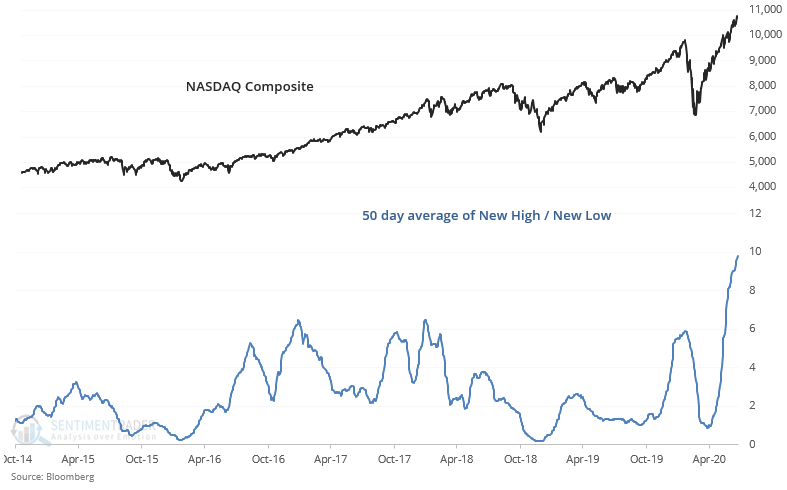

Many more new highs than lows

The unrelenting rally in tech stocks has kept the NASDAQ new 52 week high/low ratio consistently elevated. As a result, the ratio's 50 day moving average as at its highest level in years.

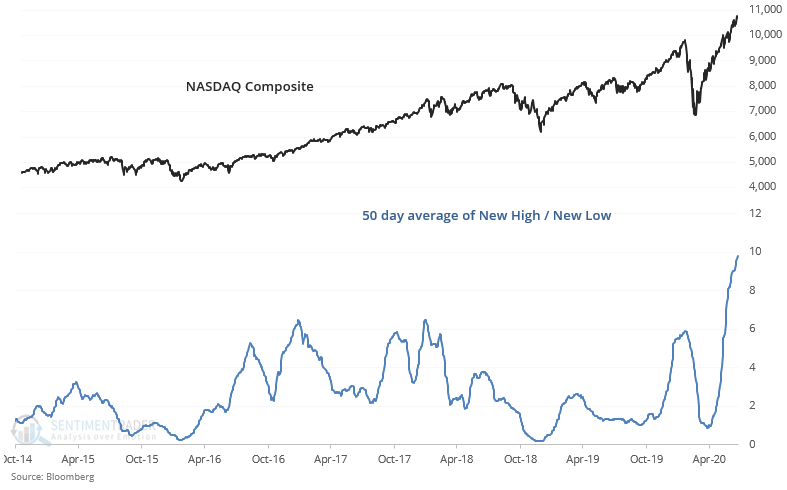

When the NASDAQ's momentum was this strong and so many members made new highs relative to new lows, the NASDAQ Composite may have pulled back in the short term. But on a 6-12 month basis, such strong momentum usually pushed tech stocks higher:

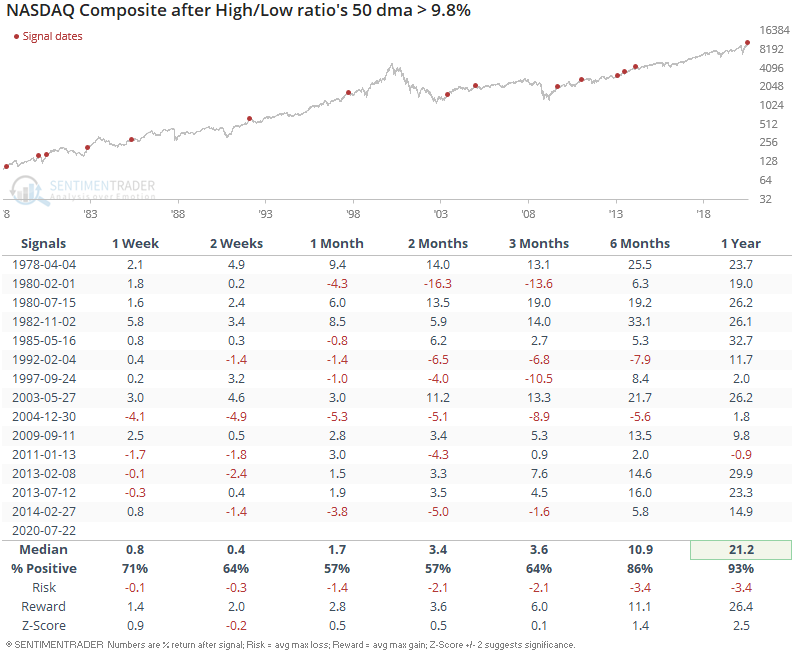

This was more positive for the S&P 500 than the NASDAQ in the short term, but just as was the case for the NASDAQ, this usually led to more S&P 500 gains over the next 6-12 months:

Strong momentum remains a bullish factor for U.S. equities over the next year, even if stocks need to take a short term breather.