Managers Favor U.S. As Market Sees Historic Split

This is an abridged version of our Daily Report.

There’s no place like home

Fund managers are showing a multi-year preference for U.S. stocks. A popular survey from BAML shows that managers are heavily overweight the U.S. versus both emerging market and eurozone stocks. But that hasn’t necessarily been a sign that the trend will reverse, unlike what we saw last year.

A historic split

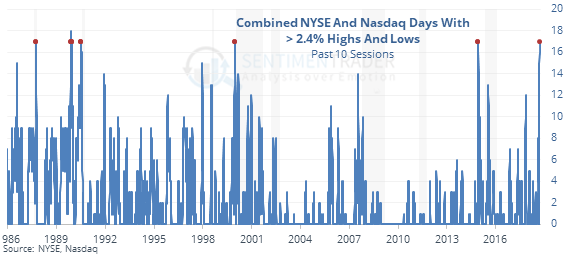

Yet again on Tuesday, an abnormally large number of securities on both the NYSE and Nasdaq exchanges hit either a new 52-week high or low. Over the past 2 weeks, there has been a historic cluster of these “split” signals, and every similar cluster preceded a bear market.

Relative extreme

The ratio between stocks and bonds is getting stretched again. While it gave a wonky signal following the election in November 2016 and outright failed in the fall of 2017, most of the similar extremes over the past 9 years have indicated period when stocks were extended and about to take a breather.

Appetite for junk

The JNK high-yield bond fund has taken in an average of more than $150 million per day over the past week. According to the Backtest Engine, over the past two years, when it has taken in this much in assets in this short of a time frame, it managed a gain over the next month only 33% of the time.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |