Market & fundamentals overview: Santa Claus rally

With the U.S. stock market rallying and various sentiment indicators at the highest level in years, here's my market outlook:

- Long term risk:reward doesn’t favor bulls. Valuations are high, but valuations can remain high for years before stocks crash.

- Fundamentals (6-12 months): still bullish because there is no significant U.S. macro deterioration.

- Technicals (3-6 months): neutral

- Technicals (1-2 months): bearish

Fundamentals (6-12 months)

The economy and the stock market move in the same direction in the long term. Hence, leading economic indicators are also long term leading indicators for the stock market.

Overall, there is no significant U.S. economic deterioration right now. This is bullish for the stock market on a 6-12 month time frame. The main weak points in U.S. macro revolve around trade, manufacturing, and the yield curve. For more details and charts, please see the bottom of this post.

Technicals (3-6 months)

Our outlook over the next 3-6 months has become more mixed. Momentum is strong, but sentiment is extremely high. Let's start with the bullish stats, and then we'll look at the bearish ones.

Bullish:

Breakouts

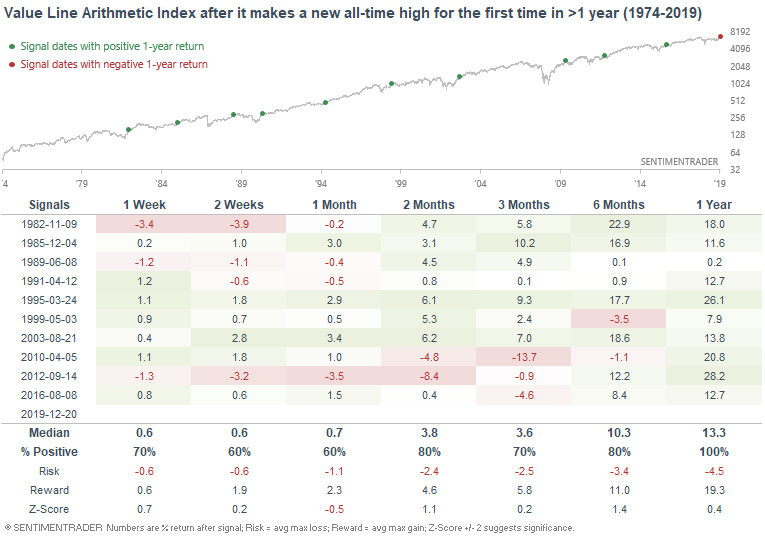

The Value Line Arithmetic Index, which tracks more than 1600 stocks from the U.S. and Canada, just broke out to a new all-time high.

When it made a new all-time high for the first time in >1 year, the Value Line Arithmetic Index usually rallied higher over the next year:

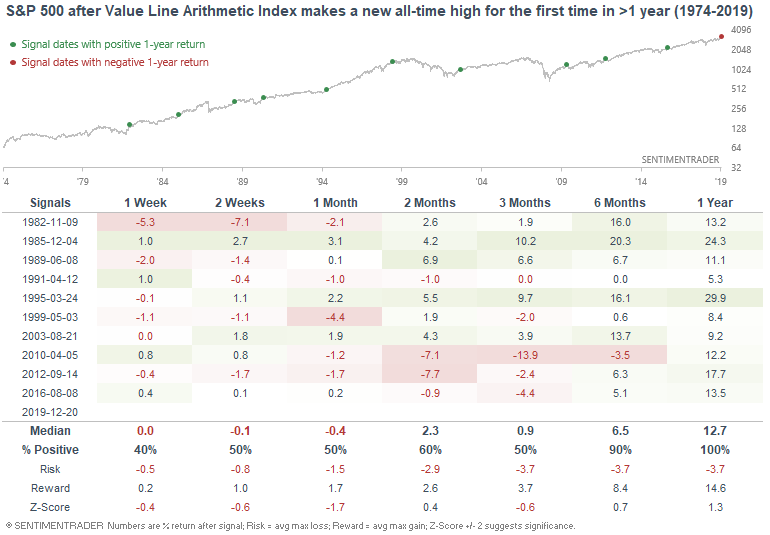

....as did the S&P 500, even if the S&P faced short term weakness over the next month:

Momentum

Perhaps we've entered a momentum-driven market like 2017, in which nothing else mattered. But then again, it's too early to tell, and it's almost always impossible to know for sure without 20/20 hindsight. Personally, I have not been able to predict beforehand a year in which contrarian indicators don't work vs. a year in which contrarian indicators do work. But that's just a part of trading - nothing works 100% of the time. So it's best to pick a strategy and stick with it through the ups and downs.

With that being said, various indicators demonstrate that the S&P's uptrend is incredibly strong right now. This usually leads to more gains in the coming months and year, even though the market may decline in the short term.

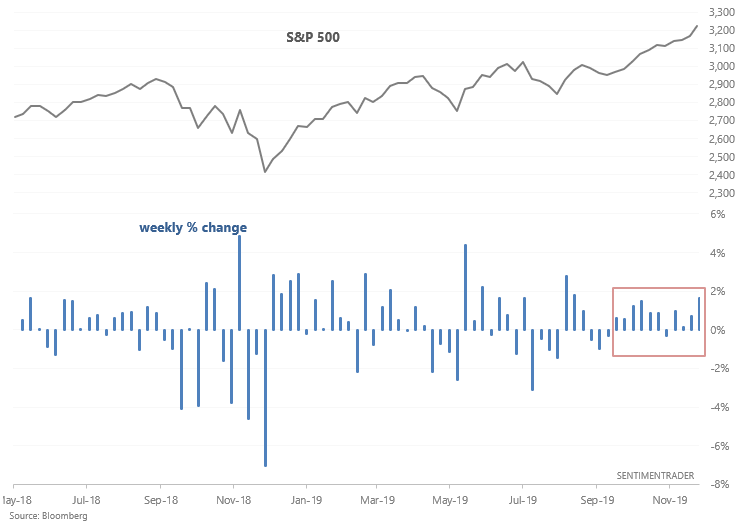

For example, the S&P has rallied 10 of the past 11 weeks:

When the S&P's momentum was this strong, it typically pulled back in the short term, and then pushed higher later.

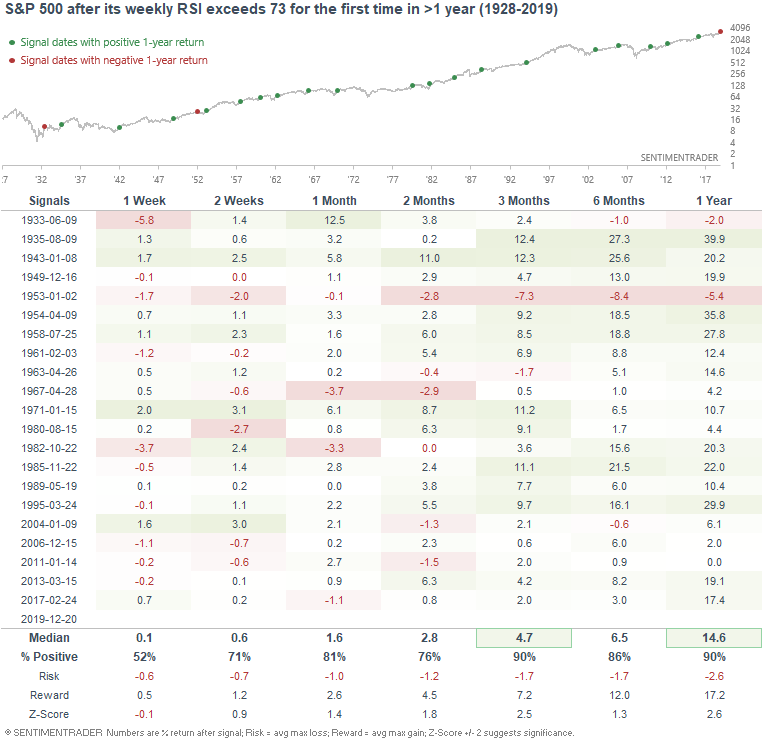

In addition, the S&P's 14 week RSI is now above 73 for the first time in almost 2 years:

Overbought conditions may lead to short term weakness, but has typically been bullish after that:

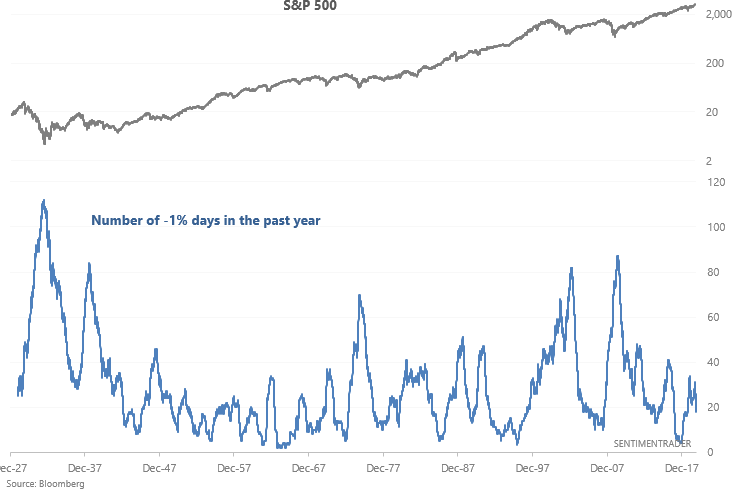

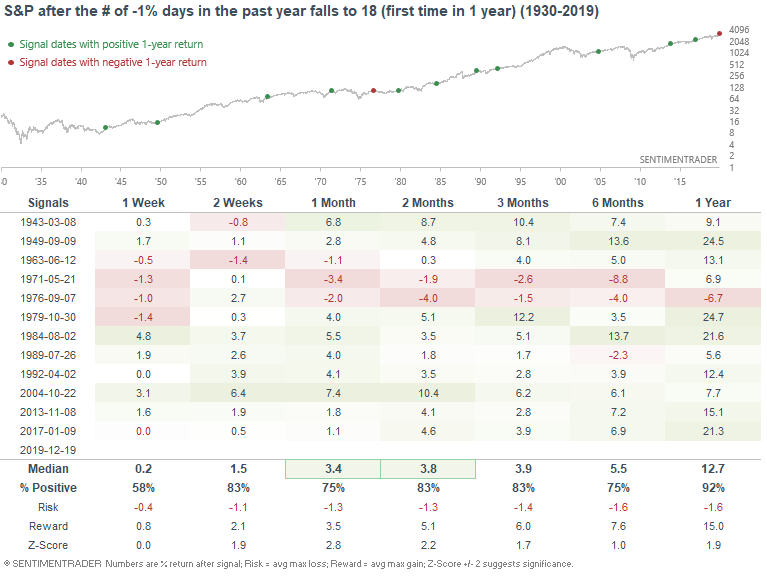

And as I noted on Friday, the # of big DOWN days has fallen this year:

When a year of low volatility followed a year of high volatility, the S&P usually continued to rally over the next few months and year.

Longer term melt-up

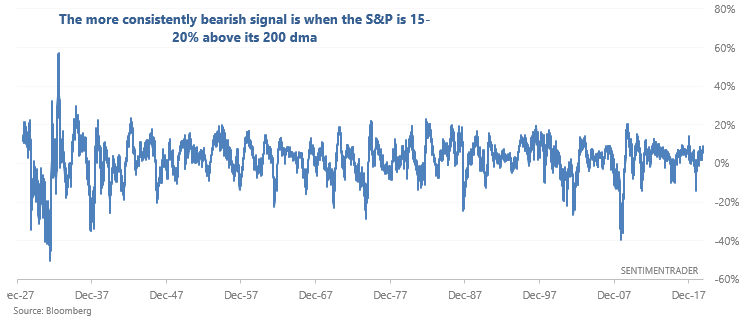

There has been a fair amount of talk about a "melt-up" recently. While the stock market may be overextended on a 1-3 month basis, this isn't quite a melt-up on a longer term basis. For example, the S&P's distance from a long term moving average is now at its highest level since January 2018, after which the stock market immediately tanked.

This may sound extreme, but if we take a longer term look at this chart, it's clear that the S&P can become far more extended above its 200 dma:

So when the S&P was more than 9% above its 200 dma for the first time in >1 year, the next 6-12 months were usually followed by more gains.

Breadth

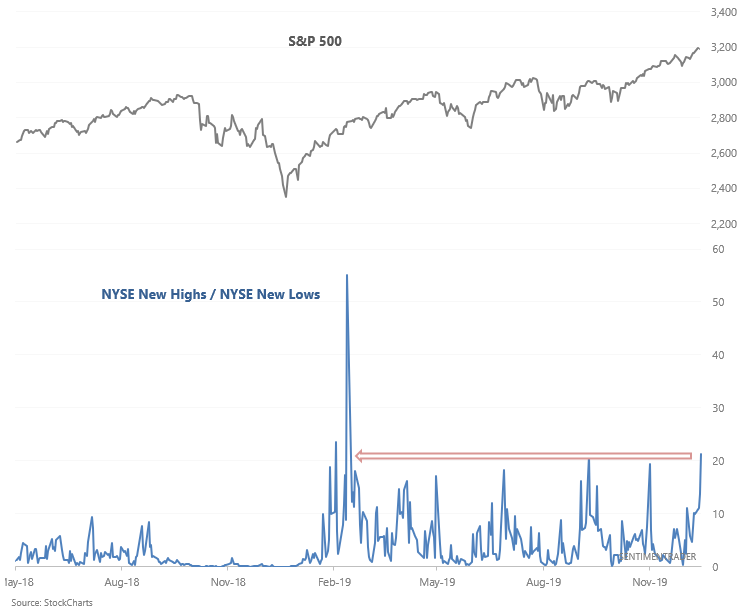

With the overall stock market surging, more and more members are making new 52 week highs vs. members making new 52 week lows. As I mentioned on Thursday, the ratio of NYSE New Highs to New Lows has spiked to highest level in more than 200 days.

When breadth surged in the past, the S&P's returns over the next few months and year were typically bullish.

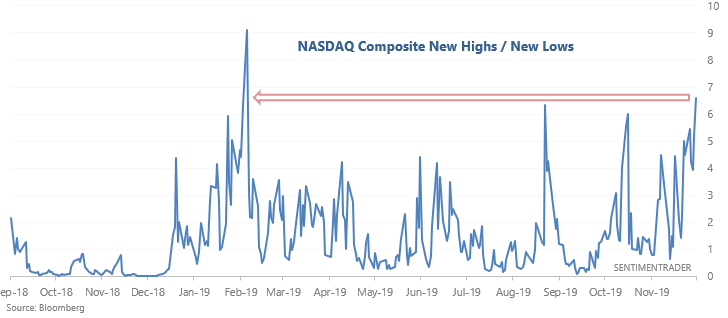

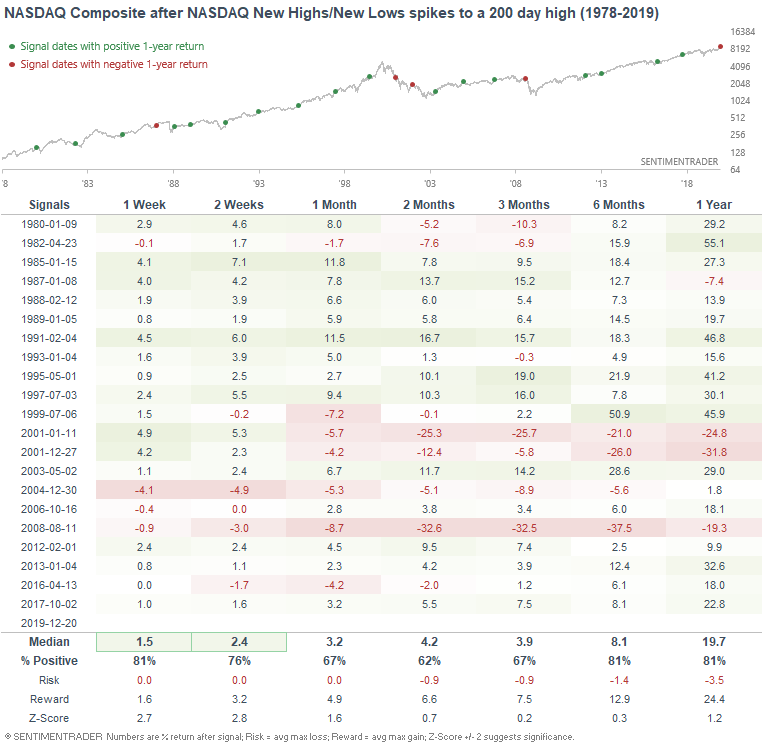

The ratio of NASDAQ New Highs to New Lows also spiked:

When it did so in the past, the NASDAQ Composite's returns were still mostly bullish, but not as bullish as for the S&P. This worked better before the 2000s than after the 2000s.

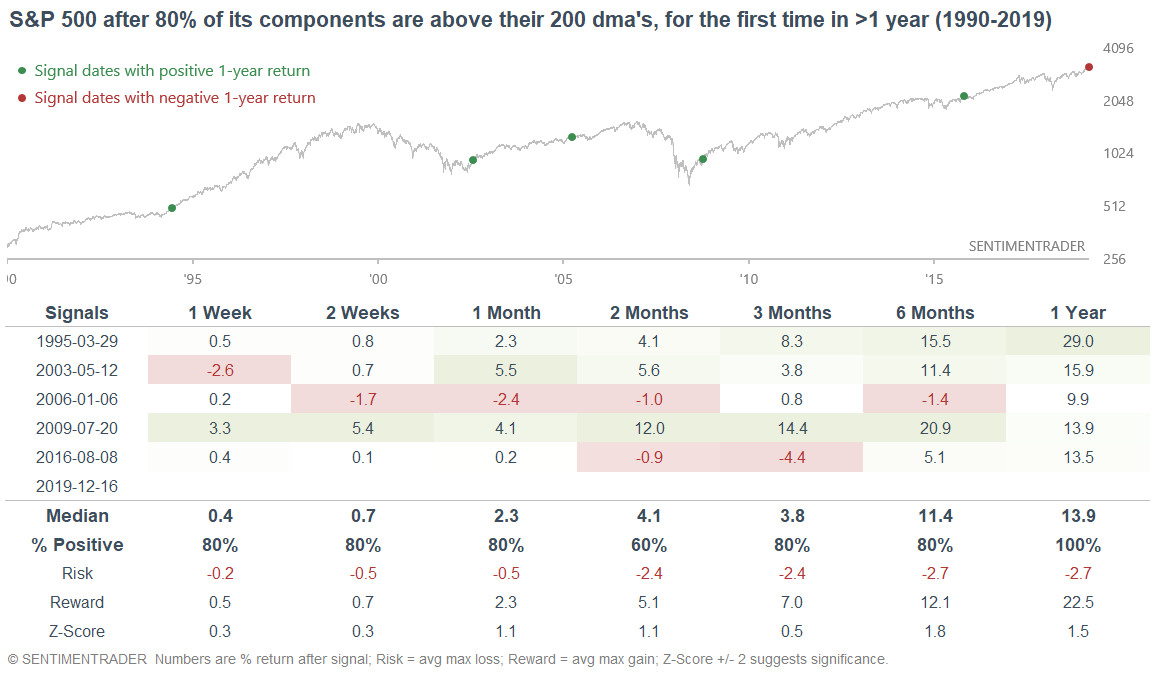

And with more and more stocks making new highs, an increasing percent of S&P 500 members are in a long term uptrend.

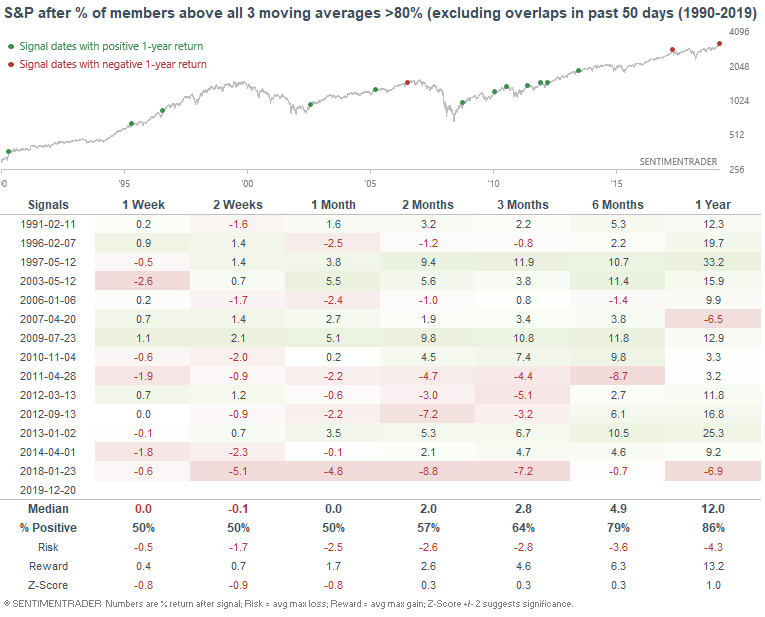

When the vast majority of its components were in an uptrend for the first time in more than a year, the S&P's gains over the next year were almost double of their historical average:

With that being said, this rally is probably overdone in the short term. More than 80% of the S&P's members are above their 10 dma's, 50 dma's, and 200 dma's. This is quite rare, and usually led to worse than average returns over the next month:

Neutral/Bearish:

Sentiment

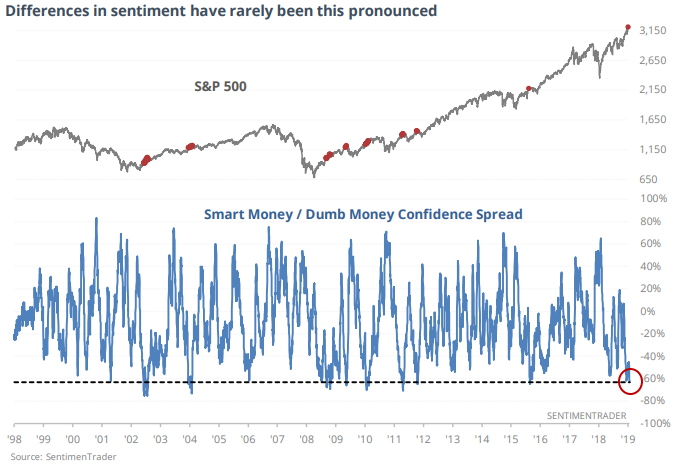

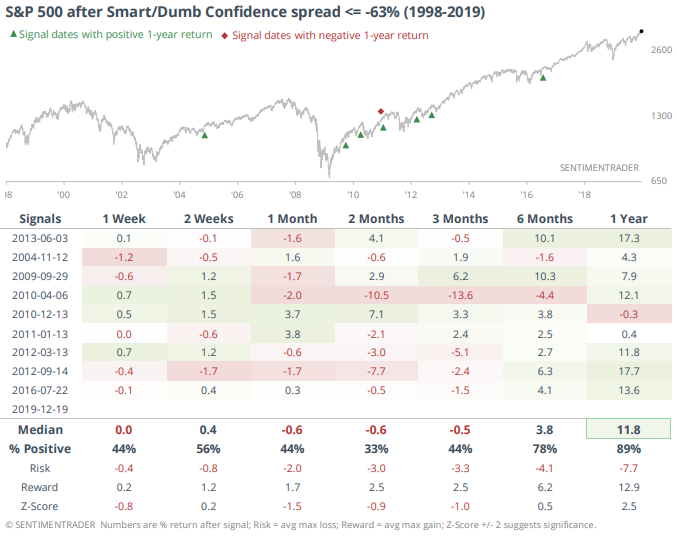

Sentiment has become extremely optimistic, which is a bearish factor for stocks. As Jason mentioned on Friday, Dumb Money is extremely optimistic relative to Smart Money:

When sentiment was this bubbly in the past, the S&P's returns over the next 1-3 months were consistently worse than average, although returns over the next 6-12 months tend to be positive:

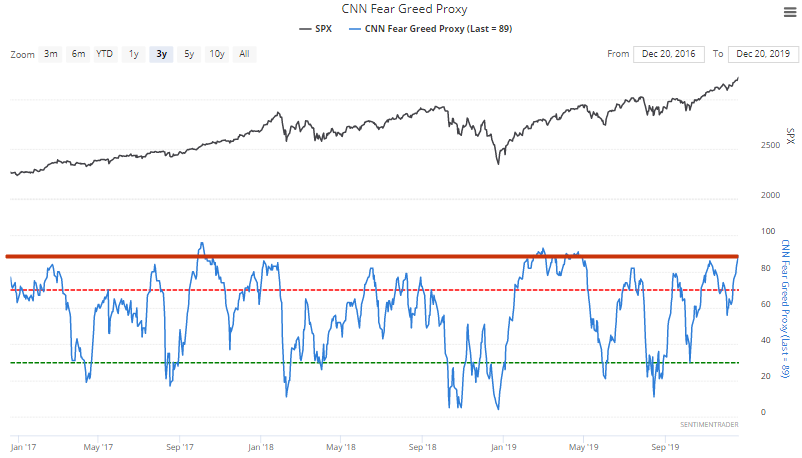

Our proxy for the popular CNN Fear & Greed Index is extremely high:

When our CNN Fear & Greed Proxy crossed above 88 in the past, the S&P's returns over the next 2 months were consistently worse than random. It would have been better to hold bonds than stocks.

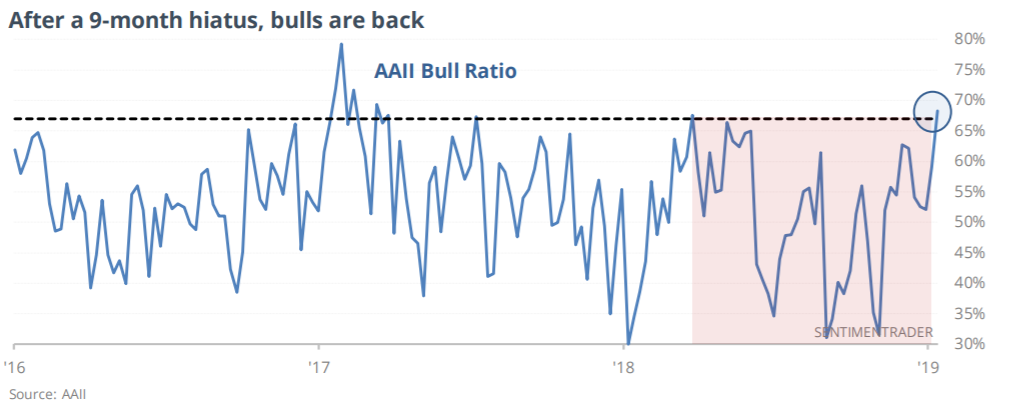

Meanwhile, the AAII Bulls ratio has spiked above 67% for the first time in over 9 months:

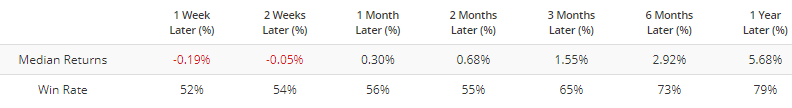

When this happened in the past, the S&P's returns over the next 2-3 months were worse than random:

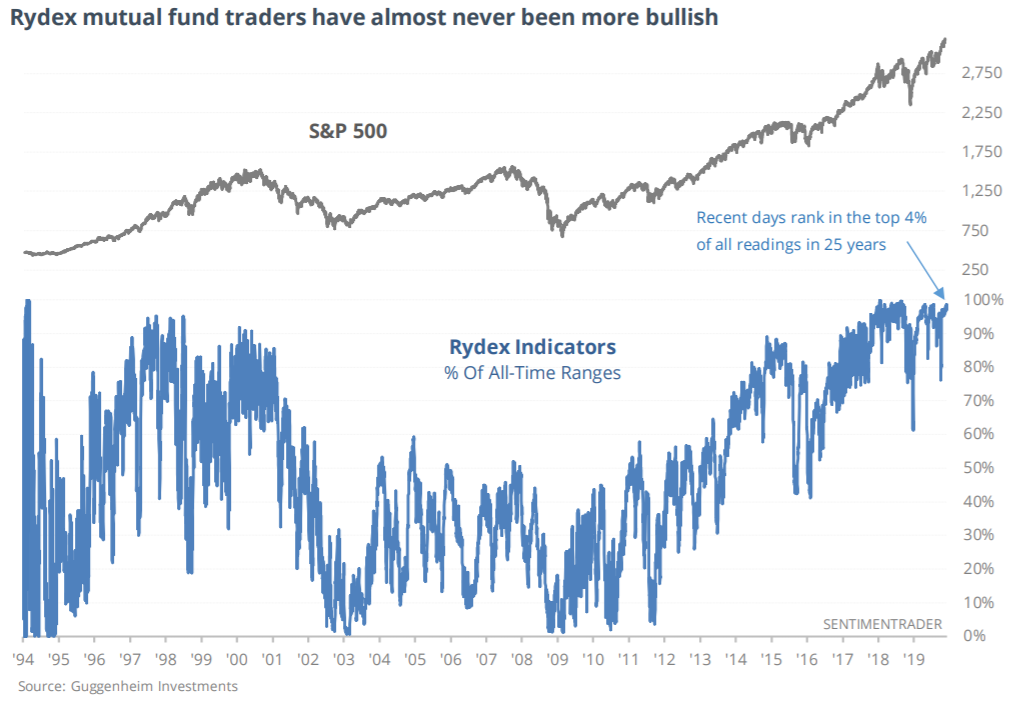

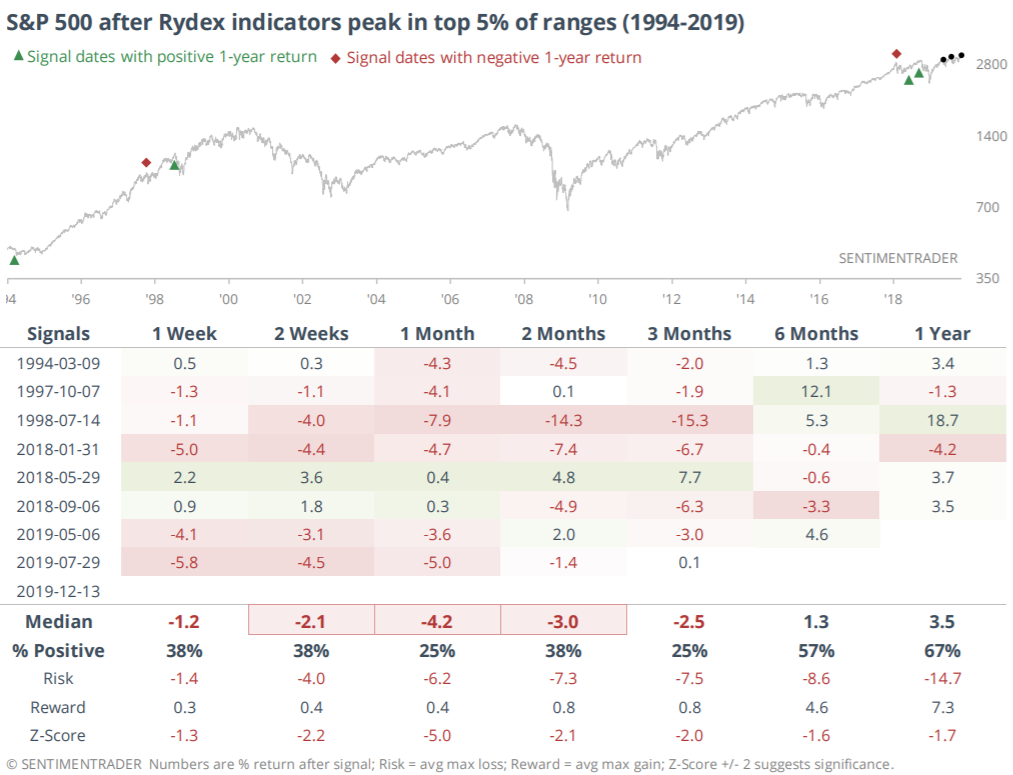

And lastly, Rydex mutual fund traders are extremely bullish:

When the Rydex indicators were this extreme, stocks usually suffered over the next 1-2 months:

Options positioning

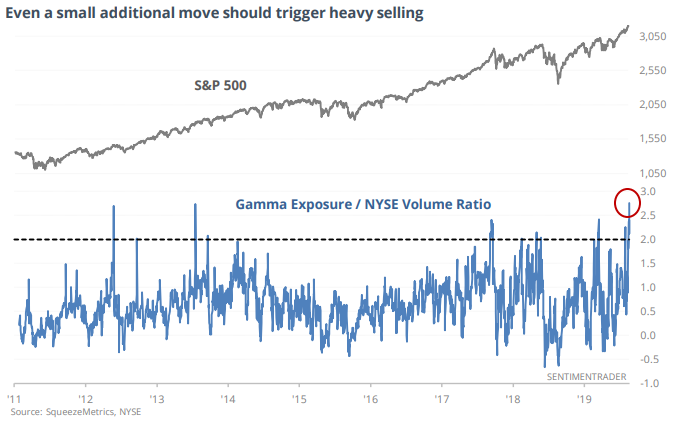

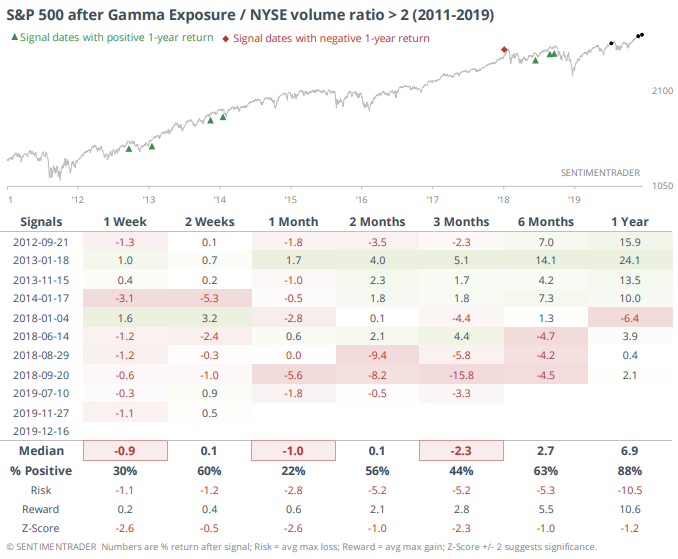

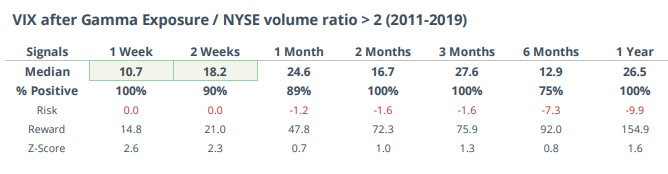

As Jason noted on Friday, Gamma Exposure (the sensitivity of option contracts to changes in the S&P 500's underlying price) is extremely high:

When it was this high in the past, the S&P's returns over the next few weeks and months were quite bearish:

...and VIX usually spiked

To recap

- Long term risk:reward doesn’t favor bulls.

- Fundamentals (6-12 months): still bullish because there is no significant U.S. macro deterioration.

- Technicals (3-6 months): neutral

- Technicals (1-2 months): bearish

Got any questions? Feel free to contact me at [email protected]

December 22, 2019: Fundamentals Overview Part 2

This is Part 2 of a weekly update on the U.S. stock market's long term fundamentals. Part 1 can be found here.

Fundamentals 1-3 years: market timing

I don't try to predict the future of the economy. Plenty of very smart people try, and when you add up the successes+failures, the results are usually no better than a 50/50 coin toss. That's why I focus instead on leading economic indicators. Look at what has already happened instead of predicting the future.

The economy drives corporate earnings, which drives the stock market in the long term. As a result, bull markets usually coincide with economic expansions, and big bear markets usually coincide with recessions.

Since the stock market tends to peak before recessions begin, we need to look at leading economic indicators, which also deteriorate before recessions begin. This doesn’t mean that the stock market’s exact top cannot occur before macro starts to peak. This happened in January 1973, when the stock market peaked a few months before macro started to deteriorate. However, the biggest part of bear markets always occur after macro has deteriorated significantly.

Here’s a brief summary of the leading and most important economic indicators I track, some of which I include in the Macro Index. The ones that are included in the Macro Index have an asterisk beside them**

Bullish factors right now

- Labor market**

- Housing**

- Financial conditions

- Heavy Truck Sales**

- Inflation-adjusted retail sales

Neutral/bearish factors right now

- Corporate profits

Bearish factors right now

- Yield curve**

- High yield spreads

- Manufacturing**

Bullish factors

Labor market

Labor market indicators do not show any significant deterioration right now.

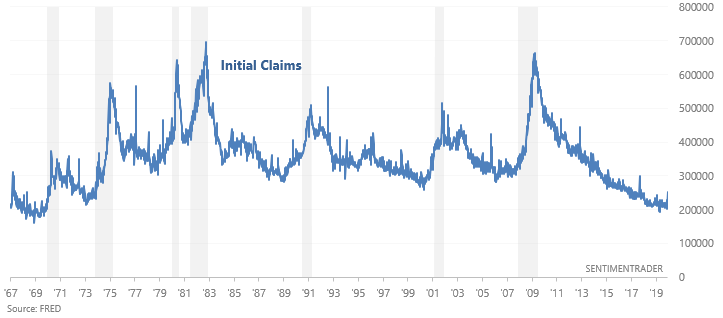

Initial Claims

Initial Jobless Claims measures the number of jobless claims filed by people who are seeking to receive jobless benefits. In other words, this measures the number of people who are recently unemployed. This economic indicator continues to trend sideways. In the past, Initial Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Initial Claims trends upwards because Initial Claims is very low right now.

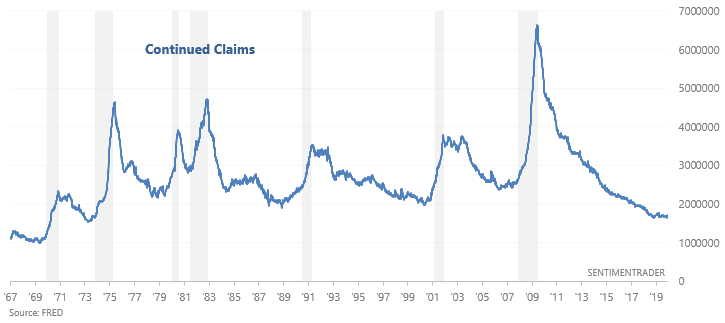

Continued Claims

Continued Jobless Claims measures the number of people who are still filing jobless claims (past the initial claim). This economic indicator continues to trend sideways. In the past, Continued Claims trended higher before a recession began. This is still a positive point for macro, but watch out over the next few months in case Continued Claims trends upwards because Continued Claims is very low right now.

Housing

Housing market indicators do not show significant deterioration right now.

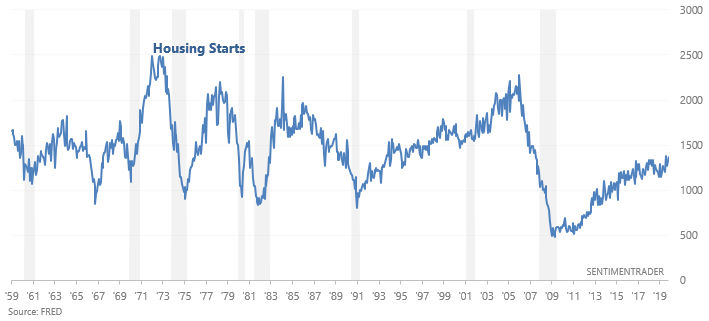

Housing Starts

Housing Starts measures the number of new homes that are starting to be built in the U.S., from the time of first excavation. This figure is trending sideways right now. In the past, Housing Starts trended downwards before recessions began. This is a positive for macro.

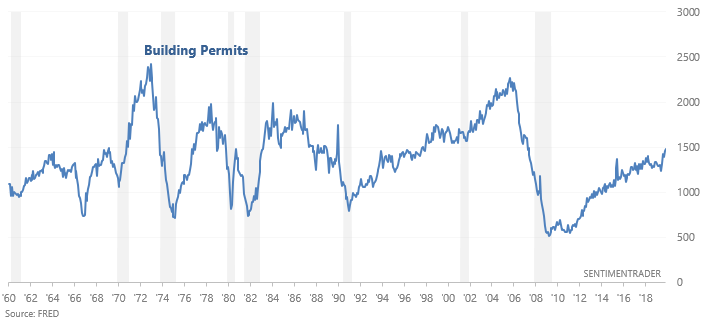

Building Permits

Building Permits are trending upwards right now. In the past, Building Permits trended downwards before recessions began. This is a positive for macro.

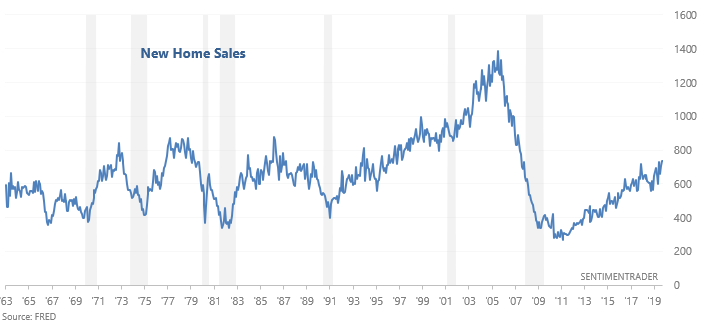

New Home Sales

New Home Sales are trending upwards right now. In the past, New Home Sales trended downwards before recessions began. This is a positive for macro.

Financial Conditions

Indicators related to financial conditions remain relatively loose. This is a positive for macro.

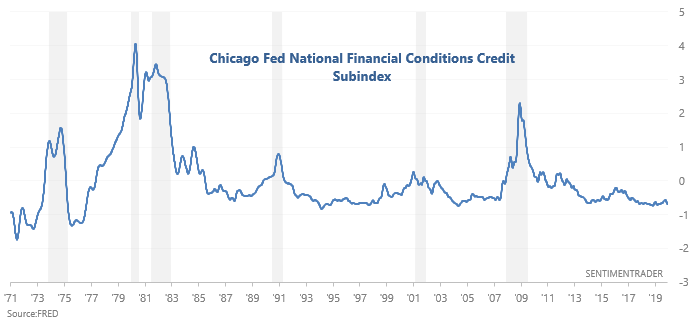

Chicago Fed Financial Conditions Credit Subindex

The Chicago Fed Financial Conditions Credit Subindex remains quite low. Looking at the bigger picture, the Credit Subindex is trending sideways right now. In a credit-driven economy, the Credit Subindex tends to trend solidly upwards (i.e. tighten) before a recession begins.

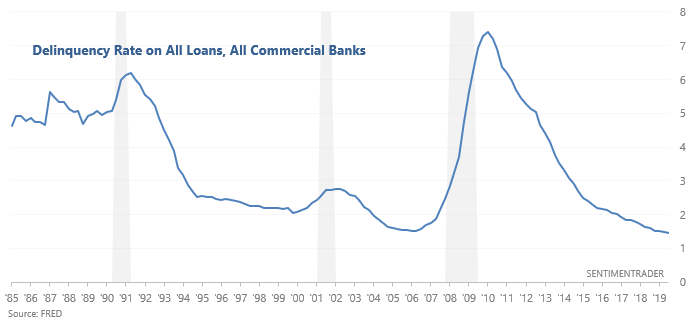

Loans

The Delinquency Rate on All Loans continues to trend downwards. In the past, the Delinquency Rate trended higher before a recession began. This is a positive for macro.

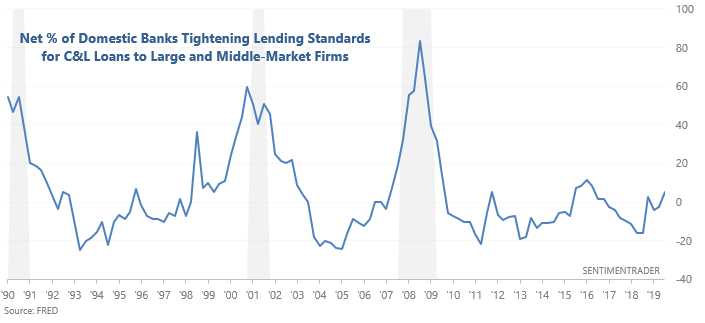

Banks’ lending standards

Banks are starting to tighten their lending standards right now. In the past, lending standards tightened for several quarters before a recession began, causing the Net Percentage of Banks Tightening Standards to trend higher. This was a positive for macro, but is now something that bulls should watch out for in case lending standards continue to tighten.

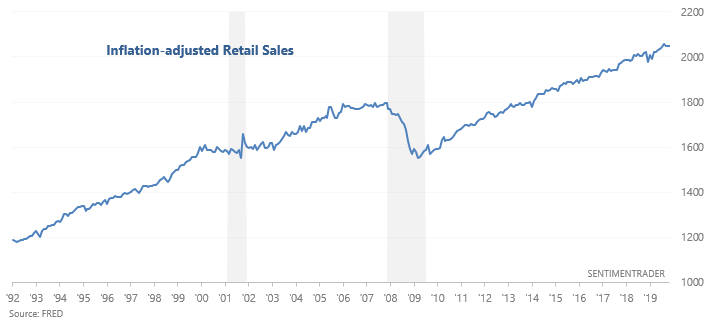

Inflation-adjusted retail sales

Inflation-adjusted Retail Sales continue to trend higher. In the past, inflation-adjusted Retail Sales trended sideways before recessions began. This is a positive for macro.

Neutral/bearish factors

Corporate Profits

Figures related to corporate profits suggest that the economic expansion is definitely late-cycle.

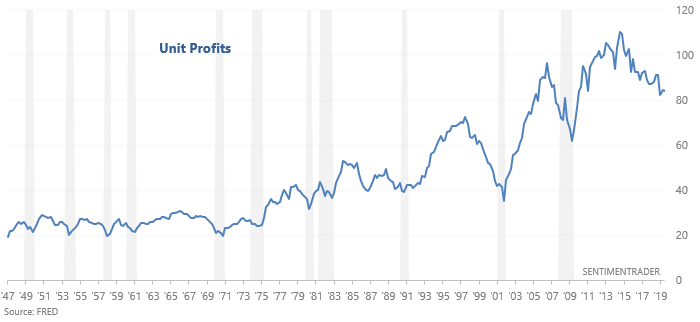

Unit Profits

Unit Profits continue to trend downwards, which is typically what happens in the second half of an economic expansion cycle. However, this indicator is not a timing tool. Unit Profits can fall for years before a recession begins.

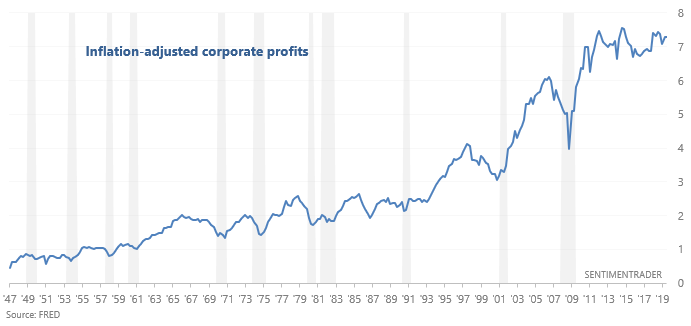

Corporate Profits

Inflation-adjusted corporate profits are trending sideways. In the past, inflation-adjusted corporate profits trended downwards for several quarters before recessions began. If corporate profits start to trend downwards, this will be a negative for macro in 2020.

Bearish factors

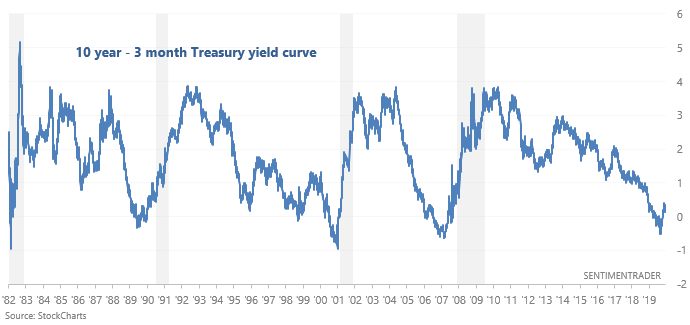

Yield Curve

Both the popular 10 year - 2 year and 10 year - 3 month sections of the yield curve were recently inverted, and are now trending higher. Here's the 10 year - 3 month yield curve, which historically has been a better market timing indicator than the 10 year - 2 year yield curve:

Overall, the yield curve is a bearish factor for macro right now because inversions & post-inversion steepenings tend to occur 1-2 years before recessions and bear markets begin. HOWEVER, the yield curve is merely one of many factors to consider, and it is not flawless.

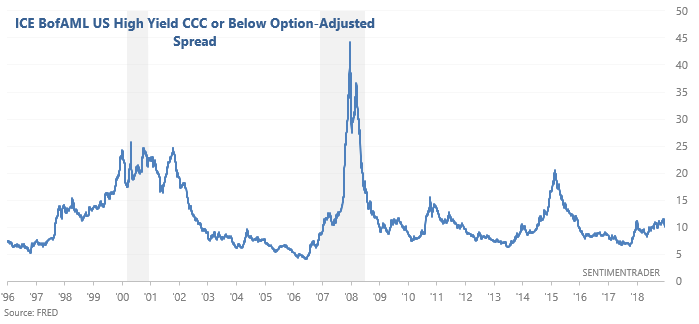

High yield spreads

From September 2018 – present, high yield spreads on the lowest rated bonds have been trending higher while the stock market has made higher highs. This is a necessary but not sufficient condition for bear markets and recessions. In the past, high yield spreads on these bonds trended higher before bear markets and recessions began. This is because the average bond market participant is usually more aware of risk than the average stock market participant..

Manufacturing

The manufacturing sector remains one of the weakest parts of the U.S. economy, and this is probably related to the trade war. For example, the ISM Manufacturing PMI is currently below 50, which signals contraction. This is a bearish factor for our Macro Index.

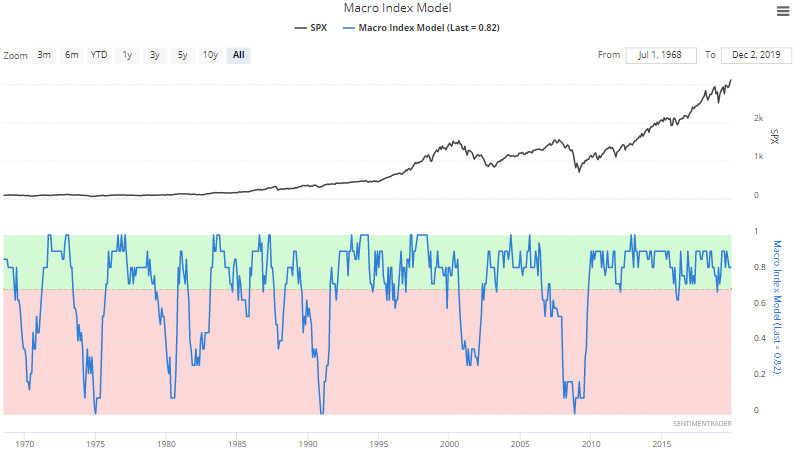

Macro Index

The Macro Index includes:

- New Home Sales

- Housing Starts

- Building Permits

- Initial Claims

- Continued Claims

- Heavy Truck Sales

- 10 year - 3 month Treasury yield curve

- S&P 500's 10 month average

- ISM Manufacturing PMI

- Margin Debt

- Inflation