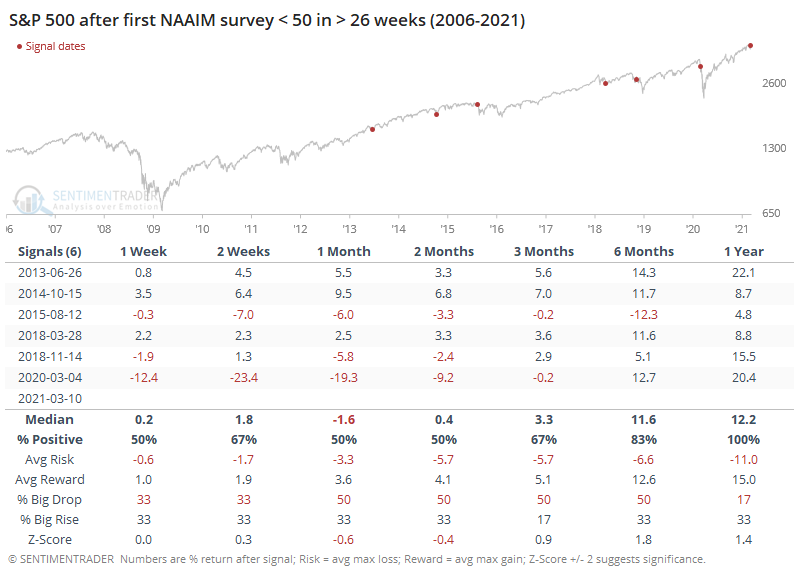

The last time we could have gotten excited about a drop in exposure was at this time last year. Not a great idea. Overall, shorter-term returns in the S&P 500 were below average, with above-average risk, but the sample size is small.

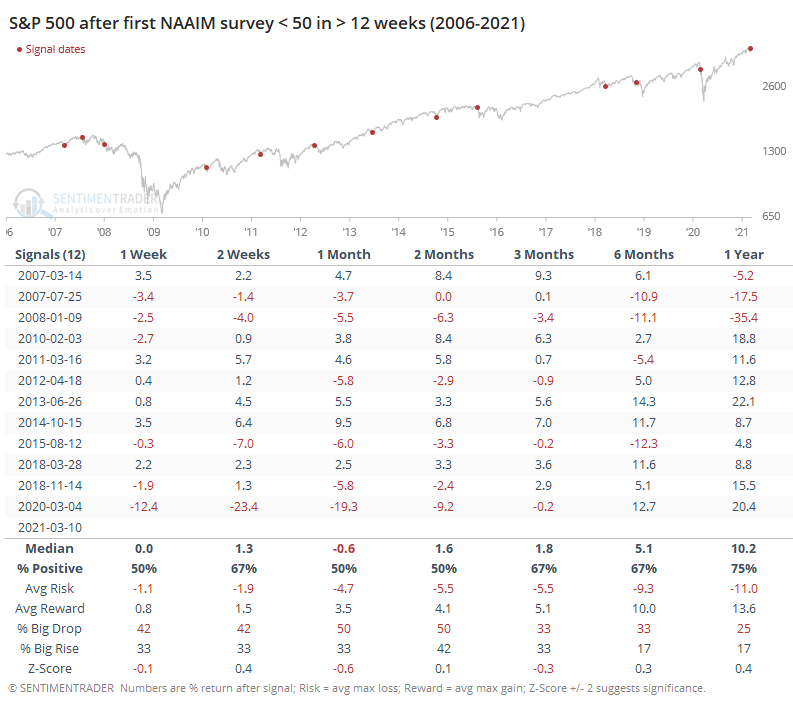

If we look for the first sub-50% reading in at least 12 weeks, then we double the sample size.

The conclusion was mostly the same - shorter-term returns were weak. After runs like we've seen, it wasn't until exposure was down to the 25% - 30% range that there was a better risk/reward for stocks.